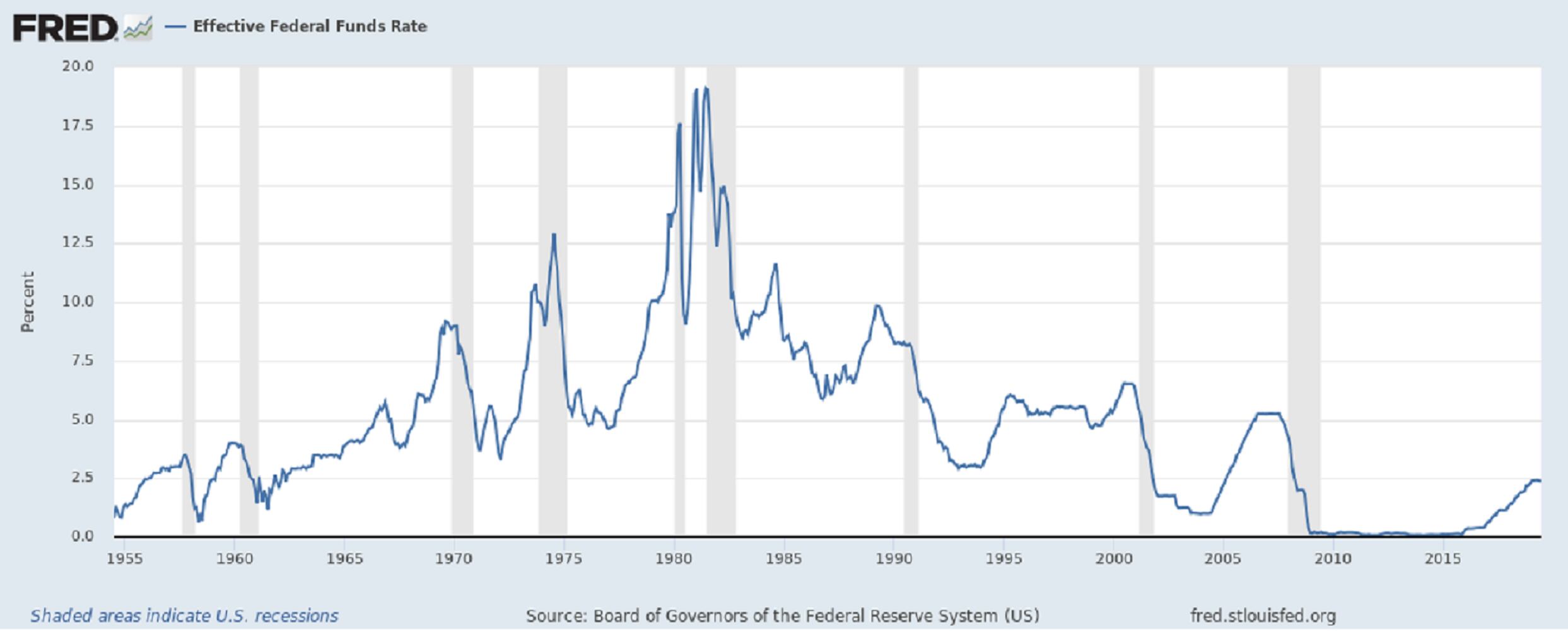

The Federal Reserve cut interest rates by 0.25 percent on Wednesday, marking the first time the U.S. central bank has lowered rates since the financial collapse in 2008. The decision puts the benchmark rate at a range between 2 and 2.25 percent.

Markets did not react kindly, dropping precipitously as Fed Chair Jerome Powell spoke, indicating that more cuts are unlikely.

This cut aimed at maintaining economic growth was widely expected, especially after the central bank kept rates steady in June and Powell warned of enduring economic “uncertainties” earlier this month. The decision, however, is noteworthy given the historically low unemployment rate in the U.S. and the high level of consumer spending.

“The outlook for the U.S. economy remains favorably and this action is designed to support that outlook,” Powell said at a press conference following the announcement, adding that the cut is a “mid-cycle adjustment to policy” and not the start of a rate-slashing cycle.

Lowering interest rates, the Fed said, was due to weak global economic growth, the government's inconsistent trade policies, and muted inflation pressures.

“You've got negative rates in Europe, you've got Japanaese production slowing down, and you've got other central banks around the world having accommodative monetary policies as well,” Matt Battipaglia, a financial analyst at Washington Crossing Advisors, told Cheddar.

Trade tensions specifically, Powell added, “do seem to be having a significant effect on financial market conditions and on the economy.”

In light of the global risks, which Powell described as “threats” to the U.S. economic outlook, the decision to cut rates was deemed necessary for “sustaining the expansion” of the domestic economy.

Powell — who was nominated by President Trump to chair the Fed in 2017 — has been repeatedly criticized by the Trump administration for raising rates to temper economic growth and mitigate inflation.

“We never take into account political considerations,” Powell said in response to a question on pressure from Trump to lower rates. “We don't conduct monetary policy in order to prove our independence.”

After Powell's comments, Trump criticized the Fed Chairman, saying the market wanted to hear that "this was the beginning of a lengthy and aggressive rate-cutting cycle." And he said, "As usual, Powell let us down."

As recently as Monday, Trump slammed the Fed, which has historically stayed above the fray of politics, saying that the bank raised rates “way too early and way too much” and that their “quantitative tightening was another big mistake.”

“The potential wealth creation that was missed, especially when measured against our debt, is staggering,” Trump added.

The decision to cut rates was made at the two-day Federal Open Market Committee (FOMC) meeting, which is held eight times a year to determine necessary adjustments on interest rates and other monetary policies.

Eight of the 10 voting members on the FOMC, including Powell and Vice Chairman John C. Williams, voted in favor of lowering rates. The president of the Federal Reserve Bank of Boston, Eric Rosengren, and the president of the Federal Reserve Bank of Kansas City, Esther George, dissented, arguing instead to leave rates unchanged.

“Today’s decision to cut short-term interest rates by a quarter-point makes lots of sense,” Josh Bivens, the director of research at the Economic Policy Institute, said in a statement. “The Fed should be applauded for trying to stay ahead of the curve in fostering continued growth.”