A plunge in U.S. stocks Monday morning once again flipped an emergency circuit breaker, halting trading for 15 minutes.

The S&P 500 dropped more than 7 percent within seconds of the opening bell, which triggered its circuit breaker for the third time since the coronavirus outbreak has thrown markets into turmoil.

Today’s drop occurred despite news this morning that the Federal Reserve cut interest rates for the second time this year. The central bank cut rates by 1 percent to between 25 and zero percent.

The Dow Jones Industrial Average was also down nearly 10 percent at the open, and the Nasdaq fell around 6 percent.

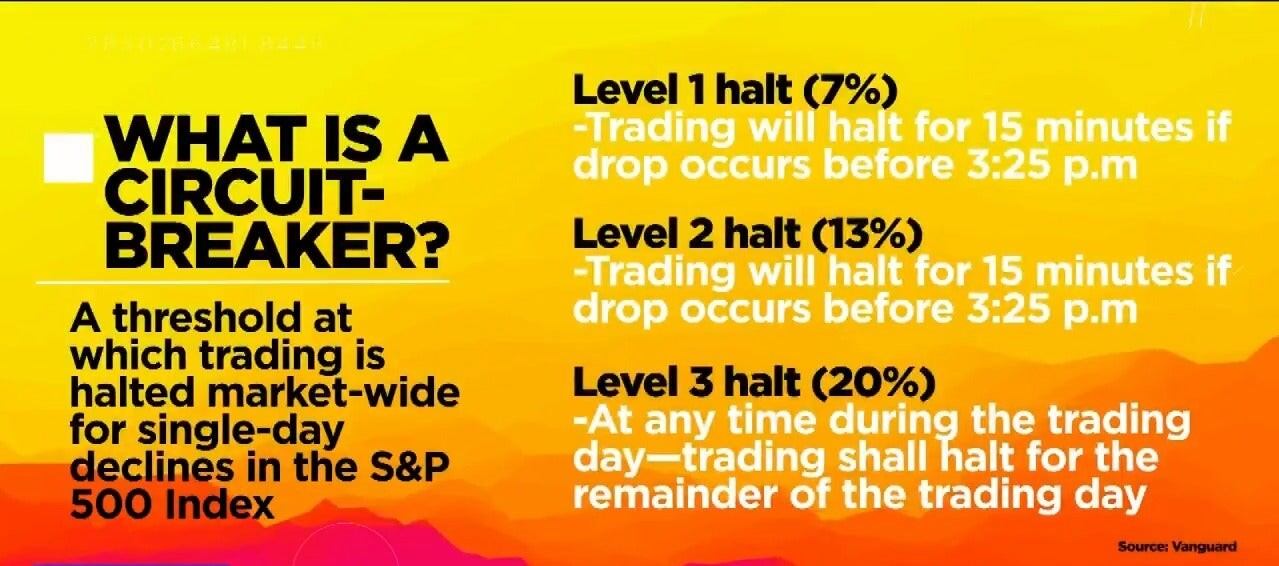

The level one circuit breaker kicks in after a drop of 7 percent or more. If markets drop another 13 percent after trading resumes, the level two circuit breaker activates another 15 minute pause. The third level hits after a 20 percent drop, ending trading for the rest of the day.

The latter two have never been used before in the U.S. stock market.

The New York Stock Exchange has revised the circuit breaker system several times since it was first created, with the latest updates coming after the “flash crash” of 2010, when the DOW dropped 9.2 percent within minutes. The threshold has since been lowered to 7 percent.

Prior to this month, the stop-gap measure was last triggered in 1997 during the Asian financial crisis that sunk the economies of countries such as Thailand, Malaysia, and South Korea.

The measure, which functions like a pause button, was introduced after the Black Monday crash of 1987, a massive sell-off in stocks largely attributed to computerized trading.

The circuit breakers were designed to help traders avoid making a downturn worse with panicked trading behavior. The original system was based on a drop in points, not percentages, but was changed after the 1997 episode. The Securities and Exchange Commission agreed at the time that the threshold was too low.