The Trump administration last week rescinded a Obama-era rule that asked HUD recipients to measure and consider fixes to racial segregation in their communities.

President Donald Trump then followed up the decision with a tweet that critics say was an explicit appeal to white, suburban voters.

"His tweet was aimed at a strategy of appealing to racial resentment and really people's worst ideas about how our communities should be structured," David Sanchez, director of research and development for the National Community Stabilization Trust, told Cheddar. "Attitudes like that are a big reason why we have such severe segregation by race, class, and opportunity in this country, and unfortunately the president is trying to use those fears to benefit himself politically."

The loss of the rule itself has gotten less attention, in part due to its low profile as more of a regulatory tweak than an aggressive federal policy.

The Affirmatively Furthering Fair Housing Rule that Trump's HUD eliminated asked municipalities and housing authorities to account for racial bias in their communities by writing a report and issuing recommendations, but it did not force municipalities to address segregation directly.

"It was about gathering data," Sanchez said. "It was about getting people talking about segregation. But it wasn't about forcing communities to do anything."

In the long-term, though, he added that cutting the rule will only contribute to the ongoing economic divide between the suburbs and cities.

"It's going to continue to concentrate economic resources, social privilege in certain people who can afford to live in high-opportunity communities," Sanchez said. "In the same way the COVID crisis has supercharged inequality in this country, this is just another step in that direction."

Despite the hype and headlines earlier this year around meme stocks and Robinhood, the SEC and FINRA have made few concrete changes around retail investing.

The Senate Committee on Banking, Housing and Urban Affairs held a hotly debated hearing regarding fiat-backed stablecoins on Tuesday that still led to a conclusion the space needed some form of regulation.

Under Chair Jerome Powell, the Federal Reserve is poised this week to execute a sharp turn toward tighter interest-rate policies with inflation accelerating and unemployment falling faster than expected.

Cheddar has been covering the biggest news of the week with some of the biggest names in the biz. In case you missed it, we've pulled together some of the highlights that will keep you informed as we get ready for the week ahead.

Prices were up 6.8 percent year-over-year In November, according to the latest consumer price index from the U.S. Bureau of Labor Statistics.

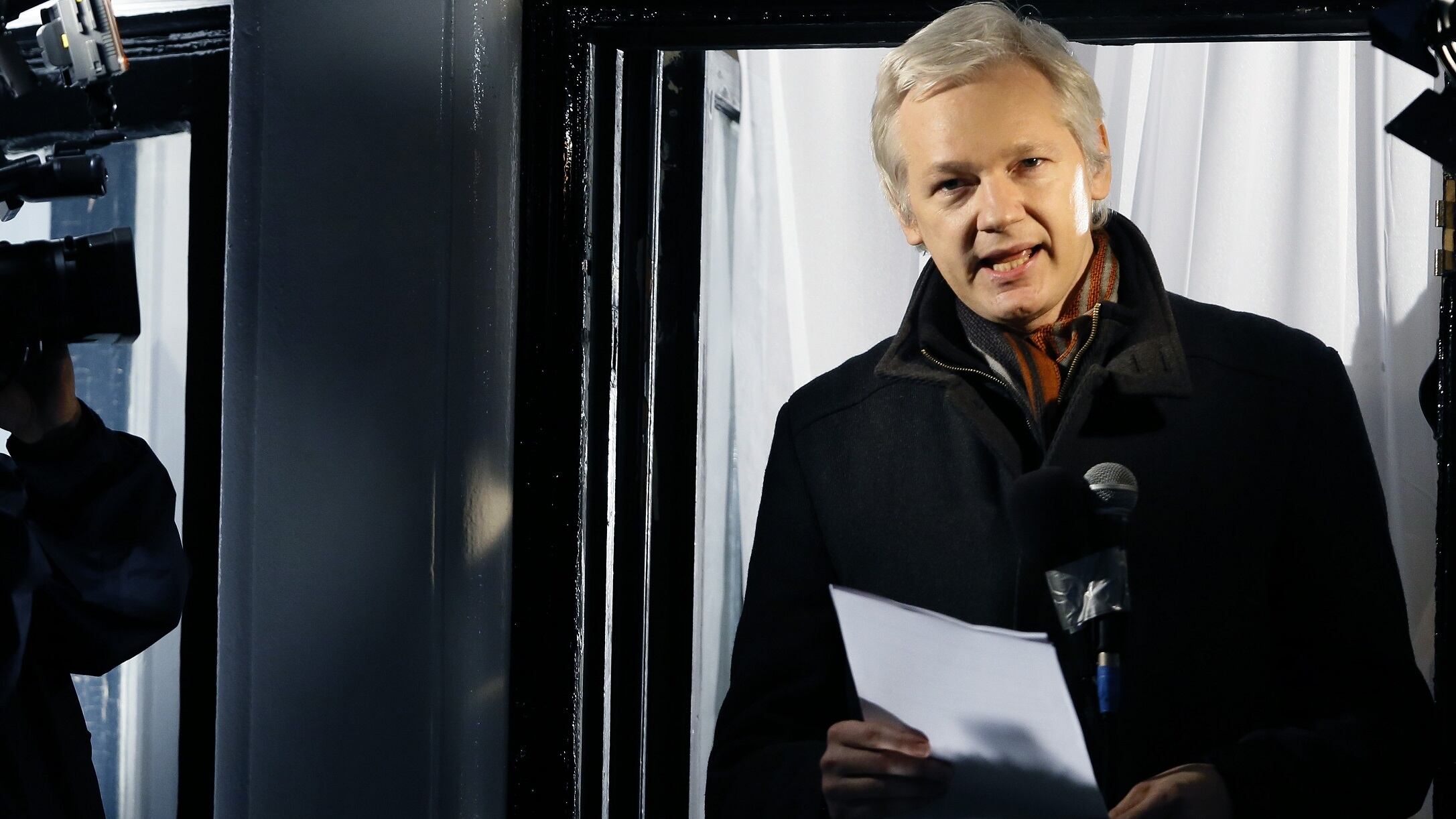

A British appellate court opened the door Friday for Julian Assange to be extradited to the United States by overturning a lower court's decision that the WikiLeaks founder's mental health was too fragile to withstand the American criminal justice system.

New Zealand’s government believes it has come up with a unique plan to end tobacco smoking — a lifetime ban for those aged 14 or younger.

The number of Americans applying for unemployment benefits plunged last week to the lowest level in 52 years, more evidence that the U.S. job market is recovering from last year’s coronavirus recession.

Congress got a crash course in crypto on Wednesday, as six executives from companies representing a cross-section of the digital economy answered questions from the House Financial Services Committee.

In the spirit of the holidays, Cheddar presents the 12 days of the top terms of 2021.