*By Conor White*

The positive [news](https://cheddar.com/videos/tesla-stock-surges-after-q2-earnings-report) in Tesla's second quarter earnings report outweighed the negatives for most investors, sending shares up more than 12 percent to their highest level in a month.

The electric carmaker announced that Model 3 production is up, but it posted losses of more than $700 million.

Some analysts have fundamental doubts about Tesla's future.

"It's a story stock," said Mark Spiegel, managing member at Stanphyl Capital. "What you have here are: bulls who couldn't care less about balance sheets or profit and loss statements; and you've got bears, or as I would call them, realists, who care a lot about that kind of stuff."

Spiegel counts himself in the latter group. He said in an interview Thursday on Cheddar that Tesla didn't do nearly enough to assuage fears about its future ー and that doesn't even account for all the other car companies eager for a bigger slice of the electric vehicle industry.

"There's a massive amount of competition coming for this company," Speigel said. "Between the Jaguar that's out now and the Audi, Mercedes, and Porsche coming out next year, it's going to destroy Model S and X sales, and that's where \[Tesla's\] margin isーwhatever margin they have."

And even though [outspoken](https://cheddar.com/videos/will-elon-musk-behave-on-this-weeks-earnings-call) CEO Elon Musk behaved on this conference call, there's no telling what he will do next.

After reaching its production goal of 5,000 Model 3 cars per week, Tesla reports it now wants to churn out 10,000 per week, "as fast as we can."

Spiegel dismissed those numbers ー and Tesla more generally.

"They're a perennial over-promiser and under-deliverer," he said.

"The reason they keep putting out these aggressive numbers is it supports the stock, which is an absurd valuation. If Tesla were a normal car company losing this much money, the stock would be in the low single digits."

For more on this story, [click here](https://cheddar.com/videos/tesla-announces-biggest-loss-ever-but-shares-rally).

Jed McCaleb, the co-founder of the Stellar Development Foundation, told Cheddar how blockchain technology can revolutionize how digital payments are tracked and secured.

Tesla's worries are no longer limited to the erratic behavior of Elon Musk. Stanphyl Capital's Mark Spiegel, a vocal short seller of the stock, said that Tesla is about to be overcome with competition from Mercedes, Jaguar, and Audi.

Christopher Mims, technology columnist for the Wall Street Journal, said that Apple is staking a "third act" on its wearables and accessories business, which includes the Apple Watch and AirPods.

Tesla shares dropped Friday after a slew of bad headlines. Elon Musk smoked a joint and drank whiskey in an interview with Joe Rogan, Tesla's chief accounting officer Dave Morton resigned after just a month on the job, and Tesla HR boss Gaby Toledano decided to not return to the company after taking a leave of absence last month. Plus, we're joined by Daymond John, entrepreneur and 'Shark Tank' star, to hear about his keys to building a successful career.

Guimar Vaca Sittic and Borja Moreno De Los Rios, co-founders and co-CEOs of blue-collar job platform Merlin, said they were frustrated that most job platforms seemed tailored to skilled labor positions. With Merlin, hourly workers can now search for positions in their fields.

Friday's strong employment report, showing an addition of 201,000 jobs in August and a 2.9 percent rise in wages, is a "tribute to Republican leadership," Rep. Cathy McMorris Rodgers (R-WA), the highest-ranking Republican woman in the House, said in an interview on Cheddar.

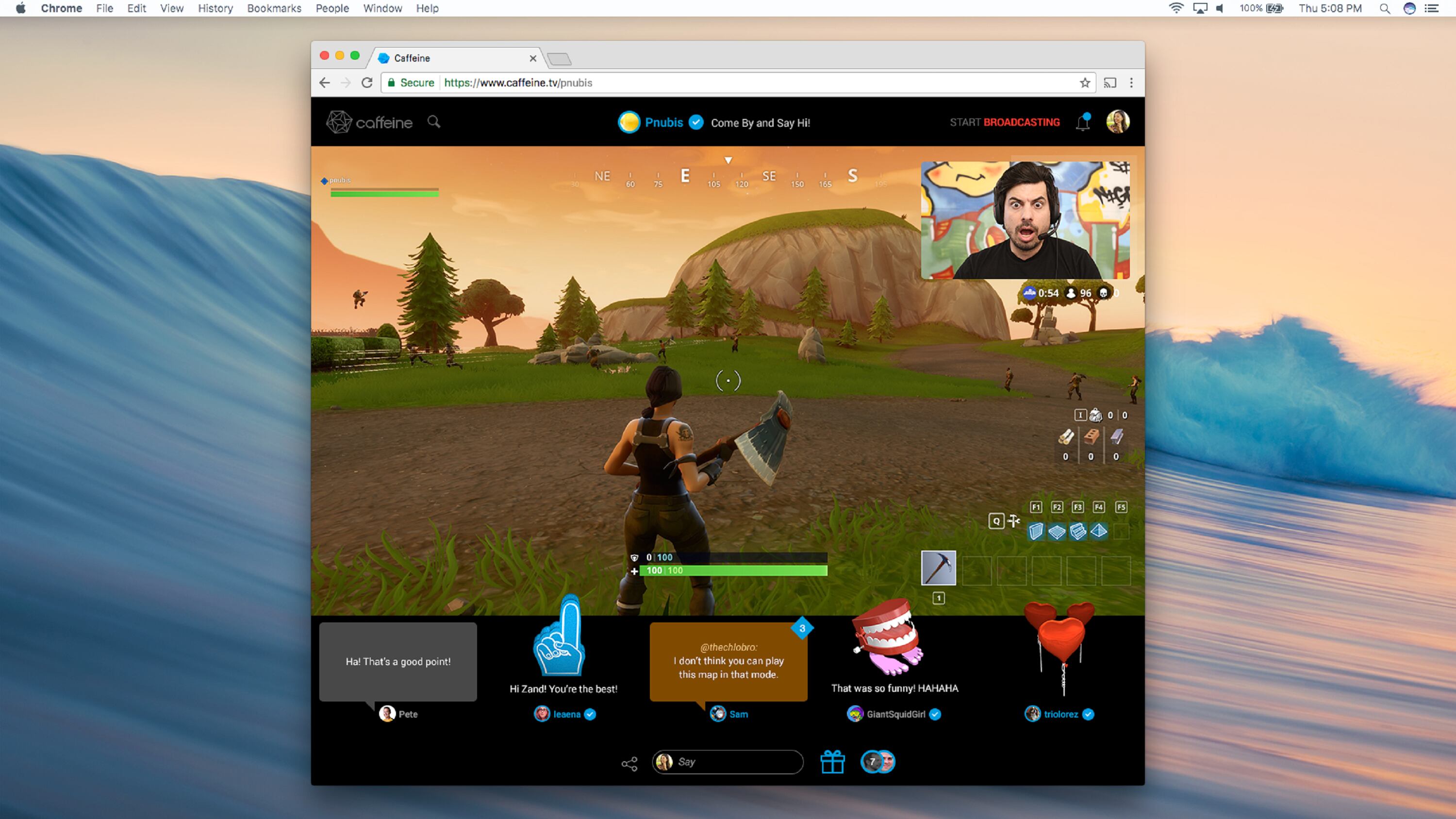

Social live-streaming is today where social media was in the mid-2000s. At least that's what 21st Century Fox is betting. The CEO of Caffeine, which just took a $100 million investment from the media giant, is looking toward the future of the industry.

A week after failing to make the cut for San Francisco's scooter permits, Spin is undeterred. The Bay Area start-up is "used to competition in this space," said head of public policy Brian Kyuhoon No.

At the Crypto Finance Conference, Cheddar's Tanaya Macheel speaks with Ripple co-founder Chris Larsen about the state of Ripple, and how he thinks XRP can rebound from its summer slump.

Jennifer Smith of the Wall Street Journal reports on a theory that autonomous trucks could come to market before passenger cars and obliterate an industry in the process.