*By Conor White*

The positive [news](https://cheddar.com/videos/tesla-stock-surges-after-q2-earnings-report) in Tesla's second quarter earnings report outweighed the negatives for most investors, sending shares up more than 12 percent to their highest level in a month.

The electric carmaker announced that Model 3 production is up, but it posted losses of more than $700 million.

Some analysts have fundamental doubts about Tesla's future.

"It's a story stock," said Mark Spiegel, managing member at Stanphyl Capital. "What you have here are: bulls who couldn't care less about balance sheets or profit and loss statements; and you've got bears, or as I would call them, realists, who care a lot about that kind of stuff."

Spiegel counts himself in the latter group. He said in an interview Thursday on Cheddar that Tesla didn't do nearly enough to assuage fears about its future ー and that doesn't even account for all the other car companies eager for a bigger slice of the electric vehicle industry.

"There's a massive amount of competition coming for this company," Speigel said. "Between the Jaguar that's out now and the Audi, Mercedes, and Porsche coming out next year, it's going to destroy Model S and X sales, and that's where \[Tesla's\] margin isーwhatever margin they have."

And even though [outspoken](https://cheddar.com/videos/will-elon-musk-behave-on-this-weeks-earnings-call) CEO Elon Musk behaved on this conference call, there's no telling what he will do next.

After reaching its production goal of 5,000 Model 3 cars per week, Tesla reports it now wants to churn out 10,000 per week, "as fast as we can."

Spiegel dismissed those numbers ー and Tesla more generally.

"They're a perennial over-promiser and under-deliverer," he said.

"The reason they keep putting out these aggressive numbers is it supports the stock, which is an absurd valuation. If Tesla were a normal car company losing this much money, the stock would be in the low single digits."

For more on this story, [click here](https://cheddar.com/videos/tesla-announces-biggest-loss-ever-but-shares-rally).

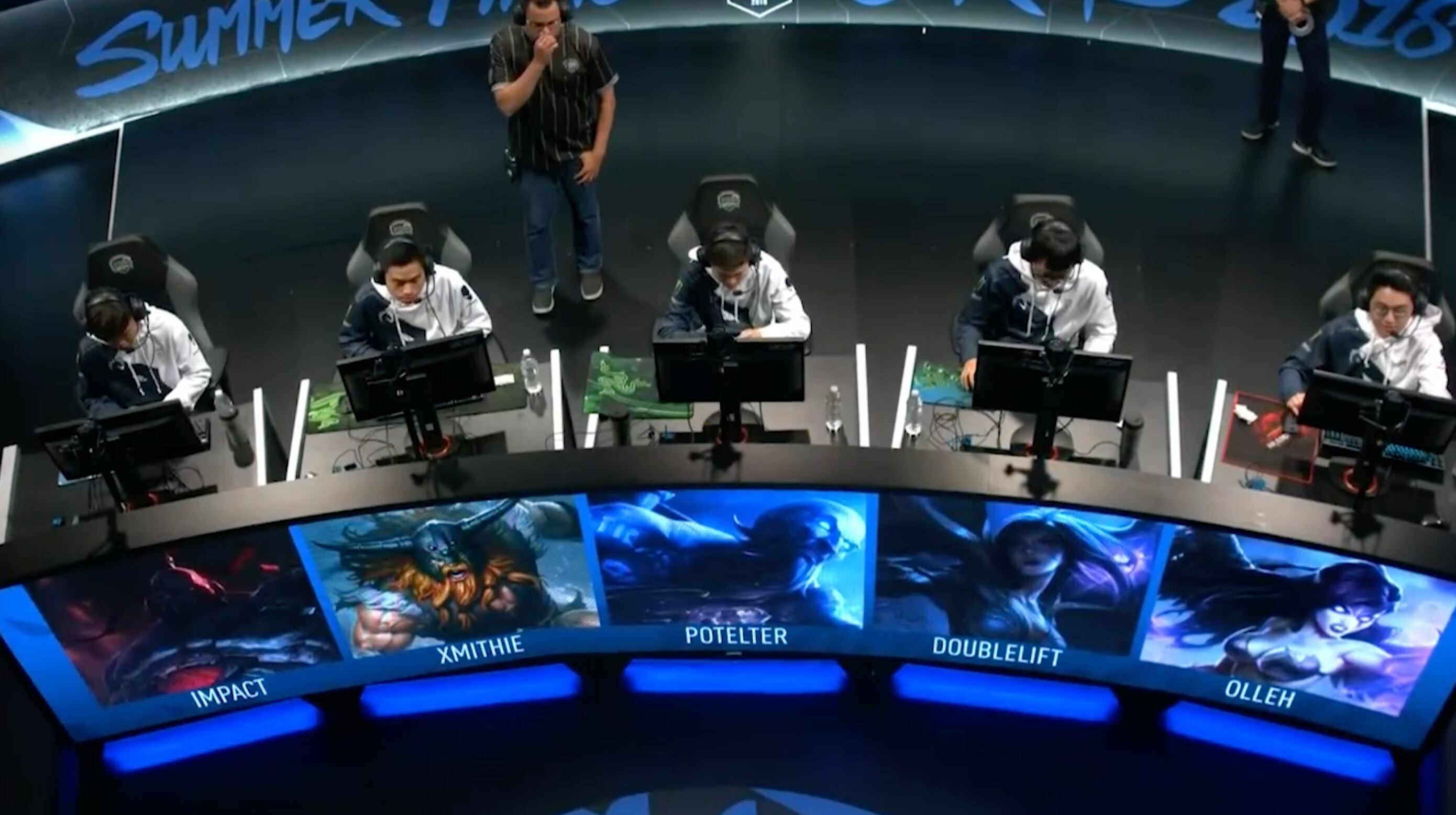

If you had any lingering doubts that eSports had gone mainstream, they would have been erased when the North American League of Legends Summer Split took over the Oracle Arena ー home to the defending NBA champion Golden State Warriors. Cheddar was there for the last stop before the World Championships in South Korea next month.

Apple casts a long shadow, and that's never more apparent than after a new product launch. John Vinh, equity research analyst at KeyBanc, ticked off the companies that, as part of Apple's supply chain, stand to benefit from the latest iPhone launch.

These are the headlines you Need 2 Know.

At its annual event in Cupertino, Calif., Apple announced three new iPhones and a new Apple Watch Series 4. With new features such as bigger screens and an EKG monitor on the watch, Apple hopes to reach audiences that may have not bought into the last edition of its products.

At Apple's annual keynote event Wednesday, the tech giant unveiled three new iPhone models as well as a redesigned Apple Watch.

Your phone's autofill function can come up with some strange suggestions, but Botnik Studios wants to put an intentionally comedic spin on predictive text. CEO Jamie Brew joined Cheddar to discuss how he's creating art out of machine learning.

Digital adviser Pefin incorpoates machine learning with financial advice. Ramya Joseph, the company's founder, told us she started the company after helping her father get through the last recession.

Louis Hsieh, the CFO of NIO, which went public on the NYSE Wednesday, said that the Chinese regulations and restrictions on the automotive industry have left no choice but to prioritize electric vehicles.

Snap Inc. opened at an all-time low Wednesday morning after BTIG analyst Rich Greenfield downgraded the stock and gave it 12-month price target of $5 a share. The stock fell about 10 percent to start the day.

Ganesh Bell, the president of Uptake, said that his company's software will be able to predict when machines will fail before they do, helping avoid costly mistakes. Uptake uses artificial intelligence in the industrial space for big business in order to streamline their processes.