*By Conor White*

The positive [news](https://cheddar.com/videos/tesla-stock-surges-after-q2-earnings-report) in Tesla's second quarter earnings report outweighed the negatives for most investors, sending shares up more than 12 percent to their highest level in a month.

The electric carmaker announced that Model 3 production is up, but it posted losses of more than $700 million.

Some analysts have fundamental doubts about Tesla's future.

"It's a story stock," said Mark Spiegel, managing member at Stanphyl Capital. "What you have here are: bulls who couldn't care less about balance sheets or profit and loss statements; and you've got bears, or as I would call them, realists, who care a lot about that kind of stuff."

Spiegel counts himself in the latter group. He said in an interview Thursday on Cheddar that Tesla didn't do nearly enough to assuage fears about its future ー and that doesn't even account for all the other car companies eager for a bigger slice of the electric vehicle industry.

"There's a massive amount of competition coming for this company," Speigel said. "Between the Jaguar that's out now and the Audi, Mercedes, and Porsche coming out next year, it's going to destroy Model S and X sales, and that's where \[Tesla's\] margin isーwhatever margin they have."

And even though [outspoken](https://cheddar.com/videos/will-elon-musk-behave-on-this-weeks-earnings-call) CEO Elon Musk behaved on this conference call, there's no telling what he will do next.

After reaching its production goal of 5,000 Model 3 cars per week, Tesla reports it now wants to churn out 10,000 per week, "as fast as we can."

Spiegel dismissed those numbers ー and Tesla more generally.

"They're a perennial over-promiser and under-deliverer," he said.

"The reason they keep putting out these aggressive numbers is it supports the stock, which is an absurd valuation. If Tesla were a normal car company losing this much money, the stock would be in the low single digits."

For more on this story, [click here](https://cheddar.com/videos/tesla-announces-biggest-loss-ever-but-shares-rally).

As our world becomes increasingly digital, companies are increasingly turning to the "internet of things" to inform their business practices. One such company is cellphone-service provider Sprint, which recently announced a "Curiosity IoT" platform ー a network designed to turn sensor data into "actionable intelligence," according to the chief of products and solutions at the IoT division, Ricky Singh.

The Butterball Turkey Talk-Line has been answering the questions of stressed-out Thanksgiving hosts for decades, but this year it is turning to Amazon Alexa to modernize how it helps with turkey prep.

These are the headlines you Need 2 Know for Wednesday, Nov. 21, 2018.

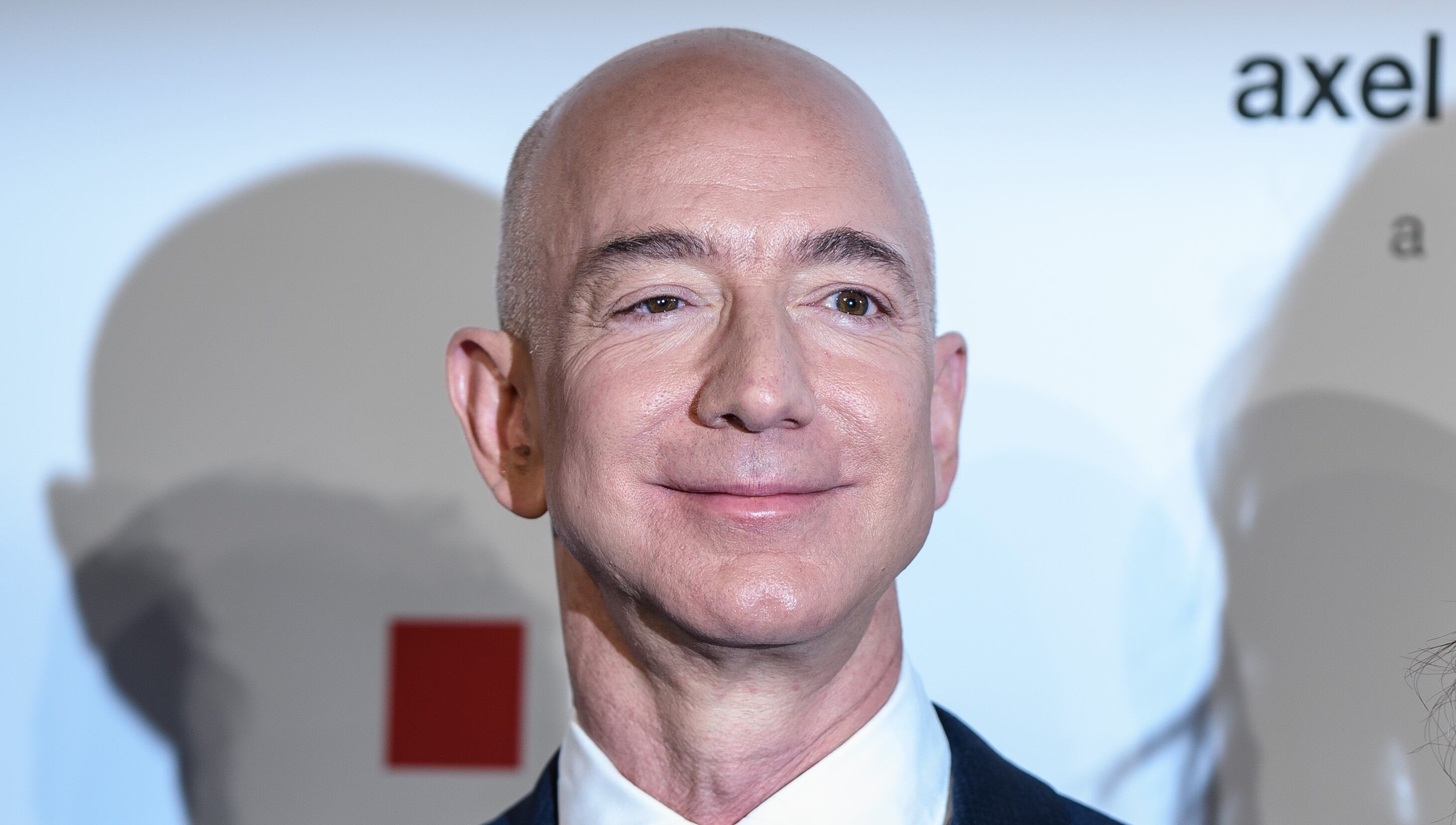

Amazon is reportedly looking to expand its foothold in live programming, with an eye on the 22 regional sports networks that Disney must spin off as part of its acquisition of 21st Century Fox. For Amazon, it would be the extension of a grand strategy that has been both simple and consistent: drive more Prime subscriptions.

The U.S. stock market plunged on Tuesday ahead of the Thanksgiving holiday, mostly fueled by investors abandoning tech stocks. Following disappointing earnings, declines in Target and select retailers pulled the retail sector and the markets lower still.

It was another rough morning for the markets as the tech sector continued to drag down the major indexes. Retailers such as Target, Kohl's, and Lowe's were also trading lower after reporting disappointing quarterly earnings results. Plus, Cheddar sits down with actress Michelle Rodriguez and director Robert Rodriguez to hear about their new VR film 'The Limit,' now available across all VR headsets.

There's a civil war underway in cryptocurrency ー and it's shaking investor confidence in the very foundation of the blockchain.

What role exactly does Facebook play in society? Does it do more good than harm ー or more harm than good? Is it too big to control? Existential questions like these are beginning to circulate as the world's largest social network finds itself embroiled in yet another state of crisis.

PlayVS, a start-up created to build an infrastructure for high school esports, has announced a new Series B funding round of $30.5 million, led by Elysian Park Ventures, a firm that operates on behalf of the Los Angeles Dodgers ownership group. The new funding will also bring in new investments from Adidas, Samsung NEXT, and Plexo Capital, and angel investors include Sean “Diddy” Combs.

Apple talks a big game on customer privacy -- but that hasn't stopped it from making billions through its partnership with ad-based search engine Google. In an interview with Axios on Sunday, Apple ($AAPL) CEO Tim Cook defended his company's relationship with the world's leading search engine, and discussed the potential for regulation in tech, which he considers inevitable.