By Josh Boak

The Treasury Department said Monday that 39 million families are set to receive monthly child payments beginning on July 15.

The payments are part of President Joe Biden's $1.9 trillion coronavirus relief package, which expanded the child tax credit for one year and made it possible to pre-pay the benefits on a monthly basis. Nearly 88% of children are set to receive the benefits without their parents needing to take any additional action.

“This tax cut sends a clear and powerful message to American workers, working families with children: Help is here,” Biden said in remarks at the White House.

Qualified families will receive a payment of up to $300 per month for each child under 6 and up to $250 per month for children between the ages of 6 and 17. The child tax credit was previously capped at $2,000 and only paid out to families with income tax obligations after they filed with the IRS.

But for this year, couples earning $150,000 or less can receive the full payments on the 15th of each month, in most cases by direct deposit. The benefits total $3,600 annually for children under 6 and $3,000 for those who are older. The IRS will determine eligibility based on the 2019 and 2020 tax years, but people will also be able to update their status through an online portal. The administration is also setting up another online portal for non-filers who might be eligible for the child tax credit.

The president has proposed an extension of the increased child tax credit through 2025 as part of his $1.8 trillion families plan. Outside analysts estimate that the payments could essentially halve child poverty. The expanded credits could cost roughly $100 billion a year.

Updated on May 17, 2021, at 2:06 p.m. ET with the latest details.

These are the headlines you Need 2 Know for Friday, Aug. 9, 2019.

The Golden State's so-called "resistance" strategy, Alex Padilla said, is rooted in a three-pronged approach: legislation, legal challenges, and civil society organization.

President Trump traveled to El Paso, Texas and Dayton, Ohio on Wednesday, two cities grieving after separate mass shootings killed at least 31 people over the weekend. The president, however, was greeted with large protests in both cities as residents and lawmakers expressed their anger over Trump’s divisive leadership and refusal to support stricter gun control measures.

The rule would be the latest move by the White House against Huawei. The Chinese tech giant was deemed to be a threat to U.S. national security in May and has since been a central component of the ongoing trade dispute between the U.S. and China.

China has historically been one of U.S. farmers' largest buyers, making the sector a prime target for Beijing's retaliatory tariffs.

On this episode of 'Your Cheddar': how one entrepreneur leverages technology to build her brand and monetize her expertise, and the CEO and co-founder of Pillar joins the show to discuss how his platform helps others manage their student loan debt. Cheddar also hits the streets to ask New Yorkers how they would decide between easy money and spending quality time with their favorite celebrities.

President Trump is scheduled on Wednesday to visit El Paso, Texas and Dayton, Ohio, two cities still grieving after separate mass shootings killed at least 31 people over the weekend. The president’s visits, however, have created an atmosphere of angst and unease.

President Trump and the Republican party filed multiple lawsuits on Tuesday to block California’s recently implemented law that requires presidential hopefuls to release their tax returns in order to appear on the state’s primary ballot.

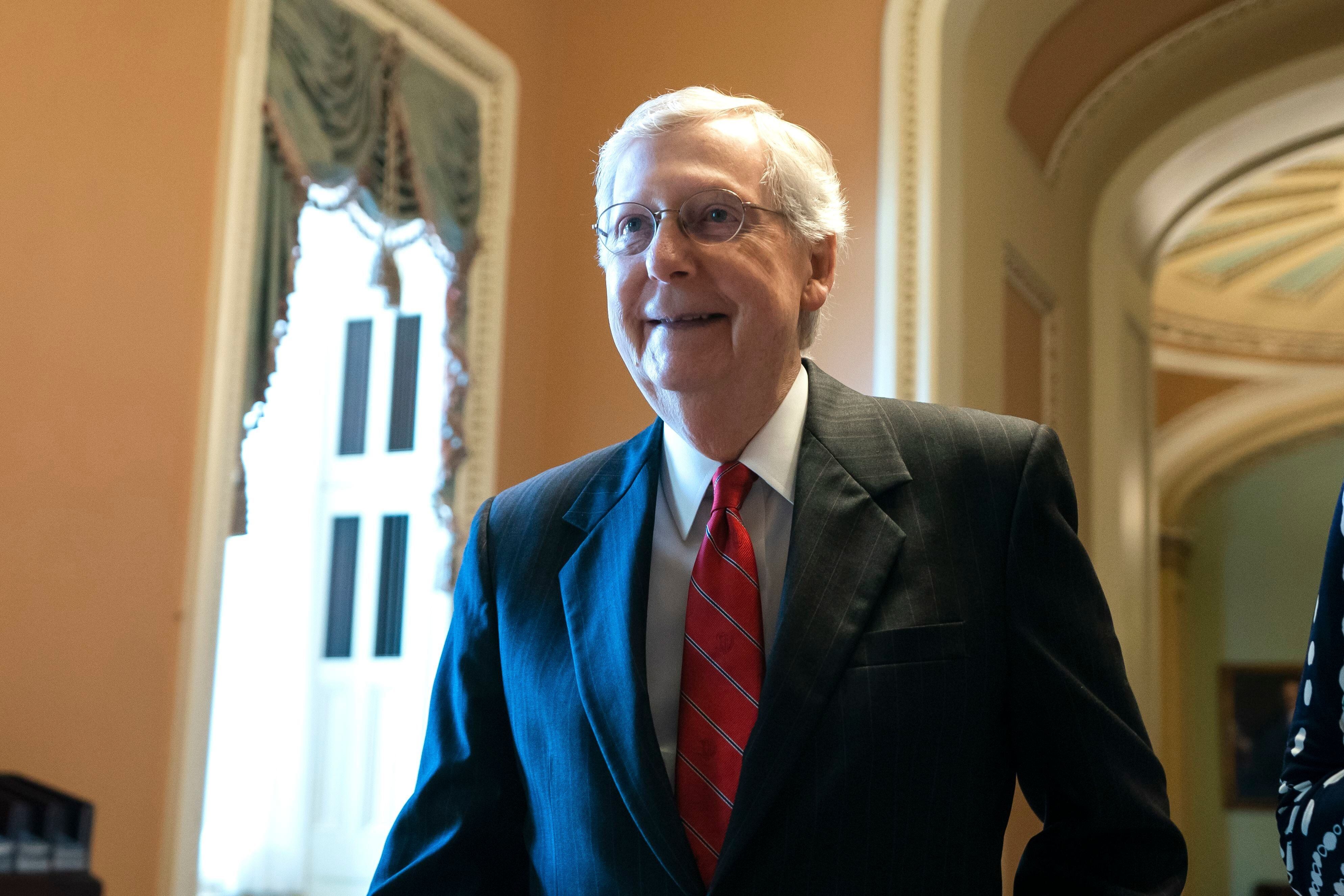

Democratic Sen. Chuck Schumer and Republican Rep. Peter King publicly called on Senate Majority Leader Mitch McConnell to hold a vote on a bipartisan background check legislation, just days after two back-to-back mass shootings in El Paso and Dayton killed over 30 people.

Congressman Matt Gaetz told Cheddar Monday that a focus on mental health is the answer to stop domestic-based gun violence, not gun control or background checks.