Could another missed production goal be enough to really change investors’ tune on Tesla?

Todd Lassa, Detroit Bureau Chief at Automobile Magazine, says falling short on Model 3 deliveries again might deal a blow to the electric automaker’s reputation.

“I think that it’ll affect perception more than bottom line, I think bottom line has always been troublesome over at Tesla,” he said. “We’re basically getting what we’ve always got from Elon Musk, but I think it’s finally starting to catch up to him.”

He points out that he’s long expressed concerns over Tesla’s ability to make money off its cars. In fact Tesla has only posted two profitable quarters in its nearly ten years as a public company, and in its most recent report it announced its biggest ever loss of more than $600 million.

It’s only been in the last few months, though, that the stock has pulled back, down 20 percent since hitting a record high in September.

“Maybe the investment community is catching up with us,” Lassa said.

Tesla has been spending heavily to match its aggressive production agenda, but some analysts aren’t convinced those efforts will pay off. KeyBanc Capital earlier this week slashed its forecast for Model 3 deliveries in the fourth quarter from 15,000 to 5,000.

To put that in perspective, Tesla originally said it would be rolling out 5,000 of the mass-market vehicles *each week* by the end of the year.

For full interview [click here](https://cheddar.com/videos/teslas-model-3-outlook-slashed).

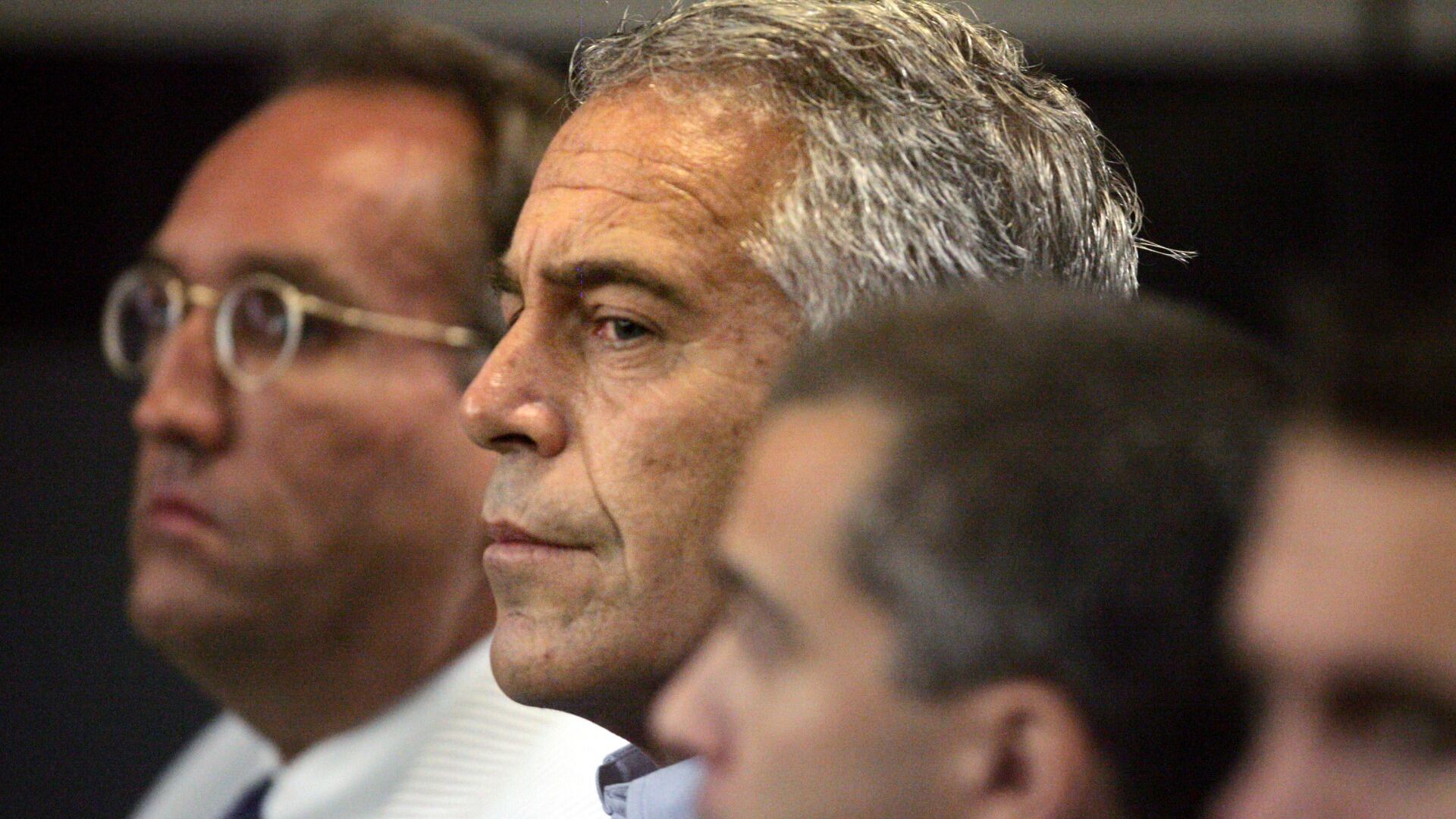

The bank said it regrets its involvement with Epstein over the years that he was a JPMorgan client. The settlement must still be approved by the judge in the case.

Stocks are ticking higher on Wall Street early Monday ahead of a big week for central banks and interest rates around the world.

Billionaire investor turned philanthropist George Soros is ceding control of his $25 billion empire to a younger son, Alexander Soros, according to an exclusive interview with The Wall Street Journal published online Sunday.

UBS said Monday that it has completed its takeover of embattled rival Credit Suisse, nearly three months after the Swiss government hastily arranged a rescue deal to combine the country's two largest banks in a bid to safeguard Switzerland’s reputation as a global financial center and choke off market turmoil.

Gene sequencing test maker Illumina Inc. said Sunday that its board has accepted the resignation of its CEO and director, Francis deSouza, effective immediately.

“Any consumer can tell you that online airline bookings are confusing enough," said William McGee, an aviation expert at the American Economic Liberties Project. "The last thing we need is to roll back an existing protection that provides effective transparency.”

Cheddar News checks in to see what to look out for Next Week on the Street as former president Donald Trump makes an appearance in federal court after being indicted. Investors will also keep an eye on the Federal Reserve meeting to see what comes out of that while earnings continue to pour in.

Google will launch its long-delayed News Showcase product this summer.

Walmart is expanding its HIV treatments, planning to add over 80 specialty facilities across nearly a dozen states by the end of the year.

The Internal Revenue Service said there are about $1.5 billion in unclaimed tax refunds dating back to 2019.