Nearly two years after its attempted initial public offering of shares disintegrated, WeWork is going public in a merger with a special-purpose acquisition company.

WeWork is merging with BowX Acquisition, a SPAC, in a transaction that would value the embattled communal office-space company at $9 billion plus debt, the companies said in a joint statement Friday.

That is far below the $47 billion valuation given the New York venture in September 2019 when WeWork's IPO imploded after massive losses were revealed in regulatory filings.

WeWork said it would also raise $1.3 billion. The listing plan was first reported by the Wall Street Journal.

The company said during a call with industry analysts Friday that it anticipates strong growth as the economy recovers. WeWork anticipates 1.5 million total memberships at some point in 2024. That compares with 2020's 476,000 memberships. Revenue, excluding ChinaCo, is predicted to climb to $7 billion, more than double last year's revenue.

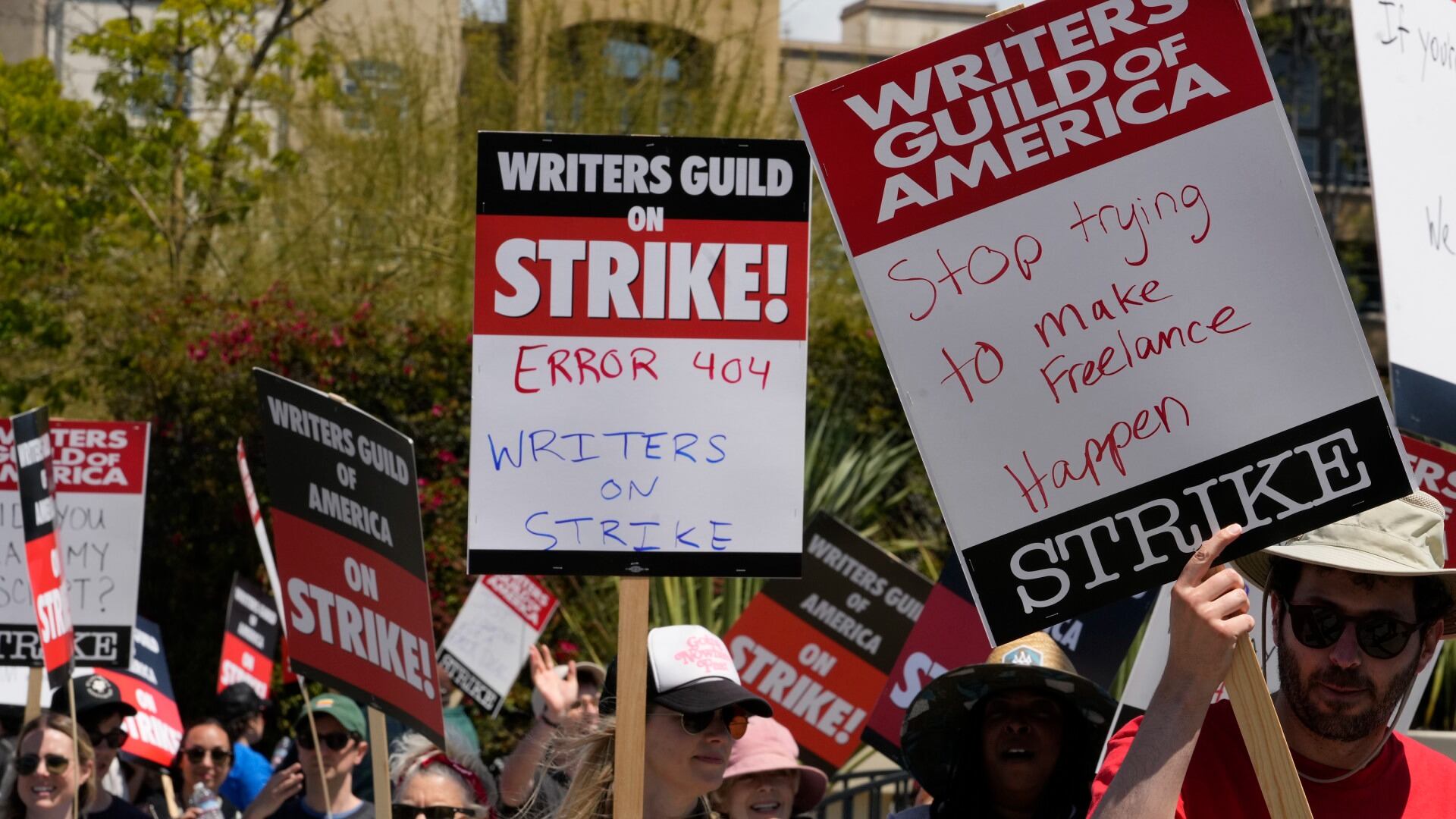

WeWork leases buildings and divides them into office spaces to sublet to members, which include small businesses, start-ups and freelancers who want to avoid laying out funds for permanent office space. The company's operating expenses were exorbitant and it became reliant on repeated cash infusions from private investors.

CEO and founder Adam Neumann, known for erratic behavior as much as for his innovative vision, was pushed aside. He used some of his WeWork stock to secure a $500 million personal loan prior to the IPO. He also drew criticism after The We Company — WeWork’s recently renamed parent — paid him nearly $6 million for the trademark “We.” He returned the money following a backlash.

“WeWork has spent the past year transforming the business and refocusing its core, while simultaneously managing and innovating through a historic downturn," Sandeep Mathrani, who took over as CEO after Neumann's ouster, said in a prepared statement. “As a result, WeWork has emerged as the global leader in flexible space with a value proposition that is stronger than ever."

Neumann co-founded WeWork in 2010 with one shared office in Manhattan. It now has 850 locations in 150 cities around the world.

WeWork's business model may well have better prospects after the coronavirus pandemic than it did before, commercial property experts said.

For starters, there's the typical post-recession surge in new businesses set up by people who lost their jobs, and “the obvious place to start your business nowadays is in a serviced office," said Mat Oakley, head of UK and European commercial research at Savills. There's also the considerable uncertainty around how existing businesses are going to return to the office, combined with employers who find they now need to satisfy their staff’s desire to “work in a more agile fashion,” he said.

Oakley said that while leasing volumes are still low, inquiries for serviced office space have been rising since the start of the year.

“There could be a reasonably optimistic story for serviced office providers going forward," he said.

___

Kelvin Chan reported from London. Michelle Chapman reported from New Jersey.