Venture capital investments in female-founded companies more than doubled in value from 2017 to 2018, according to a study by PitchBook and All Raise, a non-profit organization accelerating the success of female founders and funders.

The study, supported by divisions of Goldman Sachs and Microsoft, found that VC investment in startups with at least one female founder more than doubled to $46 billion in 2018 from $21.9 billion in 2017.

"It's an incredible step," Jenny Abramson, an active member of All Raise, told Cheddar Tuesday. "To see that kind of exponential growth, both in terms of the numbers of deals getting funded as well as the dollars going, is incredible."

The study also found that companies with a female founder are more likely to exit one year faster than companies with male-only founding teams. Recent reports also show that investor returns are higher, revenue is higher, and companies are more capital-efficient when a female is part of the founder or leadership team.

"In the private markets, time is money," Abramson said, referencing the accelerated exits. "So, this is a very exciting report."

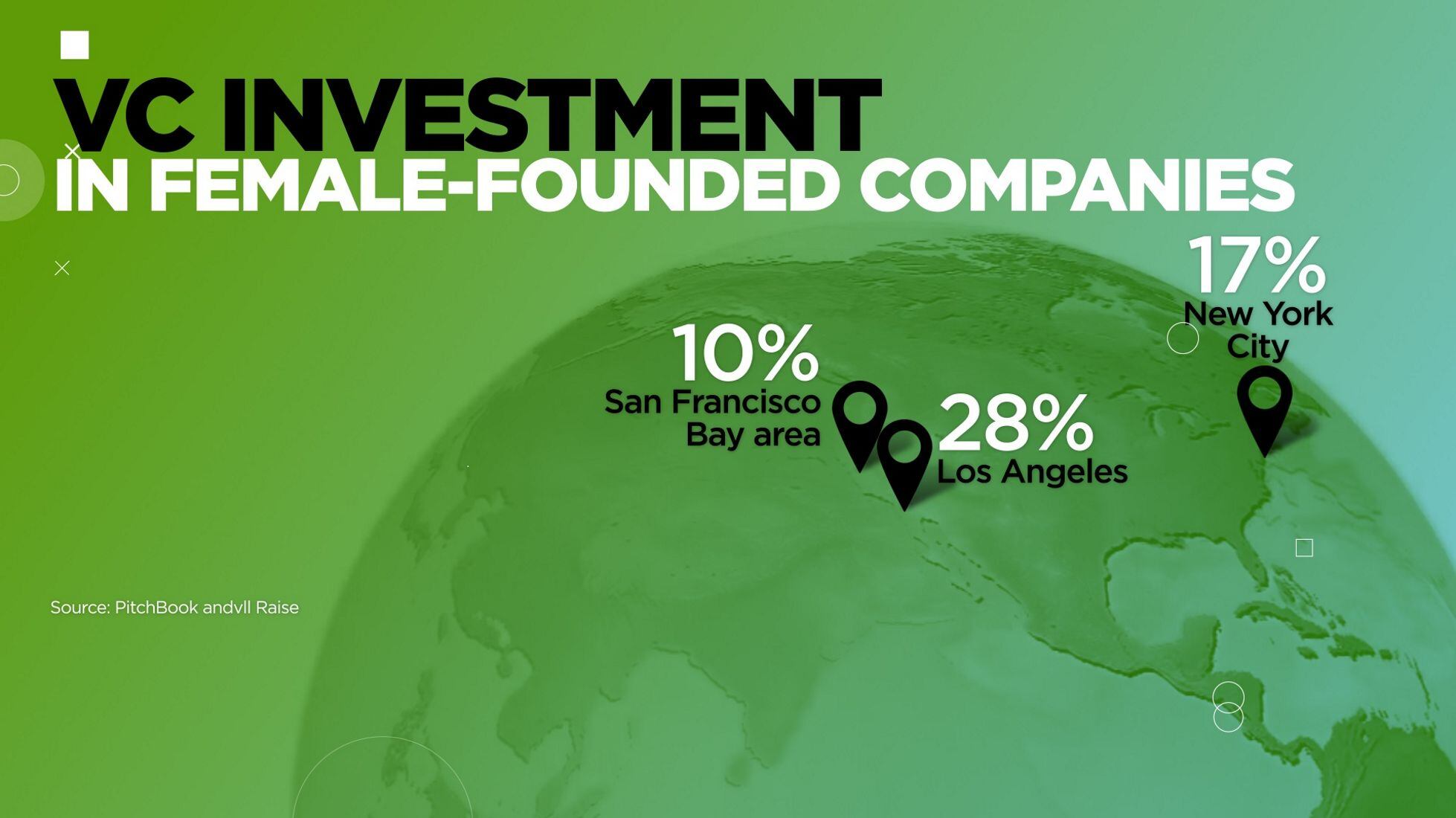

While there's lots of good news in this report, it does highlight some areas in need of improvement. According to the study, in the San Francisco bay area, VC funding into female founding companies was just 10 percent. That number improves to 17 percent in New York City and 28 percent in Los Angeles.

"The numbers in L.A. and New York are pretty impressive compared to Silicon Valley," Abramson said.

Abramson said that there are a number of reasons why some cities are leveling the playing field better than others, citing better networking and mentorship opportunities in L.A. in New York. Still, Abramson notes, a bias toward familiarity may be swaying VC dollars.

"Some of this has to do with the age-old part of venture capital, which is pattern recognition," Abramson said. "When you don't have perfect data on businesses you're investing in, you often invest with some unconscious bias. I think that's traditionally been the case in Silicon Valley."

Abramson, who is the founder and a managing partner at female-centric VC firm Rethink Impact, says firms like her own and movements like All Raise have aided in bringing more awareness and action to the problem.

"Movements, like All Raise and #MeToo and others, are really mattering and really helping people see that this is the moment," she said.