The Federal Deposit Insurance Corp. is set to pay almost $23 billion to stabilize the banking sector. That money comes from an insurance fund that is refilled annually through fees paid by banks. Now the agency is considering a special assessment on the entire industry to help make up the costs, according to a Bloomberg report. It also noted that big banks (who have been the biggest beneficiaries, as depositors have flocked to safer ground) might have to pay extra.

Apple announced that starting this week, it will stop selling some versions of the Apple watch in the U.S.

Southwest Airlines will pay a $35 million fine as part of a $140 million settlement to resolve a federal investigation into a debacle in December 2022 when the airline canceled thousands of flights and stranded more than 2 million travelers over the holidays.

The House of Representatives recently passed a bill aimed at increasing transparency in healthcare.

If you have a flexible spending account, here's some short information for you so you don't leave money on the table.

With high healthcare costs, bills can quickly add up. In some cases, it is possible to negotiate your medical bills. Barak Richman, law professor at George Washington University, joined Cheddar News to discuss the easiest way to talk to medical debt companies about what's owed.

Millions of people have selected insurance plans for 2024 but sometimes navigating them can be tricky time consuming and expensive. Paula Pant, host of 'Afford Anything' podcast, joined Cheddar News to break down what's needed to know about their insurance plans.

The European Union is investigating Elon Musk's X over alleged illicit content and disinformation on its platform. Cheddar News breaks it all down and discusses what it could mean for users.

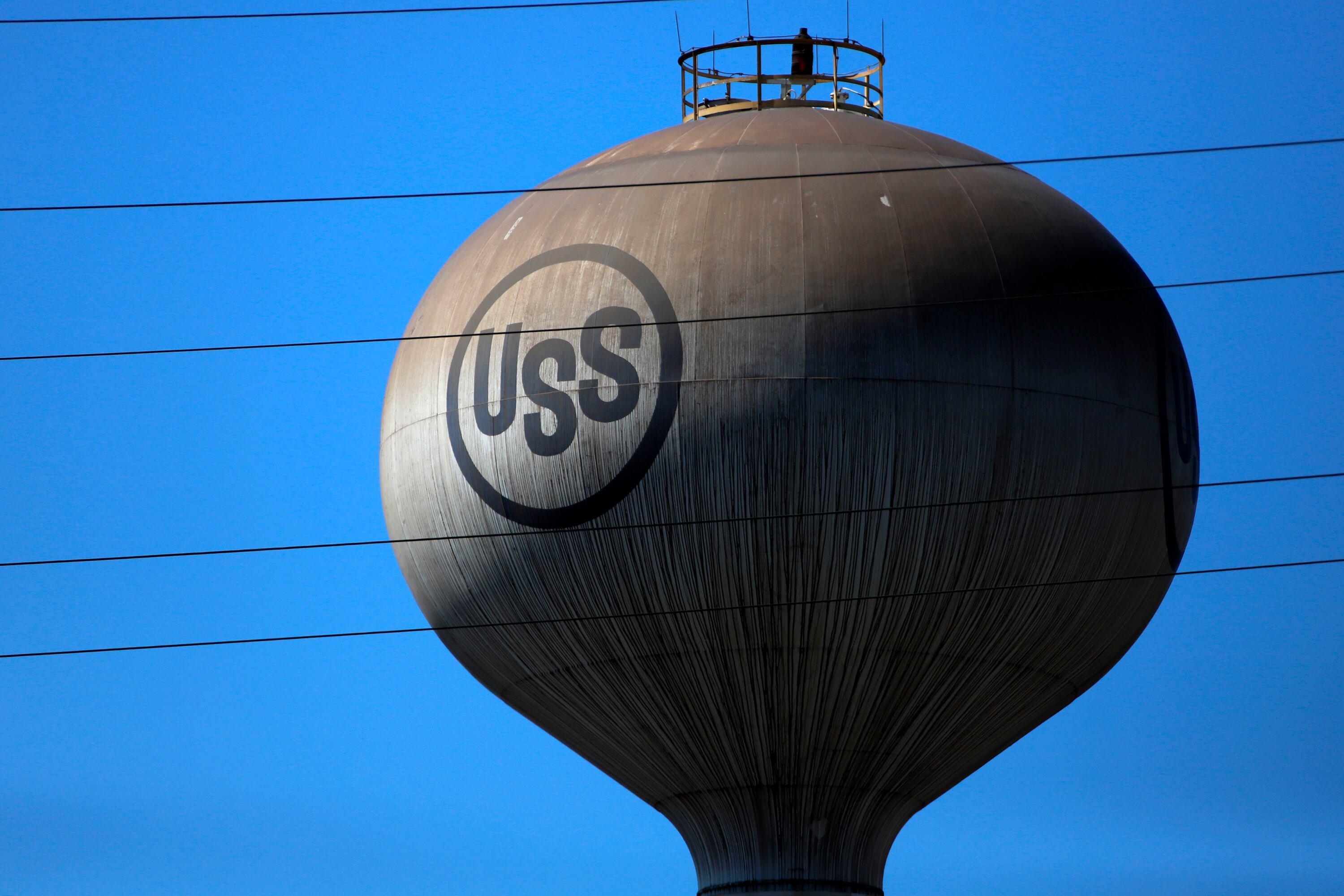

Adobe and Figma called off their $20 million merger, Southwest Airlines gets fined, Nippon Steel is buying U.S. Steel and oil and gas prices surge after a pause in shipments.

With more employees being called back to the office, many workers are suddenly protesting by being in the office for as little time as possible. As the term suggests, coffee-badging means coming in for just enough time to have a cup of coffee, show your face, and swipe your badge.

Japan's Nippon steel is buying U.S. Steel for $14.9 billion.