FinTech in China is booming, and one of the country's peer-to-peer lenders is making its market debut on the New York Stock Exchange. Simon Ho, CFO of PPDAI, joins us to discuss his company's decision to go public. Shares opened for trading at $13.30, slightly above its IPO price of $13 a share.

PPDAI is not the only Chinese lending company seeking investments from the public markets. Ho fills Cheddar in on why there is such a massive opportunity in peer-to-peer lending in China. He notes that companies capitalized on the governments unwillingness to hand out small loans to individuals.

The IPO comes during a time of heightened concerns over Chinese regulations over tech companies. Regulators are worried some lenders are charging unreasonably high rates. Ho explains how the PPDAI is navigating the waters of regulations and breaks down the company's rate structure.

A study from US News and World Report has found the most affordable place to retire is in Ohio.

Millions of households could see higher internet costs next year as the affordable connectivity program could end.

Viveca Chow, NYC lifestyle expert, spoke with Cheddar News to provide tips on how to have some festive fun in the city on a budget.

Apple announced that it's releasing an iPhone security update to prevent attackers from acquiring users' private passcodes.

As the new year approaches, many people are looking to find a job with a higher salary or are planning to ask their current boss for a raise. Taliya Bashani, real estate attorney and negotiation expert, joined Cheddar News to provide tips on how to properly and better negotiate better financial terms.

Meta says it will start testing a program that would allow posts from Threads to appear on other social media sites.

Several healthcare companies are reportedly joining President Biden's artificial intelligence risk management plan.

The Biden administration says it will impose inflation penalties on dozens of drug makers to lower costs for those on Medicare.

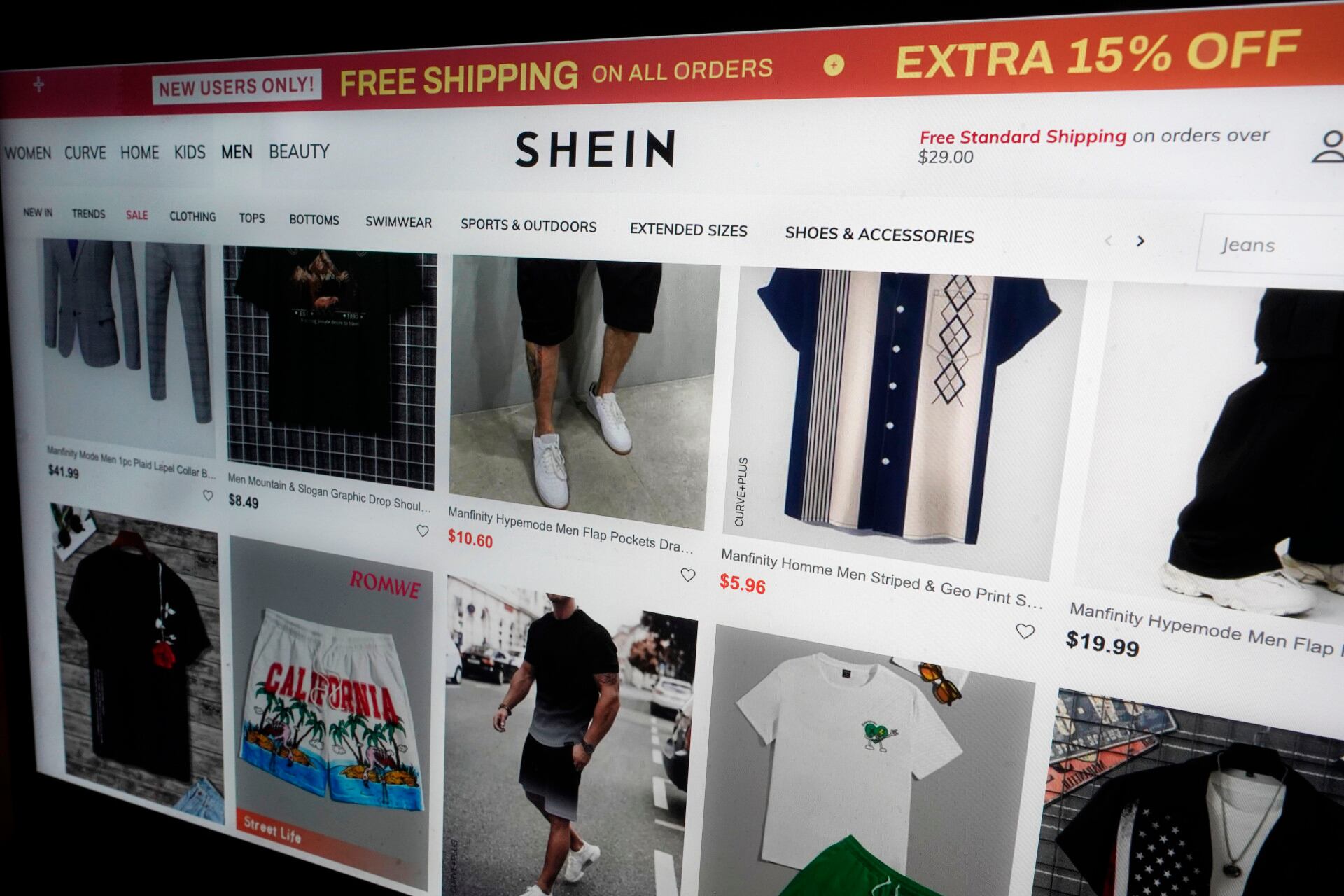

Two of the top low-cost online retailers are going head to head in a new legal battle. Cheddar News' Michelle Castillo breaks the lawsuit down.

The number of Americans filing for jobless benefits fell last week as the labor market continues to thrive despite high interest rates and elevated costs.