Partake Brewing, a Canadian non-alcoholic beverage brand has raised $4 million in institutional funding as it banks on consumers turning towards alternative drinking options.

"I think the big reason for our success and for the renaissance of craft [non-alcoholic] is this drive toward healthier drinking and eating," Partake Brewing CEO Ted Fleming told Cheddar.

Partake is banking on more consumers choosing non-alcoholic options at moments usually associated with drinking beer or wine, such as a happy hour event or party.

"They can have it at lunch and be productive in the afternoon when they get back to work," he said. "They can have it at a business meeting and have that same social experience and connection that comes with those meetings and also then be able to go back and be productive."

Fleming said Partake aims to compete directly with alcoholic options, rather than soda or other non-alcoholic drinks, meaning it's shooting for a larger presence in bars as well as retailers.

While alcohol consumption grew during the coronavirus pandemic, Partake saw its sales rise as well, and now the company is anticipating an uptick thanks to health-consciousness.

"We're expecting there to be a bit of shift now toward healthier products as people get into September, back to school, some resemblance of back to normal," Fleming said. "It's a period where people will re-evaluate how much they're drinking and maybe look towards non-alc a bit more going forward."

Partake's products, which include beer varieties such as IPAs, stouts, pale ales, and blondes, contain zero carbohydrates and as few as 10 calories per drink.

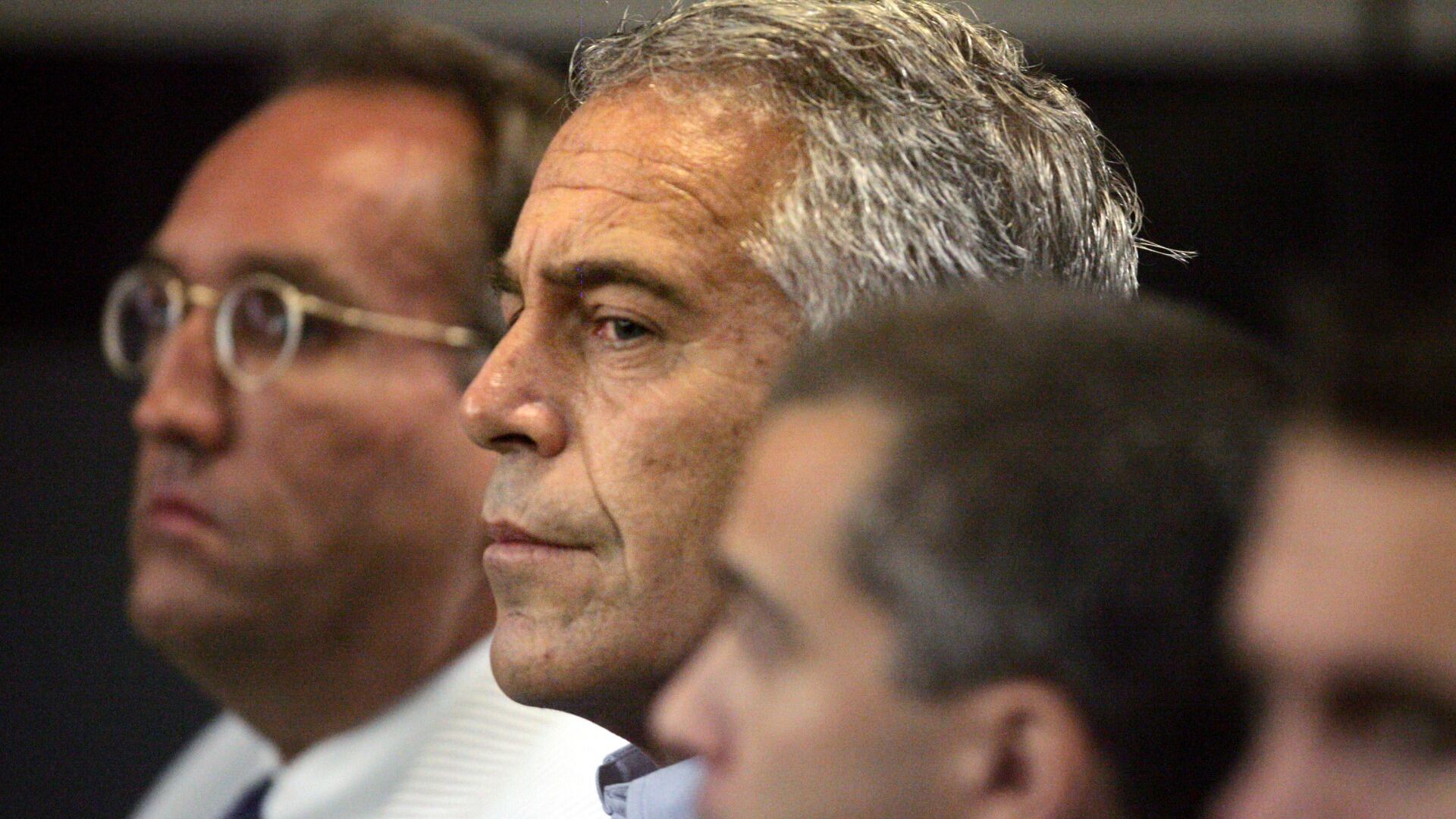

The bank said it regrets its involvement with Epstein over the years that he was a JPMorgan client. The settlement must still be approved by the judge in the case.

Stocks are ticking higher on Wall Street early Monday ahead of a big week for central banks and interest rates around the world.

Billionaire investor turned philanthropist George Soros is ceding control of his $25 billion empire to a younger son, Alexander Soros, according to an exclusive interview with The Wall Street Journal published online Sunday.

UBS said Monday that it has completed its takeover of embattled rival Credit Suisse, nearly three months after the Swiss government hastily arranged a rescue deal to combine the country's two largest banks in a bid to safeguard Switzerland’s reputation as a global financial center and choke off market turmoil.

Gene sequencing test maker Illumina Inc. said Sunday that its board has accepted the resignation of its CEO and director, Francis deSouza, effective immediately.

“Any consumer can tell you that online airline bookings are confusing enough," said William McGee, an aviation expert at the American Economic Liberties Project. "The last thing we need is to roll back an existing protection that provides effective transparency.”

Cheddar News checks in to see what to look out for Next Week on the Street as former president Donald Trump makes an appearance in federal court after being indicted. Investors will also keep an eye on the Federal Reserve meeting to see what comes out of that while earnings continue to pour in.

Google will launch its long-delayed News Showcase product this summer.

Walmart is expanding its HIV treatments, planning to add over 80 specialty facilities across nearly a dozen states by the end of the year.

The Internal Revenue Service said there are about $1.5 billion in unclaimed tax refunds dating back to 2019.