The New York Stock Exchange's trading floor on Wall Street has been shut down since March 23 as its owner, Intercontinental Exchange, has shifted to a fully-electronic system.

"It's absolutely our intention to reopen all of our trading floors, and we'll do so as soon as we believe it's able to be done in a way that reduces the risk for the trading floor community and our employees," Michael Blaugrund, chief operating officer of the NYSE, told Cheddar on Friday.

NYSE has begun that process on the West Coast, as it prepares to partially open its options trading floor in San Francisco, with multiple safety precautions taken.

"On a typical day, we might have 70 people in that facility," Blaugrund said. "We'll have less than half of that on Monday."

There will be medical screening, enforcement of strict social distancing rules, and changes to choreography on the trading floor. Face coverings will also be required for everyone in the building.

The New York-based trading floors will remain closed though, and there's no telling when the world-famous investing buzz will return to 11 Wall Street.

"The local conditions in New York City are much different than in San Francisco," Blaugrund explained. "Including the significant dependency on public transportation for the hundreds of people that work on the New York Stock Exchange floor."

Blaugrund says it's likely that the reopening of the New York trading floor will be similar to that of San Francisco's phased approach.

"Even though we don't know when we'll reopen, we can begin thinking about how we will reopen," Blaugrund said.

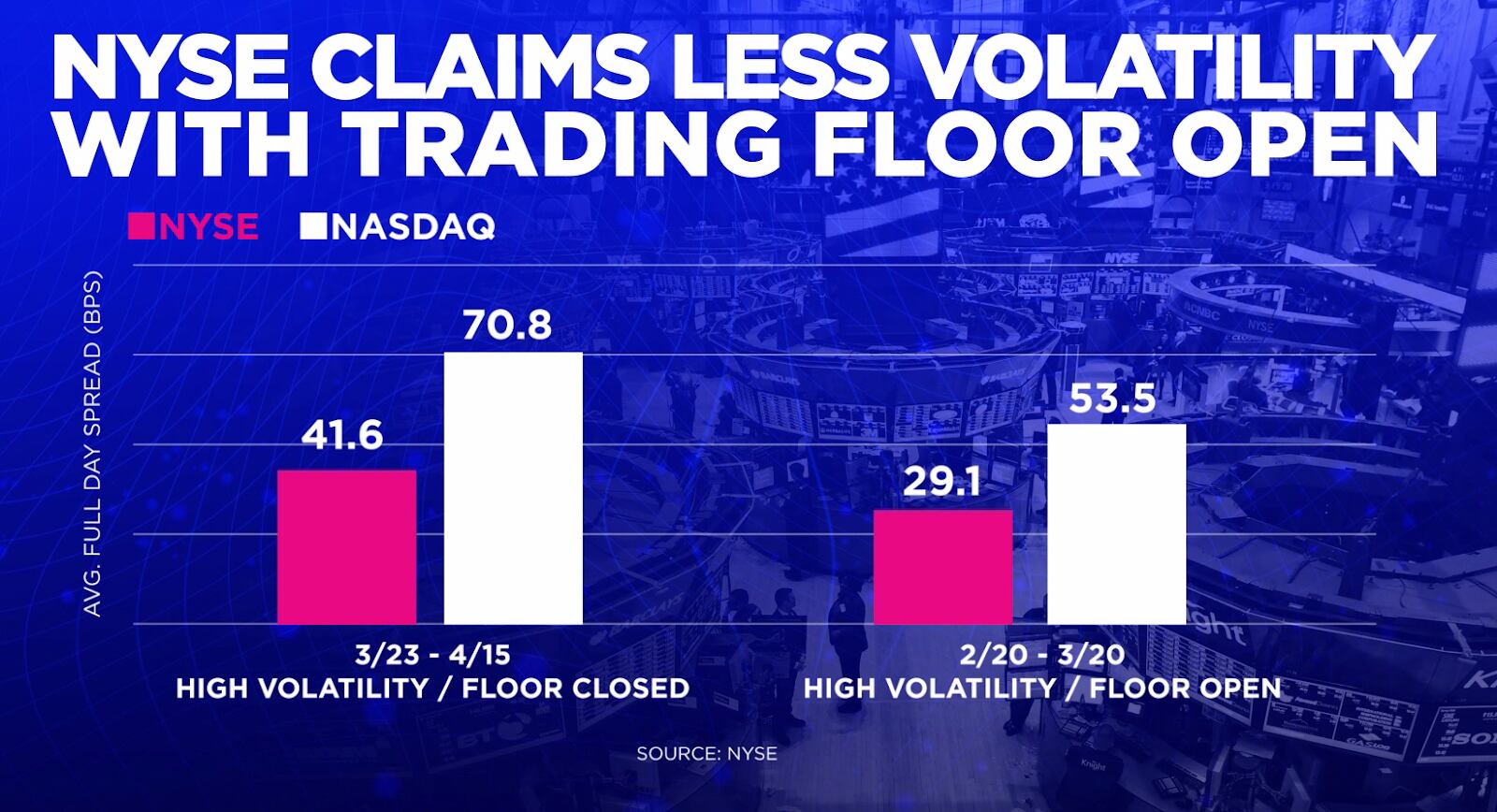

In the meantime, the NYSE has been able to collect data on the value of physical traders by comparing metrics that often affect market volatility.

"For the first time, we've been able to research... 'how much is the out-performance attributed to the human interactions?'" Blaugrund said.

According to NYSE's research, humans on the floor lead to more accurate auction pricing, which limits volatility in the market.

"It's been very gratifying to see that the human interactions on the trading floor create millions of dollars of savings every day for normal investors."