*By Michael Teich*

Netflix's strong quarterly subscriber growth doesn't disguise the reality that Wall Street is grossly overvaluing the streaming giant, said Wedbush Securities analyst Michael Pachter.

"The Street is valuing the stock at more like $450 \[a share\], which implies a valuation of more like $200-$225 billion," Pachter said Wednesday in an interview on Cheddar. "That's crazy talk."

It's also nearly a 25 percent premium to where shares closed the day on Wednesday.

In order to justify a valuation that large for Netflix ($NFLX), Pachter said 200 million people ー 63 million more than currently subscribe ー would have to each pay about $100 more per year, or $8 more a month, on the service.

But adding that many users and hiking rates yet again will be tough amid intense competition from both tech and media rivals, he said.

He predicted it would take three years to hit those subscriber numbers.

As far as its monthly cost, he said Netflix can "probably get to $18-20 without competition."

"But there is competition. Competition comes from Amazon ($AMZN) at $11 a month, Hulu at $11 a month, very likely Disney ($DIS) at $15."

Still after a big miss in user growth for the second quarter, Netflix seemed to quell investor concerns when it said it added nearly 7 million subscribers globally last quarter, handily topping the 5 million that the company forecast and the 5.18 million analysts estimated.

Shares initially rose more than 15 percent after its earnings report, but ended up a little more than 5 percent.

Wedbush Securities lifted its 12-month price target to $150 a share, up from $125. That's 60 percent lower than where the stock closed on Wednesday.

For full interview [click here](https://cheddar.com/videos/the-lonely-bear-case-for-netflix).

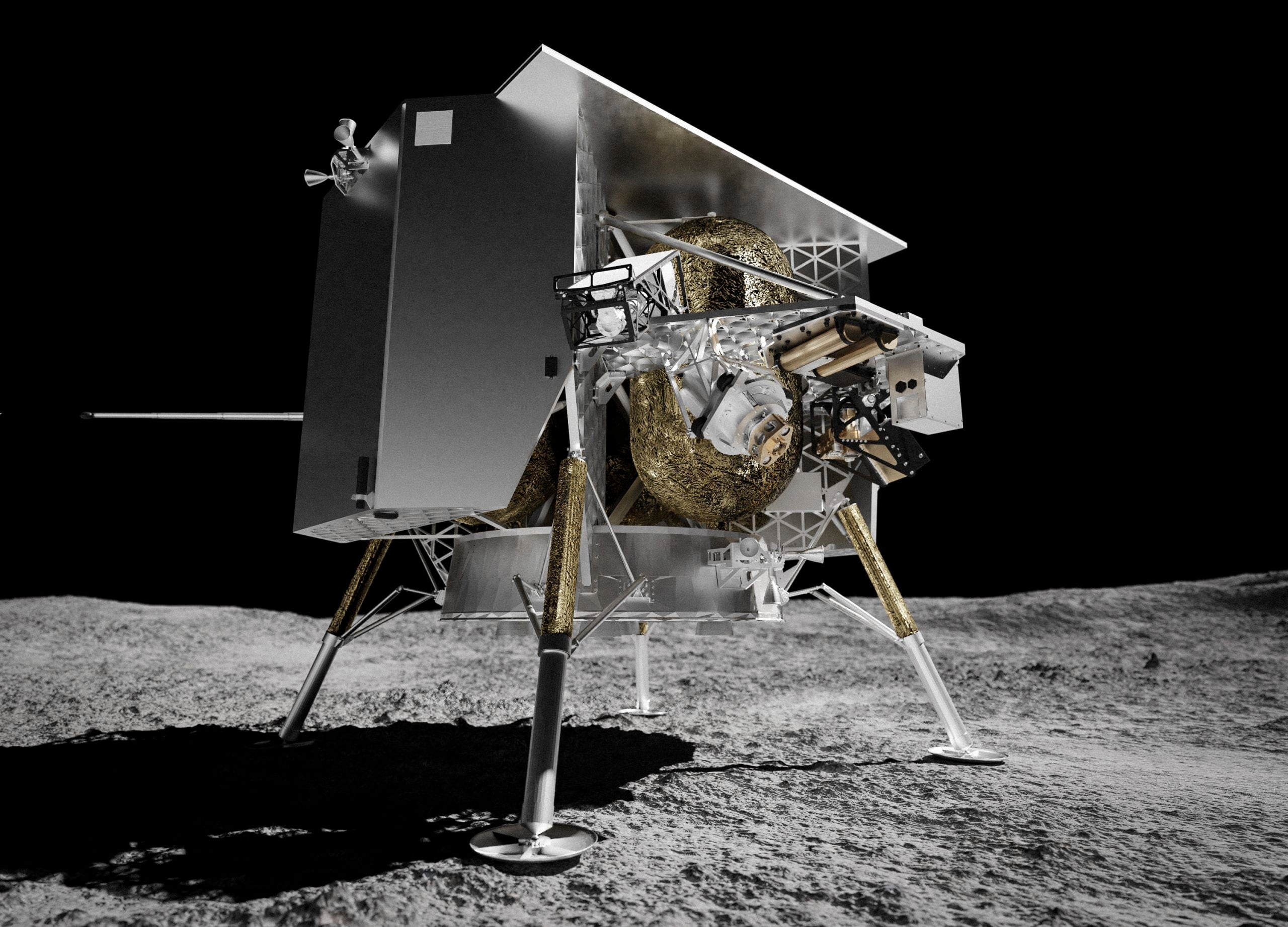

A moon landing attempt by a private US company appears doomed because of a fuel leak on the newly launched spacecraft. Astrobotic Technology managed to orient the lander toward the sun Monday so its solar panel could capture sunlight and charge its onboard battery.

Treasury Secretary Janet Yellen has announced that 100,000 businesses have signed up for a new database that collects ownership information intended to help unmask shell company owners. Yellen says the database will send the message that “the United States is not a haven for dirty money.”

A new version of the federal student aid application known as the FAFSA is available for the 2024-2025 school year, but only on a limited basis as the U.S. Department of Education works on a redesign meant to make it easier to apply.

A steep budget deficit caused by plummeting tax revenues and escalating school voucher costs will be in focus Monday as Democratic Gov. Katie Hobbs and the Republican-controlled Arizona Legislature return for a new session at the state Capitol.

The first U.S. lunar lander in more than 50 years is on its way to the moon. The private lander from Astrobotic Technology blasted off Monday from Cape Canaveral, Florida, catching a ride on United Launch Alliance's brand new rocket Vulcan.

Global prices for food commodities like grain and vegetable oil fell last year from record highs in 2022, when Russia’s war in Ukraine, drought and other factors helped worsen hunger worldwide, the U.N. Food and Agriculture Organization said Friday.

Wall Street is drifting higher after reports showed the job market remains solid, but key parts of the economy still don’t look like they’re overheating.

The Biden administration is docking more than $2 million in payments to student loan servicers that failed to send billing statements on time after the end of a pandemic payment freeze.

The nation’s employers added a robust 216,000 jobs last month, the latest sign that the American job market remains resilient even in the face of sharply higher interest rates.

A U.S. labor agency has accused SpaceX of unlawfully firing employees who penned an open letter critical of CEO Elon Musk and creating an impression that worker activities were under surveillance by the rocket ship company.