With President Trump's tax reform bill now signed into law, some major U.S. corporations may now be prompted to bring back their cash from abroad. Raw Story Staff Writer Elizabeth Preza and CRTV Congressional Correspondent Nate Madden explain how people and businesses are reacting to the new tax policy.

"You're going to see an influx of some companies bringing assets back," says Madden. "They've gotten a one-time break on this, so they can move it without taking a tax hit." Corporations bringing more investments to the United States aligns with President Trump and the GOP's message on jobs says Madden.

Preza says it's important to look at the impact on jobs through previous corporate tax cuts like the one in 2004 enacted by the Bush administration. "The Congressional Research Service found that, instead of using money to invest back into the company, [corporations] really paid out shareholders and gave it back to themselves," says Preza.

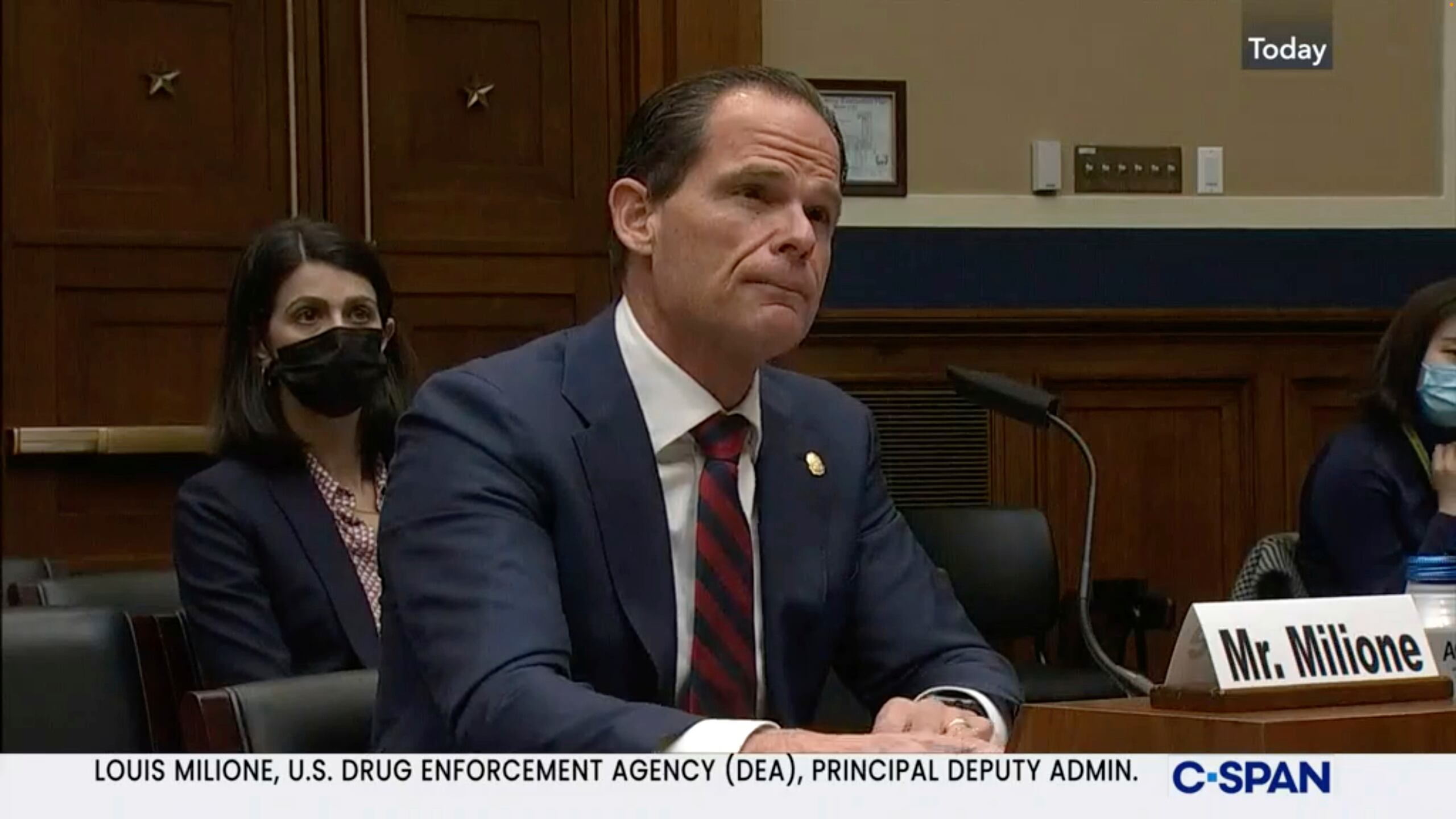

The U.S. Drug Enforcement Administration’s second-in-command has quietly stepped down amid reporting by The Associated Press that he once consulted for a pharmaceutical distributor sanctioned for a deluge of suspicious painkiller shipments and did similar work for the drugmaker that became the face of the opioid epidemic: Purdue Pharma.

The Biden administration on Wednesday proposed new guidelines for corporate mergers, took steps to disclose the junk fees charged by landlords and launched a crackdown on price-gouging in the food industry.

Former Secretary of State Henry Kissinger made a secret trip to China to meet with leaders.

Travis King, a private 2nd Class U.S. soldier, was identified as the individual that crossed the North and South Korean border earlier this week.

Several civil rights groups are suing Florida Gov. Ron DeSantis over his new immigration laws.

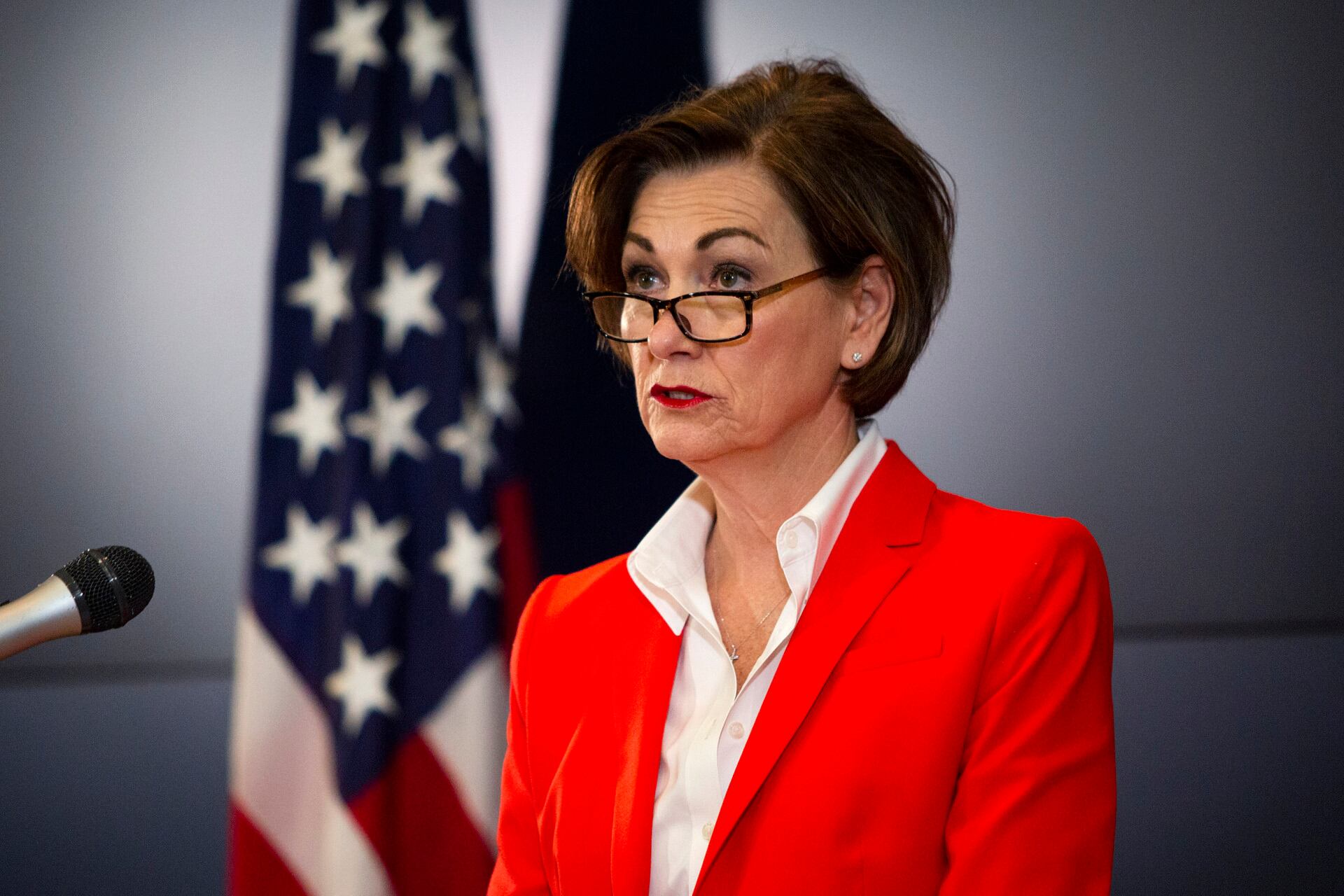

A judge in Iowa temporarily blocked the state's six-week abortion ban.

A U.S. national is being held in North Korea after crossing its closely-guarded border with South Korea.

The Biden administration and major consumer technology players on Tuesday launched an effort to put a nationwide cybersecurity certification and labeling program in place to help consumers choose smart devices that are less vulnerable to hacking.

Former President Donald Trump said Tuesday that he has received a letter informing him that he is a target of the Justice Department's investigation into efforts to undo the results of the 2020 presidential election, an indication that he could soon be indicted by federal prosecutors.

A judge in Iowa has temporarily blocked the state's new six-week abortion ban from taking effect.