Early Wednesday morning the Senate passed its tax reform bill, hours after it was sent back to the House for a re-vote. Romina Boccia, Deputy Director at The Heritage Foundation, joins Cheddar to discuss how the bill will impact small companies and what she wishes was included in the legislation.

She predicts there will be more foreign direct investments into American companies, which will drive wages and create jobs in the U.S. It will encourage major corporations to move their headquarters to America. The corporate tax rate will drop from 35% to 21%, bringing American closer to the world's average, she says.

Plus, many are concerned about the removal of the state and city tax deduction. Boccia explains you can still deduct up to $10,000 with the cap now. She says only very wealthy individuals will feel an impact.

Russian President Vladimir Putin arrived in Beijing, underscoring China's continued support of Moscow amid Russia's ongoing war in Ukraine.

The Justice Department is appealing the prison sentence of the lengths of four Proud Boys leaders who were convicted in the January 6th Capitol attack.

Supreme Court Justice Amy Coney Barrett endorsed the idea that the court adopt a formal code of conduct.

The Supreme Court ruled it would allow the Biden administration to regulate so-called ghost guns, or those untraceable homemade weapons, and also barred two Texas-based manufacturers from selling products that can be turned into ghost guns.

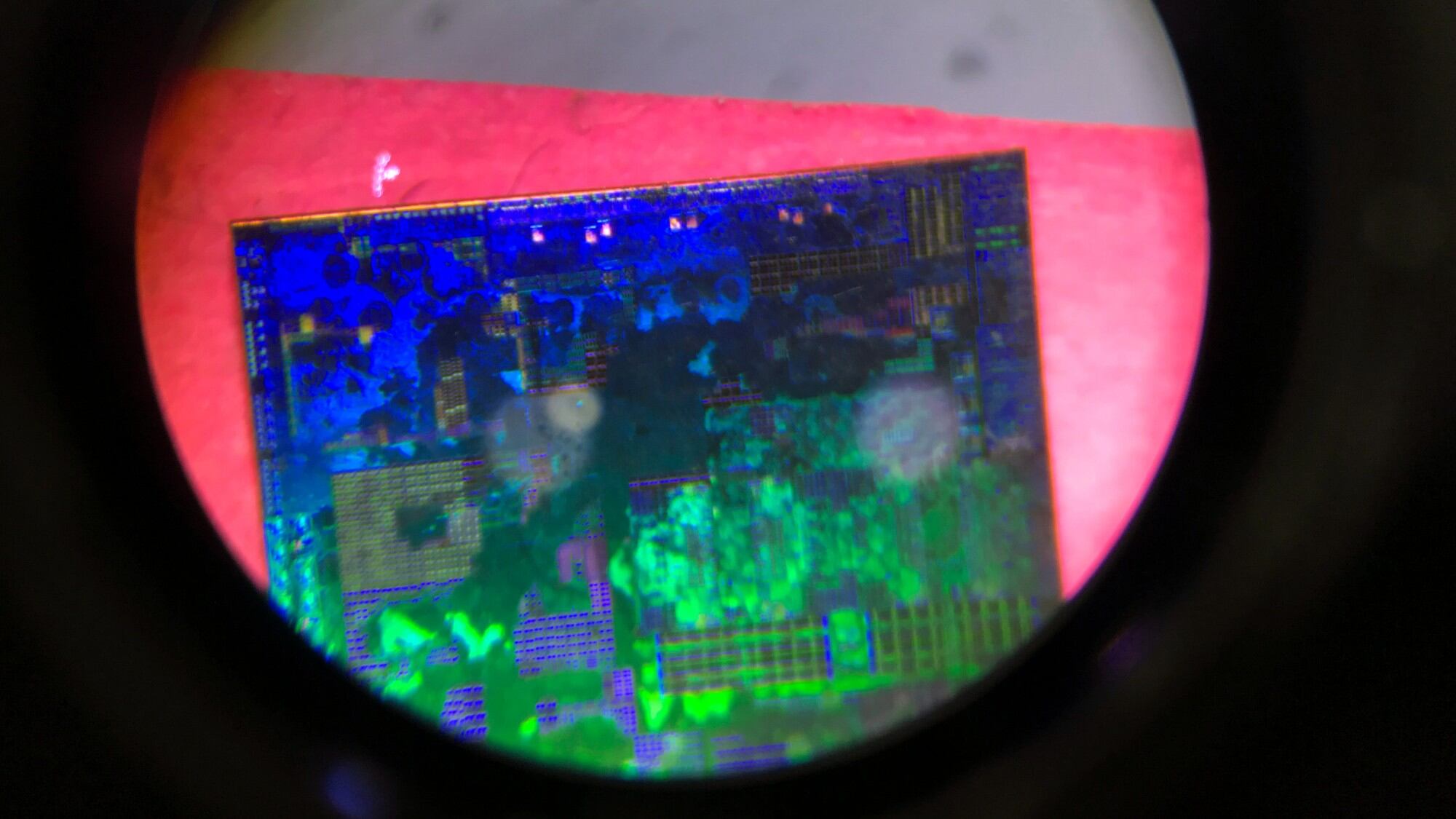

The Commerce Department on Tuesday updated and broadened its export controls to stop China from acquiring advanced computer chips and the equipment to manufacture them.

And in a surprise move, President Joe Biden has joined former President Trump's Truth social platform.

The Supreme Court ruled it would allow the Biden administration to regulate so-called ghost guns, or those untraceable homemade weapons, and also barred two Texas-based manufacturers from selling products that can be turned into ghost guns.

Former President Donald Trump returned to a New York City courtroom Tuesday to watch the civil fraud trial that threatens to disrupt his real estate empire, renewing his claims that the case is a baseless and politically targeted distraction from his 2024 campaign.

Over 30 people were arrested outside of the White House Monday during a protest against the Israel-Hamas war.

President Joe Biden swept into wartime Israel for a 7 1/2-hour visit Wednesday that produced a heaping dose of vocal support and a deal to get limited humanitarian aid into Gaza from Egypt.