Early Wednesday morning the Senate passed its tax reform bill, hours after it was sent back to the House for a re-vote. Romina Boccia, Deputy Director at The Heritage Foundation, joins Cheddar to discuss how the bill will impact small companies and what she wishes was included in the legislation.

She predicts there will be more foreign direct investments into American companies, which will drive wages and create jobs in the U.S. It will encourage major corporations to move their headquarters to America. The corporate tax rate will drop from 35% to 21%, bringing American closer to the world's average, she says.

Plus, many are concerned about the removal of the state and city tax deduction. Boccia explains you can still deduct up to $10,000 with the cap now. She says only very wealthy individuals will feel an impact.

The Florida GOP suspended its chairman yesterday amid a police investigation into a rape accusation against him.

Lawmakers may finally be close to a deal for a new border security bill.

A car crashed into a parked Secret Service SUV that was guarding President Biden's motorcade in Delaware on Sunday.

A car plowed into a parked SUV that was guarding President Joe Biden’s motorcade Sunday night while the president was leaving a visit to his campaign headquarters.

Negotiators insist they are making progress, but a hoped-for framework did not emerge. The talks come as Donald Trump, the Republican presidential front-runner in 2024, delivered alarming anti-immigrant remarks about “blood” purity over the weekend, echoing Nazi slogans of World War II at a political rally.

The Supreme Court decided to leave in place a ban on semi-automatic weapons in the state of Illinois.

The Senate passed a bill giving retroactive pay increases to those service members who may have been affected by the hold on military promotions caused by Senator Tommy Tuberville.

Jurors are expected to resume deliberations this morning in a case that centers on how much Donald Trump's former lawyer Rudy Giuliani must pay in his damages defamation trial.

President Biden said Israel needs to be more careful when it comes to civilian deaths in its war with Hamas as the next phase of the war is weeks away.

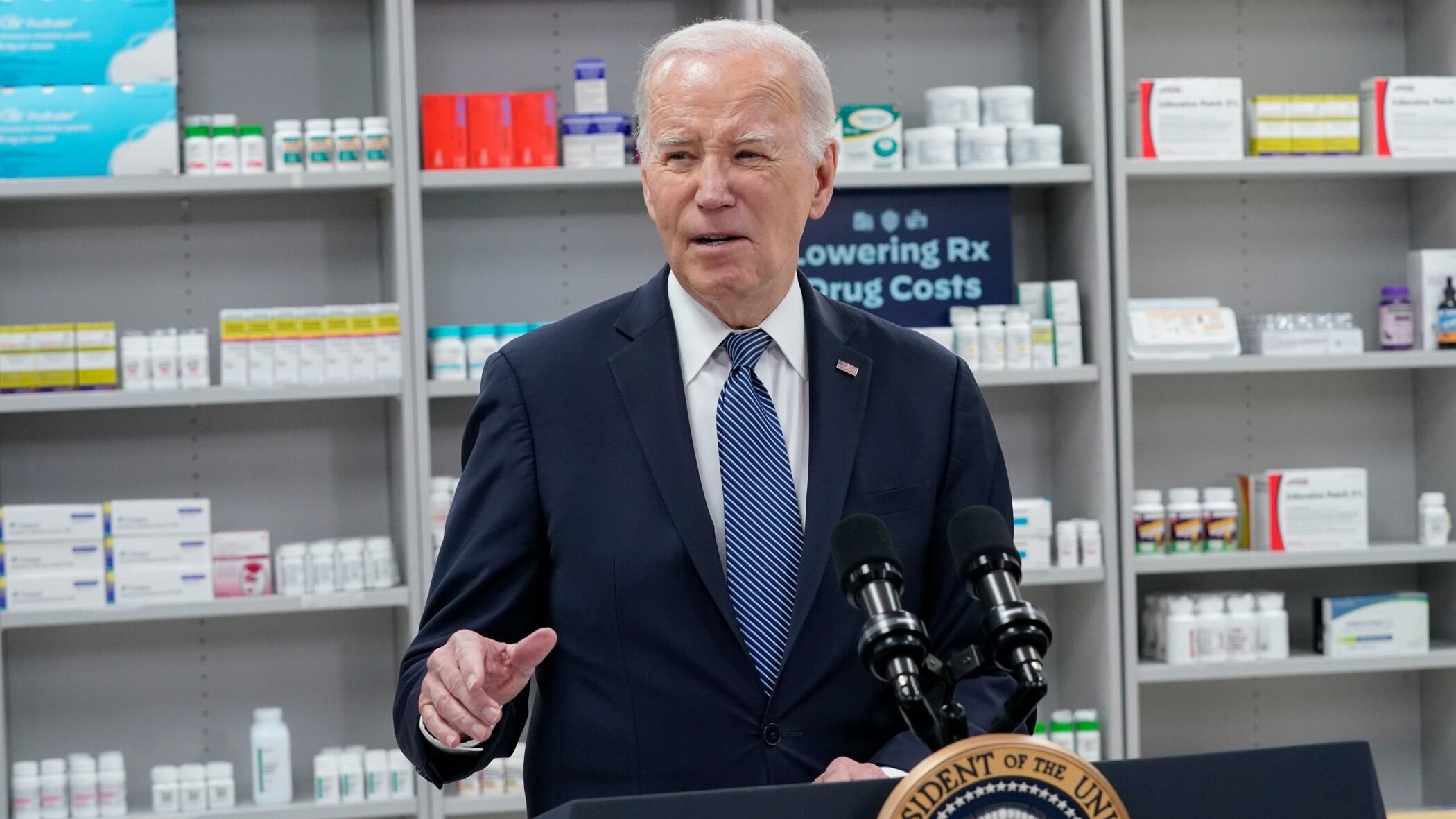

The White House has unveiled a list of 48 drugs that drugmakers will have to pay rebates to the federal government on due to raising their prices higher than the cost of inflation during this year.