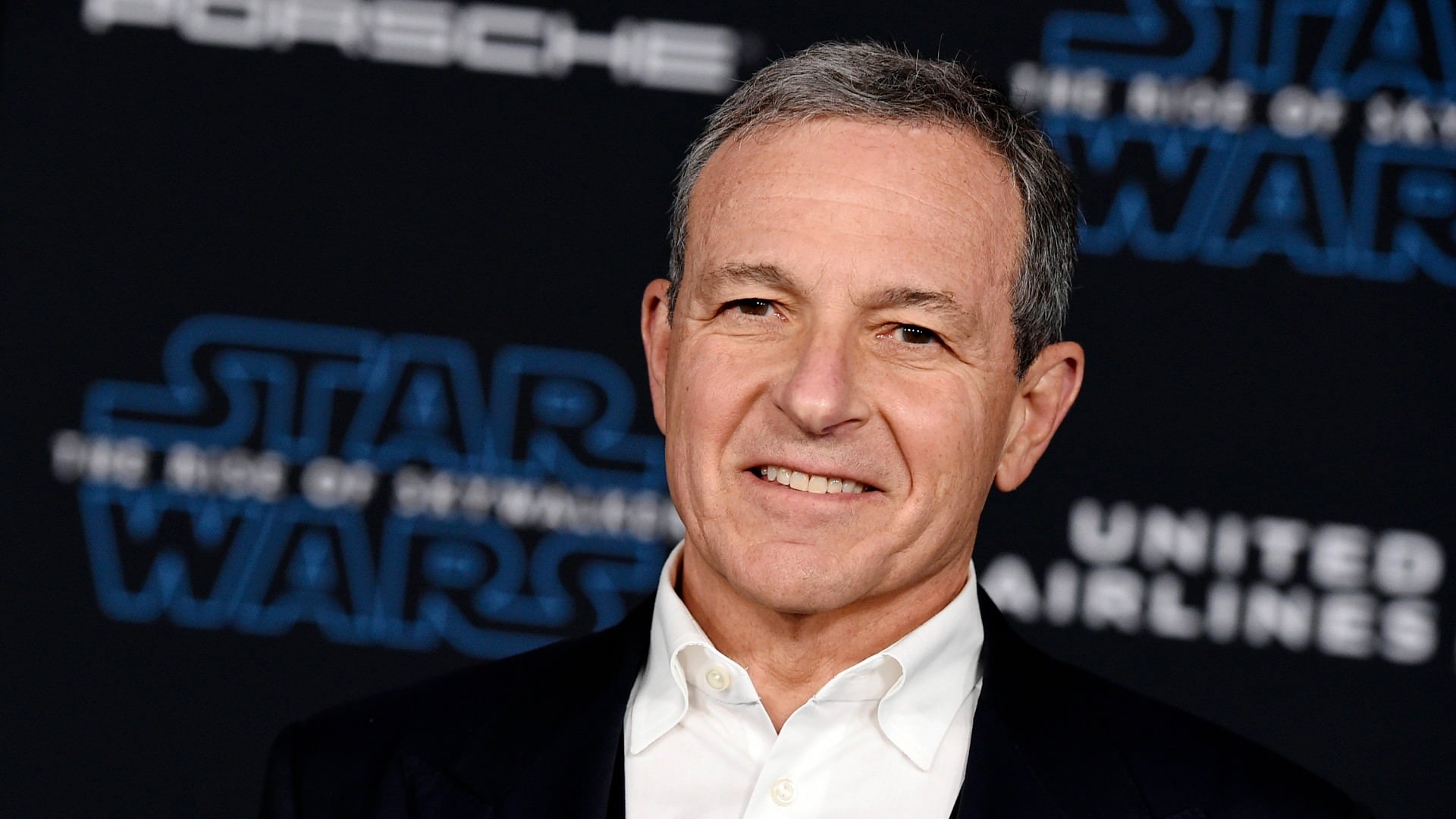

Disney shareholders rallied behind longtime CEO Robert Iger, voting Wednesday to rebuff activist investor Nelson Peltz and his ally, former Disney Chief Financial Officer Jay Rasulo, who had sought seats on the company’s board.

The company had recommended a slate of directors that did not include Peltz or Rasulo.

The dissident shareholders had said in a preliminary proxy filing that they wanted to replace Iger at Disney and align management pay with performance. Despite their loss, they declared a victory of sorts following the vote, noting that since Peltz’s company, Trian Partners, started pushing Disney in late 2023, the entertainment giant has engaged in a flurry of activity by adding new directors, and announcing new operating initiatives and capital improvement plans for its theme parks.

“Over the last six months, Disney’s stock is up approximately 50% and is the Dow Jones Industrial Average’s best performer year-to-date,” Trian said in a statement.

Disney announced in November 2022 that Iger would come back to the company as its CEO to replace his hand-picked successor, Bob Chapek, whose two-year tenure had been marked by clashes, missteps and weakening financial performance.

Iger was Disney’s public face for 15 years as chief executive before handing the job off to Chapek in 2020, a stretch in which Iger compiled a string of victories lauded in the entertainment industry and by Disney fans. But his second run at the job has not won him similar accolades.