*By Justin Chermol*

The daunting task of paying back astronomical student loans may soon be less taxing, California Congressman Scott Peters tells told Cheddar Tuesday.

Rep. Peters (D-Calif.) has received 99 co-sponsors on his bipartisan Employer Participation in Repayment Act, which would allow employers to contribute to their employees' student loan payments, tax-free.

"The idea is this: if you go to work for a company, they can pay off up to $5,250 of your student loans in a year without it being income to you, so it's not taxable to you," Peters told Cheddar's J.D. Durkin.

"If you talk to any young person about ... the big thing on their mind: it's student loan debt. They're not buying a house, they're not getting a car, they're living with their parents, all because they have this burden."

According to a recent [report](https://www.federalreserve.gov/publications/files/consumer-community-context-201901.pdf) from the Federal Reserve, the rise in student loan debt from 2005 to 2014 has contributed to a decline in home ownership.

Nearly one in four American adults are paying off student loans. That amounts to over 44 million citizens who hold collectively almost $1.5 trillion in student debt.

"The average debt now, out of a public university: $30,000 for each kid," Peters said.

Peters also said that the bill could benefit the employer as well ー as educated talent will be attracted to jobs that offer this tax-free incentive.

Peter said he feels good about the bill's chances of at least making it to the House floor for a vote.

"I am more optimistic about that in this Congress with Mrs. Pelosi, rather than Mr. Ryan. I think that we are likely to deal with this issue in a serious way," Peters said. "That's the first step."

More than 119,000 people have been injured by tear gas and other chemical irritants around the world since 2015 and some 2,000 suffered injuries from “less lethal” impact projectiles, according to a report released Wednesday.

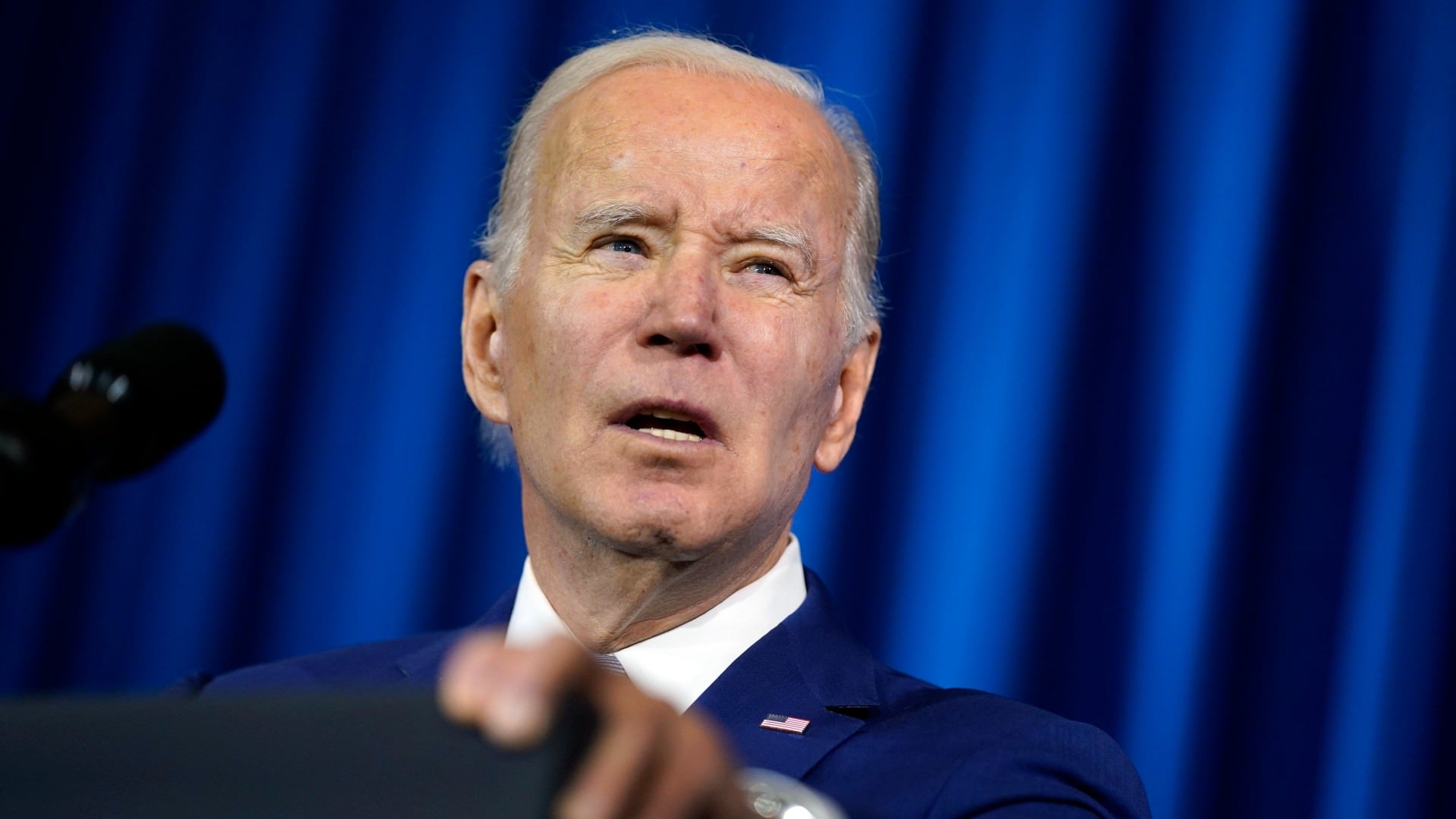

President Joe Biden is calling for more transparency by signing the COVID-19 Origins Act.

TikTok has rolled out updated rules and standards for content and its CEO warned against a possible U.S. ban on the video sharing app as he prepares to face Congress.

Tens of thousands of workers in the Los Angeles Unified School District walked off the job Tuesday over stalled contract talks, and they are being joined in solidarity by teachers in a three-day strike that has shut down the nation’s second-largest school system.

Treasury Secretary Janet Yellen is trying project calm after regional bank failures, saying the U.S. banking system is “sound” but additional rescue arrangements “could be warranted” if any new failures at smaller institutions pose a risk to financial stability.

Ted Lasso Cast Visits White House to Promote Mental Health & Wellness

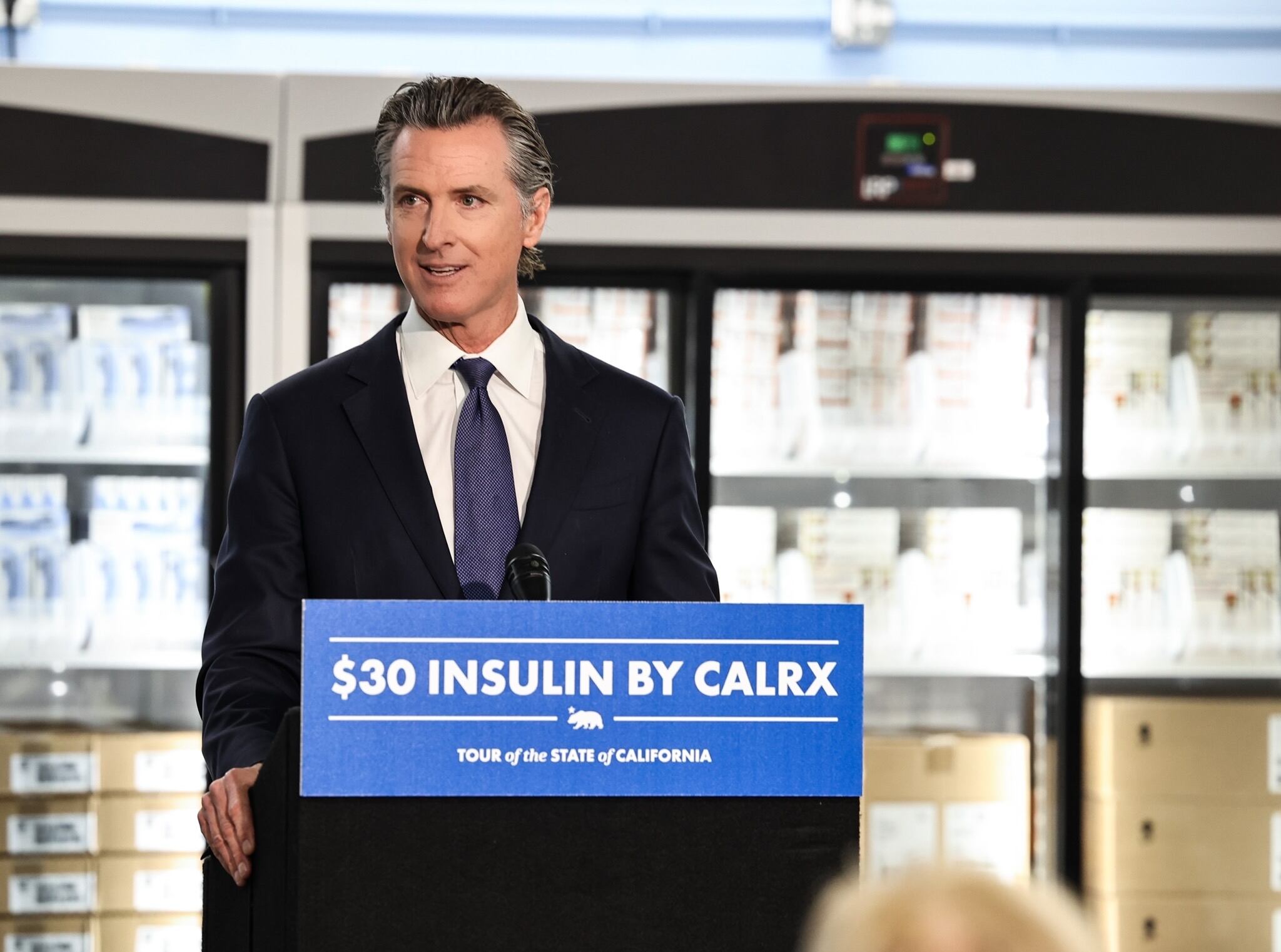

California Gov. Gavin Newsom over the weekend announced that the state has secured a contract with CIVCA to make $30 insulin available to all who need it. He also announced that the state will start manufacturing Naloxone, an emergency medication used to rapidly reverse the effects of an opioid overdose.

The International Criminal Court said Friday that it has issued an arrest warrant for Russian President Vladimir Putin for war crimes, accusing him of personal responsibility for the abductions of children from Ukraine.

Cash-short banks have borrowed about $300 billion from the Federal Reserve in the past week, the central bank announced Thursday.

A total of 33 states and the District of Columbia now allow at least some form of sports wagering, but the prospects are mixed for expanding sports betting to additional states this year.