*By Justin Chermol*

The daunting task of paying back astronomical student loans may soon be less taxing, California Congressman Scott Peters tells told Cheddar Tuesday.

Rep. Peters (D-Calif.) has received 99 co-sponsors on his bipartisan Employer Participation in Repayment Act, which would allow employers to contribute to their employees' student loan payments, tax-free.

"The idea is this: if you go to work for a company, they can pay off up to $5,250 of your student loans in a year without it being income to you, so it's not taxable to you," Peters told Cheddar's J.D. Durkin.

"If you talk to any young person about ... the big thing on their mind: it's student loan debt. They're not buying a house, they're not getting a car, they're living with their parents, all because they have this burden."

According to a recent [report](https://www.federalreserve.gov/publications/files/consumer-community-context-201901.pdf) from the Federal Reserve, the rise in student loan debt from 2005 to 2014 has contributed to a decline in home ownership.

Nearly one in four American adults are paying off student loans. That amounts to over 44 million citizens who hold collectively almost $1.5 trillion in student debt.

"The average debt now, out of a public university: $30,000 for each kid," Peters said.

Peters also said that the bill could benefit the employer as well ー as educated talent will be attracted to jobs that offer this tax-free incentive.

Peter said he feels good about the bill's chances of at least making it to the House floor for a vote.

"I am more optimistic about that in this Congress with Mrs. Pelosi, rather than Mr. Ryan. I think that we are likely to deal with this issue in a serious way," Peters said. "That's the first step."

Indiana's initial estimate for Medicaid expenses is nearly $1 billion short of its now-predicted need, state lawmakers learned in a report that ignited concern over the state's budget and access to the low-income healthcare program.

The IRS said Tuesday it is going to waive penalty fees for people who failed to pay back taxes that total less than $100,000 per year for tax years 2020 and 2021.

Senate leaders announced Tuesday that there will not be a vote this year on a border security package that included funding for Ukraine and Israel.

Criticism is continuing to mount on former President Donald Trump for his comments over the weekend saying immigrants are "poisoning the blood" of the country.

A former Proud Boys organizer was sentenced to 40 months in prison yesterday for his involvement in the January 6, 2021 attack on the U.S. Capitol.

Israel reportedly delivered an offer with possible terms for a second week-long ceasefire.

A divided Colorado Supreme Court is removing former President Donald Trump from the state’s primary ballot, saying in a historic ruling that he is ineligible to be president after his role in the Jan. 6, 2021, attack on the U.S. Capitol.

The death of a 5-year-old migrant boy and reported illnesses in other children living at a warehouse retrofitted as a shelter has raised fresh concerns about the living conditions and medical care provided for asylum-seekers arriving in Chicago.

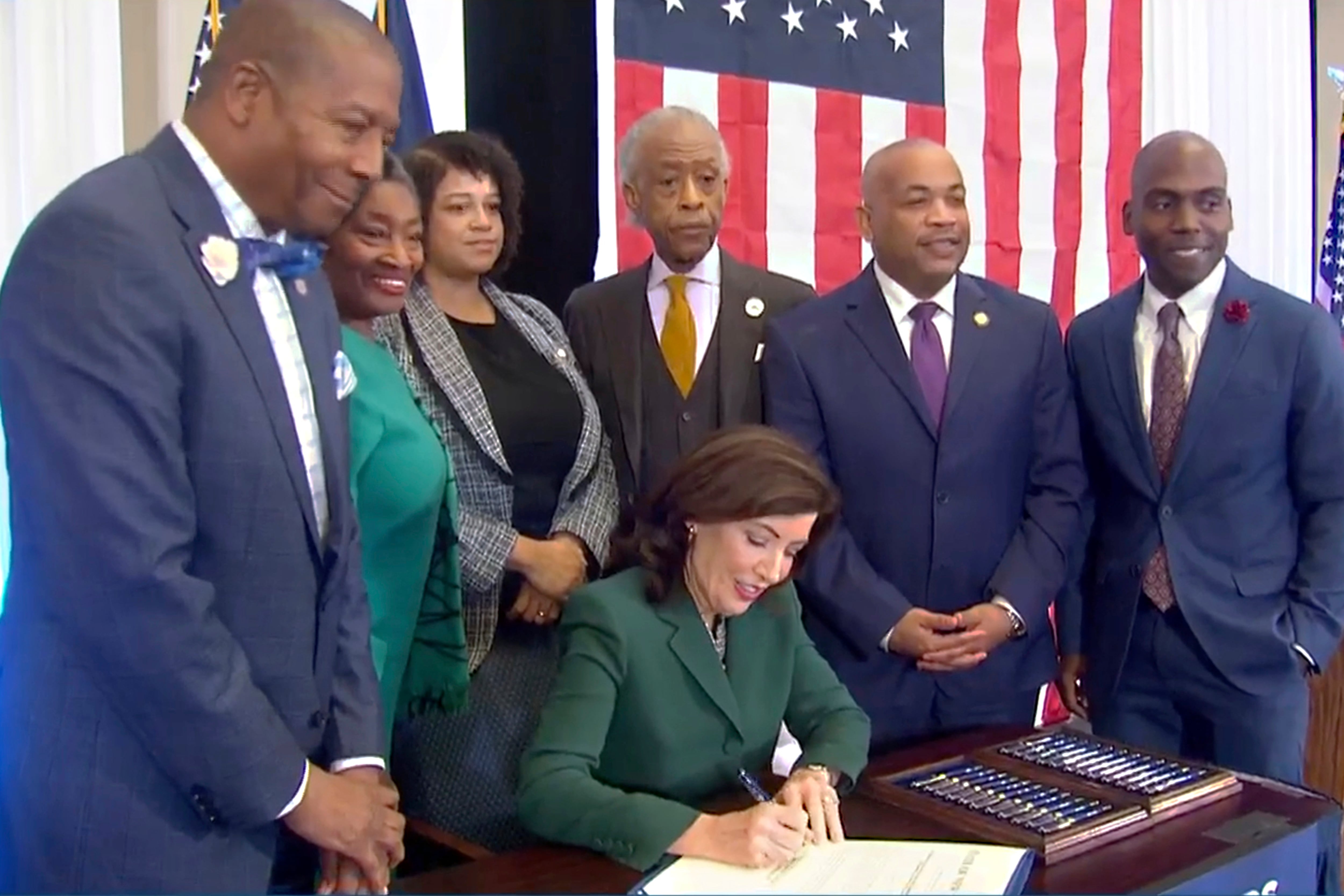

New York State will create a commission tasked with considering reparations to address the persistent, harmful effects of slavery in the state under a bill signed into law by Gov. Kathy Hochul on Tuesday.

The White House is lending its support to an auto industry effort to standardize Tesla’s electric vehicle charging plugs for all EVs in the United States.