*By Justin Chermol*

The daunting task of paying back astronomical student loans may soon be less taxing, California Congressman Scott Peters tells told Cheddar Tuesday.

Rep. Peters (D-Calif.) has received 99 co-sponsors on his bipartisan Employer Participation in Repayment Act, which would allow employers to contribute to their employees' student loan payments, tax-free.

"The idea is this: if you go to work for a company, they can pay off up to $5,250 of your student loans in a year without it being income to you, so it's not taxable to you," Peters told Cheddar's J.D. Durkin.

"If you talk to any young person about ... the big thing on their mind: it's student loan debt. They're not buying a house, they're not getting a car, they're living with their parents, all because they have this burden."

According to a recent [report](https://www.federalreserve.gov/publications/files/consumer-community-context-201901.pdf) from the Federal Reserve, the rise in student loan debt from 2005 to 2014 has contributed to a decline in home ownership.

Nearly one in four American adults are paying off student loans. That amounts to over 44 million citizens who hold collectively almost $1.5 trillion in student debt.

"The average debt now, out of a public university: $30,000 for each kid," Peters said.

Peters also said that the bill could benefit the employer as well ー as educated talent will be attracted to jobs that offer this tax-free incentive.

Peter said he feels good about the bill's chances of at least making it to the House floor for a vote.

"I am more optimistic about that in this Congress with Mrs. Pelosi, rather than Mr. Ryan. I think that we are likely to deal with this issue in a serious way," Peters said. "That's the first step."

As explosions and gunfire thundered outside, Sudanese huddled in their homes for a third day Monday in the capital Khartoum and other cities, while the army and a powerful rival force battled in the streets for control of the country.

Norwegian battery startup Freyr is planning its next factory in an Atlanta suburb because a new U.S. clean energy law offers generous tax credits for local production.

Next month, the IRS will release the first in a series of reports looking into how a publicly run system might be created.

Without citing a reason, the Delaware judge overseeing a voting machine company’s $1.6 billion defamation lawsuit against Fox News announced late Sunday that he was delaying the start of the trial until Tuesday.

“This has been an unspeakable week of tragedy for our city,” said mayor Craig Greenberg.

The Supreme Court said Friday it was temporarily keeping in place federal rules for use of an abortion drug, while it takes time to more fully consider the issues raised in a court challenge.

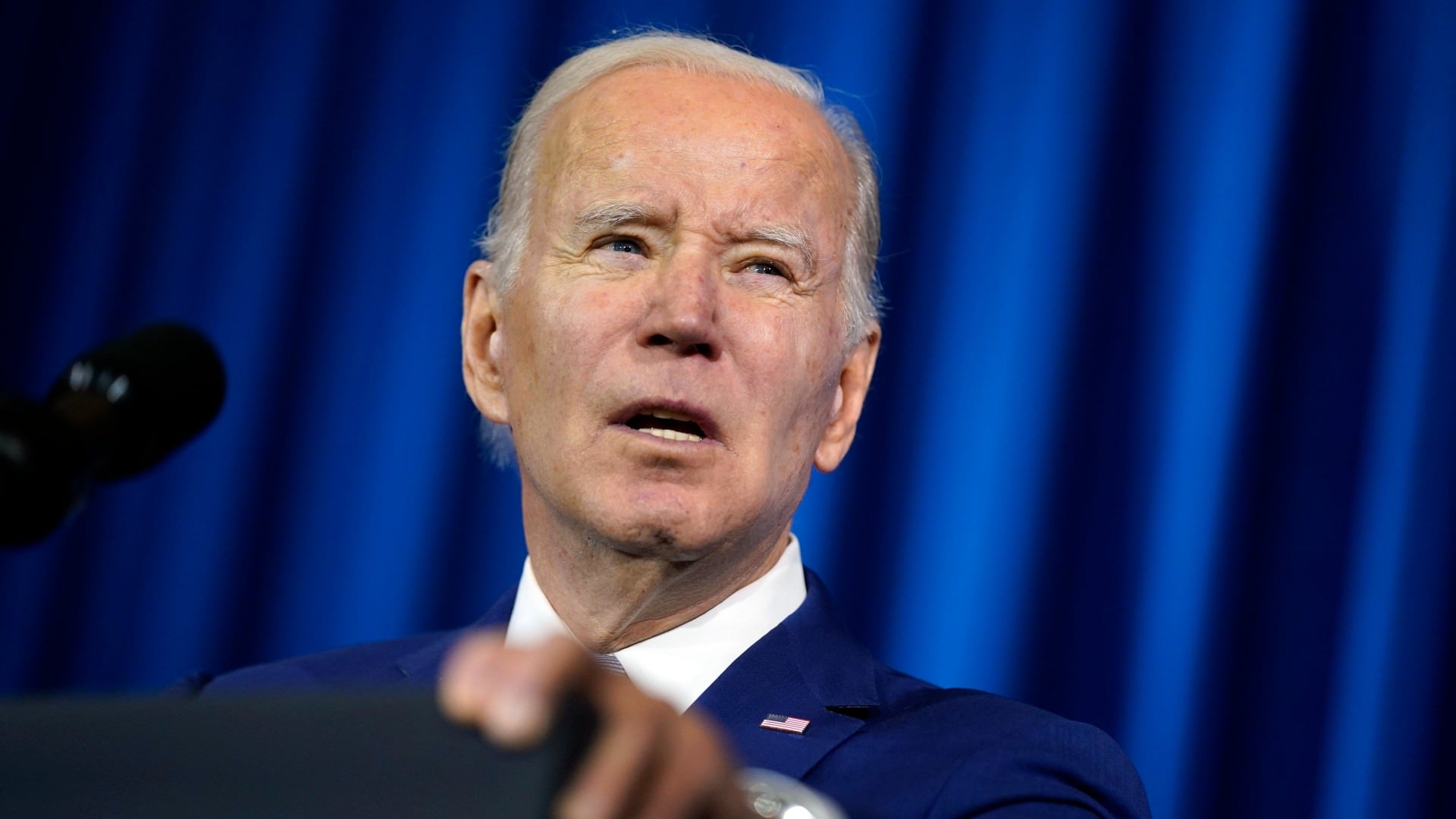

President Joe Biden announced Thursday that hundreds of thousands of immigrants brought to the U.S. illegally as children will be able to apply for Medicaid and the Affordable Care Act's health insurance exchanges.

Anyone who wants to buy a gun in Michigan will have to undergo a background check, and gun owners will be required to safely store all firearms and ammunition when around minors under new laws signed Thursday by Gov. Gretchen Whitmer.

In Ireland this week, well-wishers have lined the streets to catch a mere glimpse of President Joe Biden. Photos of his smiling face are plastered on shop windows, and one admirer held a sign reading, “2024 — Make Joe President Again.”

A Massachusetts Air National Guardsman has appeared in court, accused in the leak of highly classified military documents.