Blue Apron reported a smaller drop in revenue than expected for the fourth quarter on Tuesday. Tonya Garcia, Retail Reporter at MarketWatch and Jason Moser, Analyst at The Motley Fool, join The Long and The Short to discuss where the meal kit delivery company goes from here.

The main focus on Blue Apron has been its customer growth. This quarter it reported a loss of 15% year-over-year in customers, reflecting a cut in marketing spend. Moser says the company's biggest issue is building up that loyal customer base with the little amount of money it has for marketing. It won't make investors feel at ease until they see some solid growth in the user category.

Plus, what sets Blue Apron apart from the others? Garcia says in this type of competitive industry each company needs to have that one thing others don't. Right now, she's not seeing anything unique about Blue Apron. She's hoping if it ramps up market spending it can figure out that key piece to the puzzle.

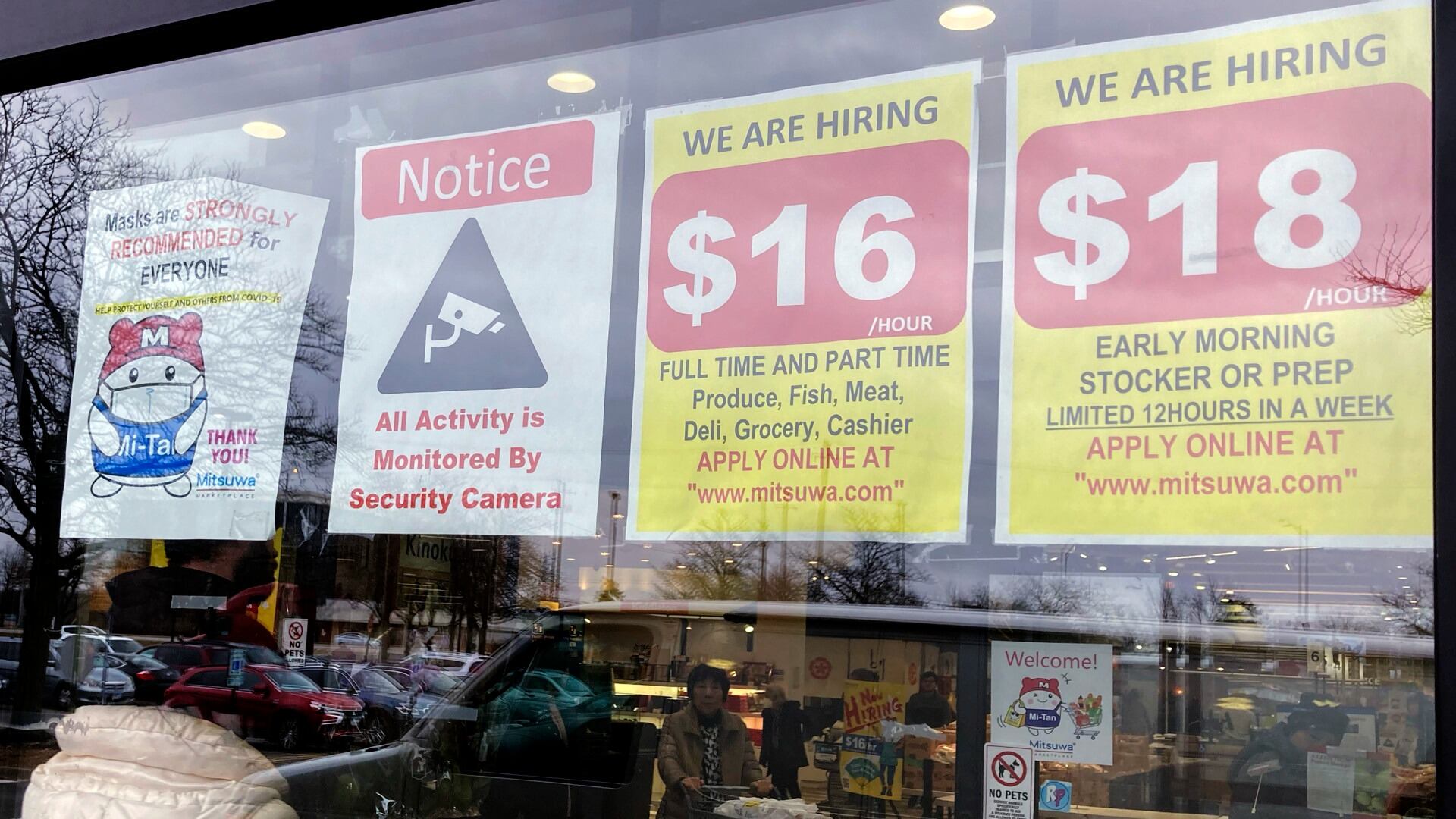

Half of U.S. states are raising their minimum wage next year.

Sony's PlayStation 5 console has now passed 50 million units sold.

FedEx decreased its full-year revenue forecast after reporting lower-than-expected quarterly profits in its latest results.

Cora is among dozens of young kids across the U.S. poisoned by lead linked to tainted pouches of the cinnamon-and-fruit puree

The IRS said Tuesday it is going to waive penalty fees for people who failed to pay back taxes that total less than $100,000 per year for tax years 2020 and 2021.

Rite Aid has been banned from using facial recognition technology for five years over allegations that a surveillance system it used incorrectly identified potential shoplifters, especially Black, Latino, Asian or female shoppers.

The union representing Southwest Airlines pilots says it reached a new contract agreement in principle with the airline following three years of negotiations.

U.S. Bank has been hit with a $36 million fine for freezing debit cards that distributed unemployment benefits during the pandemic.

Construction of new homes rose by double digits in November, according to data from the Commerce Department.

Cheddar News' Need2Know is brought to you by Securitize, which helps unlock broader access to alternative investments in private businesses, funds, and other alternative assets. The private credit boom is here and the Hamilton Lane Senior Credit Opportunities Fund has tripled in assets under management in just six months from November 2022 through April this year. Visit Securitize.io to learn more.