Vroom, an online used-car marketplace, got an enthusiastic reception from investors when it began trading on the Nasdaq Tuesday.

The stock $VRM soared 117 percent, doubling its IPO price of $22 a share.

Unlike businesses around the country that have struggled to make it through coronavirus lockdown restrictions, Vroom thrived.

"Customers are now appreciating our model even more than before [with] contact-free delivery and contact-free sales practices," Paul Hennessy, CEO of Vroom told Cheddar Wednesday.

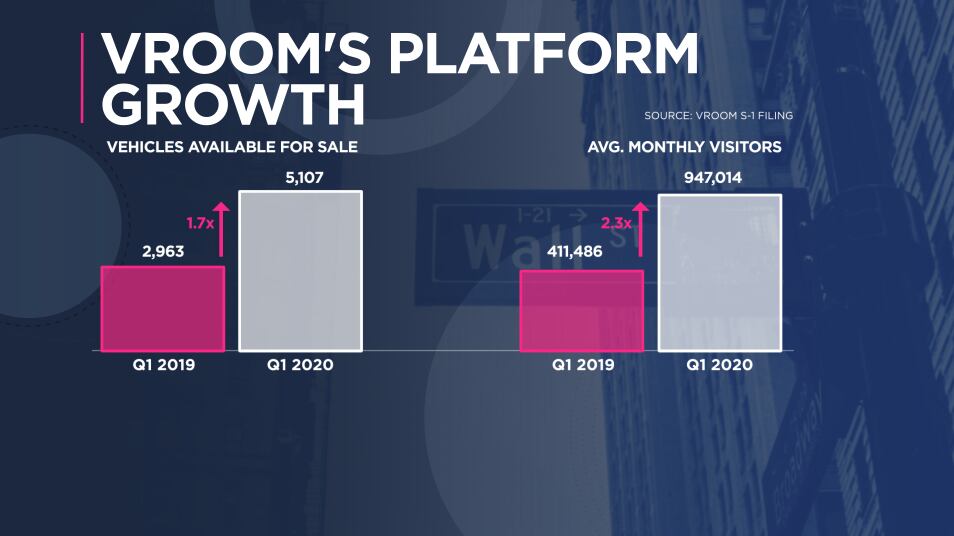

Comparing the first quarter of 2019 to this year, Vroom saw substantial growth in the number of vehicles available on its mobile platform and average monthly users.

"Once we knew that we had some tailwinds in our business, we absolutely thought this was the right time to go, and we took advantage of that," Hennessy said. "It's a great day for our company, a great day for employees, and a real testament to the model."

Vroom has had a strong showing raising capital in the private markets. In December, the company announced a $254 million Series H financing round.

Vroom intends to invest the capital raised in the public markets into the marketing and development of its platform.

Though recent surveys the company has done suggest that customer willingness to buy a car online has doubled in three months, Hennessy doesn't believe that Vroom is only surging in popularity because of the pandemic.

"We see these changes as absolutely structural," Hennessy said. "Now we want to work even harder to deliver for our customers and deliver for our shareholders."