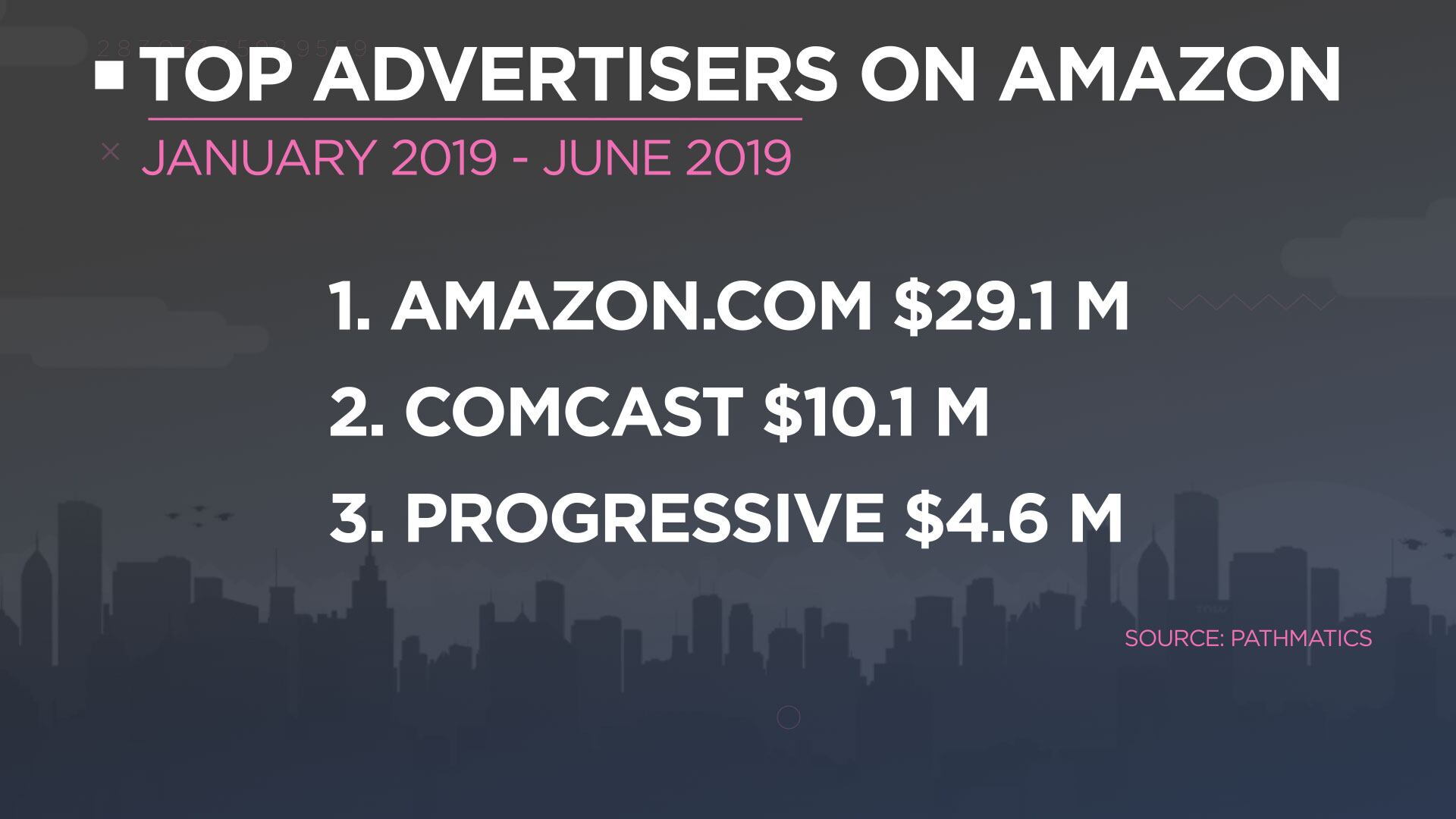

Amazon's biggest ad client this year is ー Amazon.

Amazon spent $29.1 million on ads on its own ad network between Jan. 1 and June 25 making it its own top buyer, according to marketing data company Pathmatics. Comcast, Progressive, Purina PetCare (Nestle), and AT&T rounded out its top five.

"We are in an era where consumers are inundated with messaging, so for a brand to break through the clutter they have to have a consistent point of connection in a meaningful way to drive business growth," said Sargi Mann, executive vice president of digital strategy and investments at Havas Media. "It's not shocking to see Amazon use its own network because they have scale, ability, and rich data sets to take advantage. [It also has] the potential and want to grow across the globe in both B2B (business-to-business) and B2C (business-to-consumer)."

Brands will spend $11.33 billion on ads through Amazon, according to eMarketer. Its ad business is expected to increase more than 50 percent this year, making up about 8.8 percent of the U.S. market. Meanwhile, digital ad revenue leader Google is expected to decline slightly.

"Amazon has invested heavily in a variety of different businesses like content production, grocery stores, connected home devices, etc. that they are looking to stand up against major competitors, and so they have a ton of advertising they need to do," said James Donner, vice president of media strategy at Decoded Advertising. "It makes sense that they would prioritize leveraging their own platform to do so versus spending anything with Google (DV360), AT&T (Xander), or a third party platform such as The Trade Desk."

While the top 15 advertisers spent more overall year-to-date (approximately $67.8 million in 2019 versus $56.1 million in 2018), the majority of that increase came from Amazon boosting its buys on its platforms.

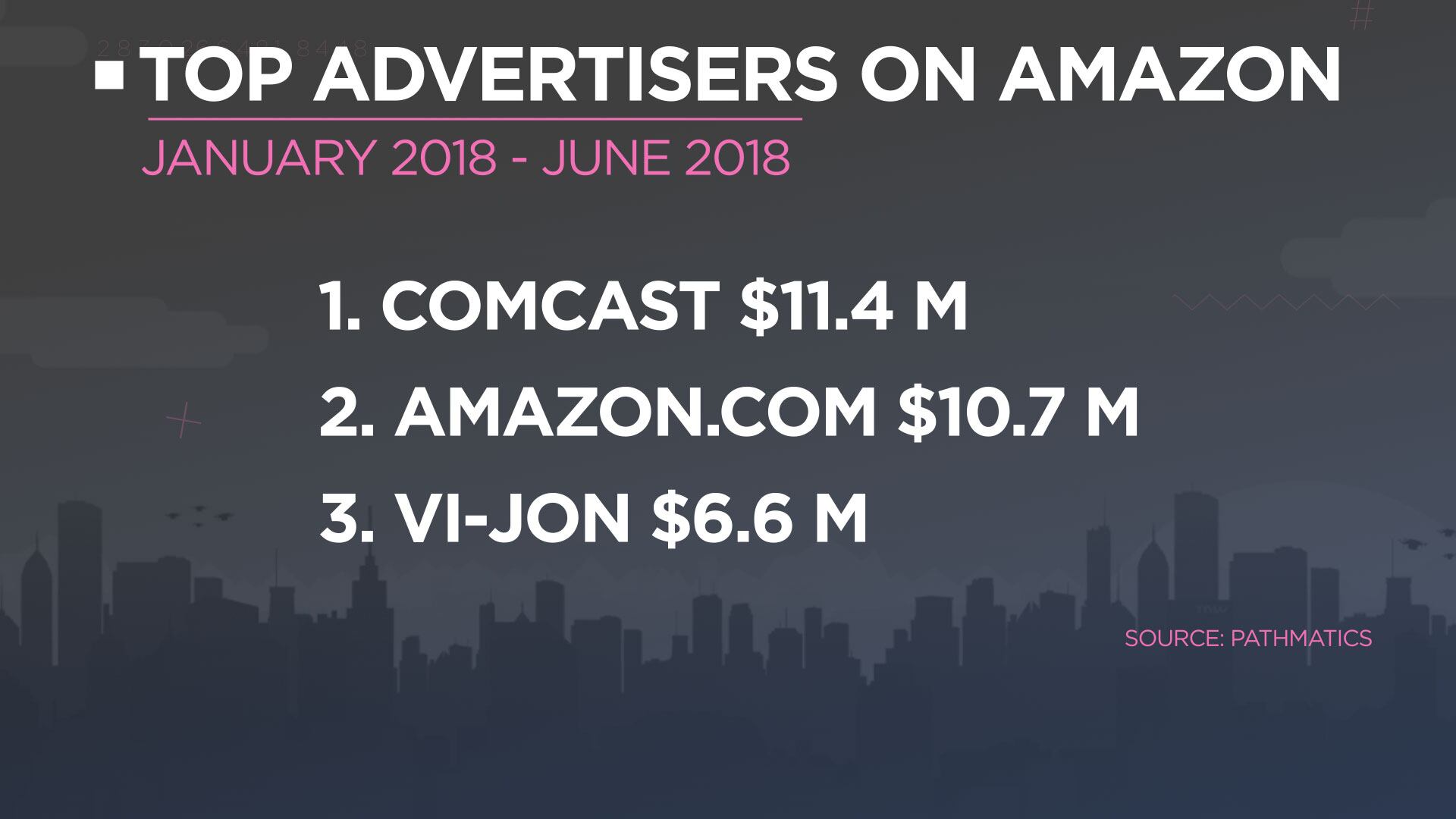

Last year, during the same time period, Amazon's largest client was Comcast. It spent $11.4 million dollars from Jan. 1 through June 23, 2018. The second largest client at the time was Amazon, spending about $10.7 million. The next largest ad buyers were Vi-Jon, Verizon, and Geico.

By Amazon investing its own money into its own ad platform, it makes its marketing more efficient, effective, and optimized. It also pumps more data into the system, which can improve the offering. The ad platform is still behind many of its competitors including some programmatic or automated controls and bid factors, said Jesse Brewer, head of demand sales and operations at behavioral marketing platform BounceX.

"Amazon is known for not having anything too impressive on the attribution front," Brewer said. "A lot of advertisers have pulled their spend outside of CPG (consumer product good) companies."

Amazon declined a request for comment.