Earth Day comes around once a year, but investors can put their money to work to combat climate change year-round.

As more individuals come to terms with the existential threat of climate change, sustainable investing is no longer niche. It's gone mainstream, and it's a growing force in the capital markets.

An often cited 2019 survey from Morgan Stanley found that 85 percent of investors with at least $100,000 in investable assets were interested in sustainable investing.

Some 48 percent of investors with $10,000 or more invested said they were "very or somewhat" interested in sustainable investment funds, according to a 2022 Gallup poll. But only 25 percent said they'd heard "a lot or fair amount" about it, and only 10 percent said they were currently invested in sustainable funds.

Not only is familiarity with sustainable investing low, concepts like ESG can be confusing. ESG refers to "environmental, social, and governance." It's a set of standards used to evaluate companies through a social lens, but a study from Stanford University found ESG ratings can be unreliable because there isn't a standardized criteria for evaluation, information gathering is expensive, and data can be incomplete or unreliable.

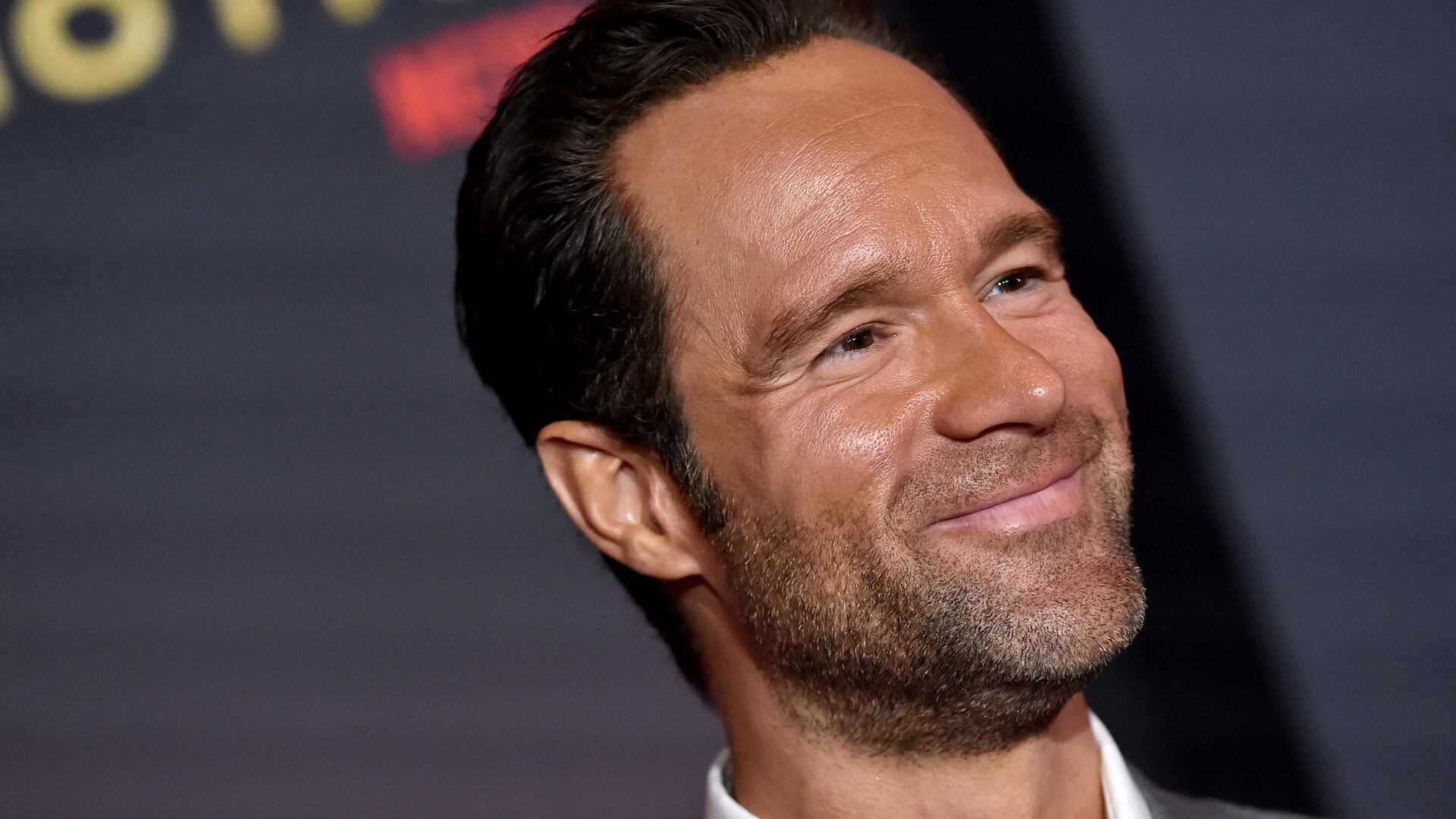

Peter Krull, a partner and director of sustainable investing at Prime Capital Investment Advisors company Earth Equity Advisors, echoed those concerns.

"An ESG portfolio that reduces its exposure to ExxonMobil is less bad. One that eliminates it entirely is better. But one that replaces it with First Solar is actually sustainable," Krull told Cheddar News.

Krull recommended sustainable investors eliminate fossil fuel companies or funds that contain them from their portfolios altogether, but other sectors aren't so cut and dried. Mining operations, for example, can mine fossil fuels, but they can also mine minerals for electric vehicle batteries. As for what goes into a green portfolio, Krull recommended alternative energy companies that focus on solar, wind, and geothermal power, as well as less obvious choices like insurance companies that consider climate risk and biotech that improves health outcomes.

"I like to call traditional index investing rearview mirror investing because it's really about investing in where we've been or where the economy has been. Whereas sustainable investing is where the economy is going," Krull said.

Being a smart and sustainable investor can require a great deal of critical thinking and research, and Krull recommended tools like Fossil Free Funds and Invest Your Values to help sort through the noise.

Ultimately, investing is about generating a return. When it comes to sustainable investing, Krull also suggested that investors think long term.

"Because sustainable investing is about investing for the future, [investments are] not always going to be up, especially when value investing is in style," he said. "Over the long term, it should play out. But in short terms, just like we're dealing with right now over the last 12 to 18 months, that value has been in style, you probably will underperform a little bit."