U.S. airlines are seeking as much as $50 billion in federal support as travel restrictions aimed at containing the spread of coronavirus have pushed the industry’s biggest players to the brink of bankruptcy.

The airlines are seeking a combination of grants, government-backed loans and tax relief, the industry’s main trade group, Airlines 4 America, has said.

The impact of the travel restrictions has been swift and dramatic: Among the country’s Big Three airlines, American Airlines has slashed its international flights by 75 percent, United Airlines plans to cut half its domestic and international flights through the next two months, and Delta Airlines has said that bookings have plummeted by roughly a third.

Meanwhile JetBlue, Southwest and Alaska have reduced their schedules, and some ultra-low-cost providers like Frontier and Spirit have taken dramatic steps to prop-up ridership, with Frontier on Monday announcing free flights for students with .edu email addresses.

“This is a today problem, not a tomorrow problem. It requires urgent action,” A4A president and CEO Nicholas Calio said in a statement.

The Wall Street Journal was the first to put a number on the bailout request.

The trade group’s statement sought to underscore the urgency, describing a “dramatic decline in demand” that is “getting worse by the day,” “historic capacity cuts” and a “staggering” economic impact on U.S. airlines.

United Airlines’ market value has plunged by 60 percent since the start of the year. American Airlines’ stock price has fallen by more than 50 percent, and Delta Airlines’ by close to 40 percent.

“U.S. carriers are in need of immediate assistance as the current economic environment is simply not sustainable. This is compounded by the fact that the crisis does not appear to have an end in sight,” the trade group said.

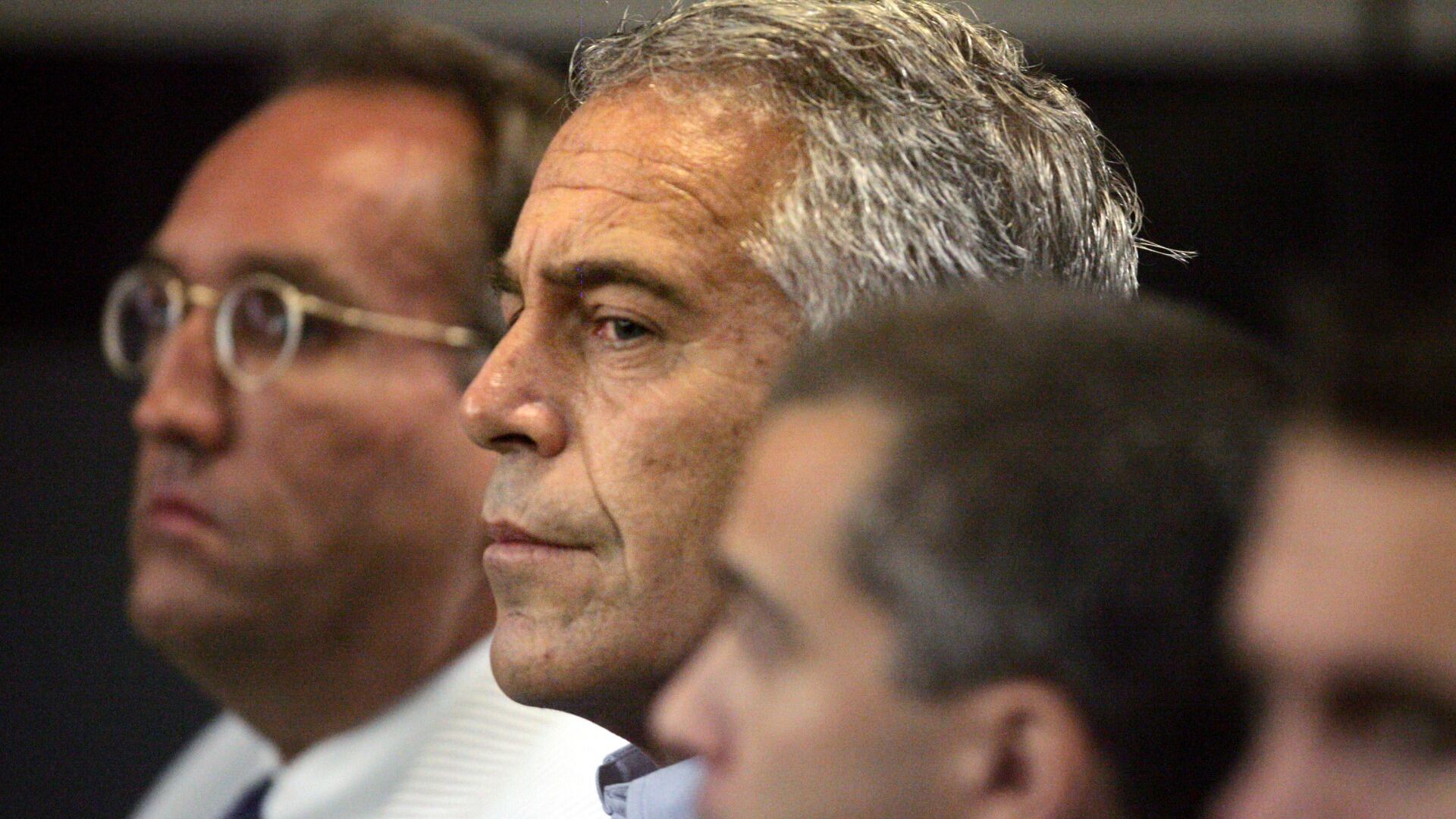

The bank said it regrets its involvement with Epstein over the years that he was a JPMorgan client. The settlement must still be approved by the judge in the case.

Stocks are ticking higher on Wall Street early Monday ahead of a big week for central banks and interest rates around the world.

Billionaire investor turned philanthropist George Soros is ceding control of his $25 billion empire to a younger son, Alexander Soros, according to an exclusive interview with The Wall Street Journal published online Sunday.

UBS said Monday that it has completed its takeover of embattled rival Credit Suisse, nearly three months after the Swiss government hastily arranged a rescue deal to combine the country's two largest banks in a bid to safeguard Switzerland’s reputation as a global financial center and choke off market turmoil.

Gene sequencing test maker Illumina Inc. said Sunday that its board has accepted the resignation of its CEO and director, Francis deSouza, effective immediately.

“Any consumer can tell you that online airline bookings are confusing enough," said William McGee, an aviation expert at the American Economic Liberties Project. "The last thing we need is to roll back an existing protection that provides effective transparency.”

Cheddar News checks in to see what to look out for Next Week on the Street as former president Donald Trump makes an appearance in federal court after being indicted. Investors will also keep an eye on the Federal Reserve meeting to see what comes out of that while earnings continue to pour in.

Google will launch its long-delayed News Showcase product this summer.

Walmart is expanding its HIV treatments, planning to add over 80 specialty facilities across nearly a dozen states by the end of the year.

The Internal Revenue Service said there are about $1.5 billion in unclaimed tax refunds dating back to 2019.