*By Michael Teich*

Pluralsight, a platform for online learning courses, was off to an auspicious start as a publicly traded company Thursday when the stock opened 33 percent above its IPO price on the Nasdaq.

Shares of the Utah-based tech company, which are trading under ticker symbol “PS”, opened for trading at $20 a share compared with the IPO price of $15. Pluralsight's CEO, Aaron Skonnard, told Cheddar that Wall Street was optimistic because investors realize that his company's cloud-based platform is well positioned to close a “massive skills gap” created by rapidly changing technology.

Pluralsight is the first company from Utah to go public in 2018. Skonnard said there are advantages to creating a technology company in Utah instead of Silicon Valley, including a thriving tech community in “Silicon Slopes” that attracts talent away from the San Francisco Bay area. The lower cost of living in Utah is also a “big home run” for employees.

The future of education is going to look a lot different in the years ahead, said Skonnard. Four-year college degrees are a lot less relevant than they were 20 years ago, and emerging technologies will cause the trend to continue. Pluralsight's focus on technology-based skills such as HTML and JavaScript put it in a position to provide courses that cater to the evolving demands by its corporate clients, which include AT&T and Adobe.

For the full interview, [click here](https://cheddar.com/videos/utah-s-tech-unicorn-pluralsight-has-strong-nasdaq-debut).

Tyson Foods is recalling about 30,000 of its dino-shaped chicken nuggets after some consumers reported finding small metal pieces in those nuggets.

Google on Monday will try to protect a lucrative piece of its internet empire at the same time it’s still entangled in the biggest U.S. antitrust trial in a quarter century.

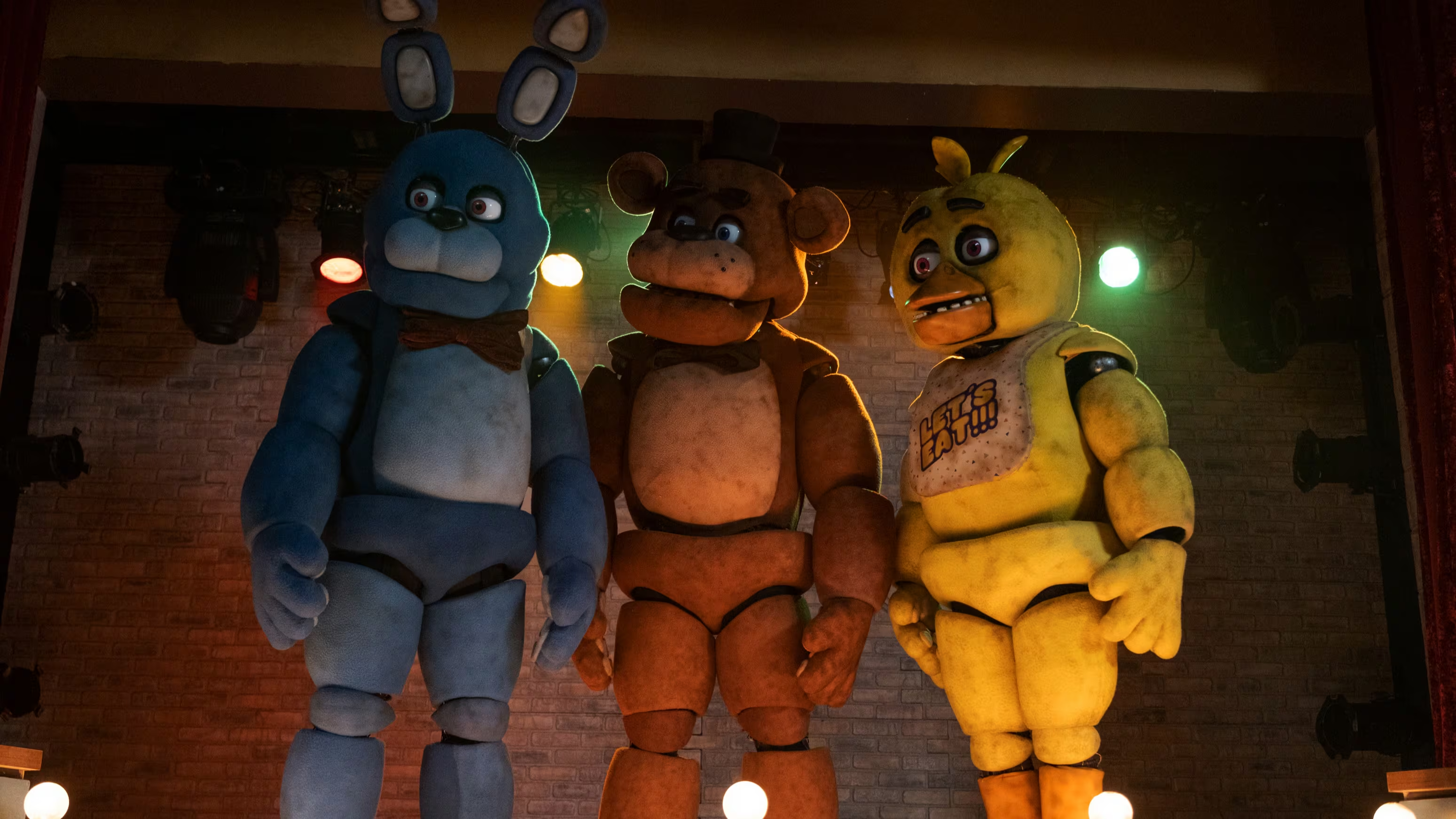

Before the SAG-AFTRA strike, this was the weekend “Dune: Part Two” was supposed to open. When Warner Bros. and Legendary pushed that opening back to March 2024 and no other blockbuster stepped in to take its spot.

A growing number of Californians are planting agave to be harvested forz use in spirits. The trend is fueled by the need to find hardy crops that don’t need much water and a booming appetite for premium alcoholic beverages.

Big Business This Week is a guided tour through the biggest market stories of the week, from winning stocks to brutal dips to the facts and forecasts generating buzz on Wall Street. This week we highlight Paramount, Maersk, Starbucks, Uber, Lyft and Beyond Meat.

With Donald Trump due on the witness stand next week, testimony from his adult sons in his civil business fraud trial wrapped up Friday with Eric Trump saying he relied completely on accountants and lawyers to assure the accuracy of financial documents key to the case.

DraftKings reported better-than-expected revenue in the third quarter.

Wallet Hub released a list of the 10 states with the highest median monthly student loan payments.

Oil and gas giant BP will purchase electric vehicle chargers from Tesla for $100 million.

Reports say olive oil prices have jumped 75% since January of 2021.