With only 1.1% of women and minorities running the asset management industry's $71.4 trillion in assets, the field is lacking diversity. Girls Who Invest, a non-profit organization, is using empowerment to try to change that. Seema Hingorani, Founder of Girls Who Invest, joined us at the New York Stock Exchange to share why she feels it is important to encourage young women to pursue careers in asset management.

Girls Who Invest is working towards the goal of getting 30% of investable assets managed by women by 2030. Hingorani says the lack of diversity is a pipeline problem. She adds that young women don’t even know about the industry and how impactful and rewarding it can be. Hingorani said there has been a cloud over the industry since the 2008 financial crisis. To reach the next generation of women, Girls Who Invest designed a 10-week summer program for college students.

President Trump's immigration policies have put up a roadblock to Girls Who Invest's international growth, Hingorani says. Girls Who Invest accepted fewer international students in 2017 than last year because several women struggled to obtain work visas. She says the policies hurt the talent pool because talented women aren’t getting interviews due to the fact they don’t have visas.

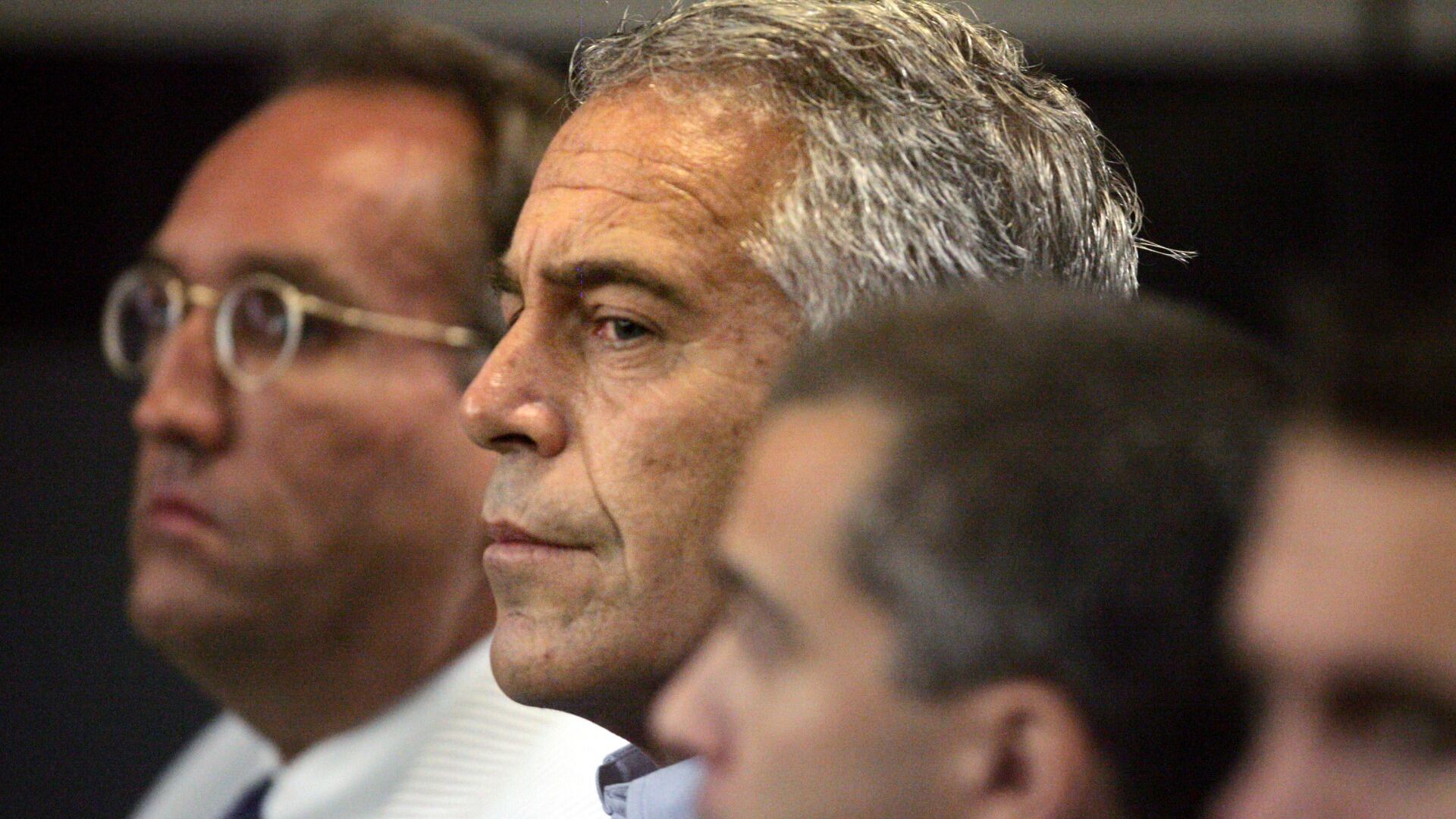

The bank said it regrets its involvement with Epstein over the years that he was a JPMorgan client. The settlement must still be approved by the judge in the case.

Stocks are ticking higher on Wall Street early Monday ahead of a big week for central banks and interest rates around the world.

Billionaire investor turned philanthropist George Soros is ceding control of his $25 billion empire to a younger son, Alexander Soros, according to an exclusive interview with The Wall Street Journal published online Sunday.

UBS said Monday that it has completed its takeover of embattled rival Credit Suisse, nearly three months after the Swiss government hastily arranged a rescue deal to combine the country's two largest banks in a bid to safeguard Switzerland’s reputation as a global financial center and choke off market turmoil.

Gene sequencing test maker Illumina Inc. said Sunday that its board has accepted the resignation of its CEO and director, Francis deSouza, effective immediately.

“Any consumer can tell you that online airline bookings are confusing enough," said William McGee, an aviation expert at the American Economic Liberties Project. "The last thing we need is to roll back an existing protection that provides effective transparency.”

Cheddar News checks in to see what to look out for Next Week on the Street as former president Donald Trump makes an appearance in federal court after being indicted. Investors will also keep an eye on the Federal Reserve meeting to see what comes out of that while earnings continue to pour in.

Google will launch its long-delayed News Showcase product this summer.

Walmart is expanding its HIV treatments, planning to add over 80 specialty facilities across nearly a dozen states by the end of the year.

The Internal Revenue Service said there are about $1.5 billion in unclaimed tax refunds dating back to 2019.