With only 1.1% of women and minorities running the asset management industry's $71.4 trillion in assets, the field is lacking diversity. Girls Who Invest, a non-profit organization, is using empowerment to try to change that. Seema Hingorani, Founder of Girls Who Invest, joined us at the New York Stock Exchange to share why she feels it is important to encourage young women to pursue careers in asset management.

Girls Who Invest is working towards the goal of getting 30% of investable assets managed by women by 2030. Hingorani says the lack of diversity is a pipeline problem. She adds that young women don’t even know about the industry and how impactful and rewarding it can be. Hingorani said there has been a cloud over the industry since the 2008 financial crisis. To reach the next generation of women, Girls Who Invest designed a 10-week summer program for college students.

President Trump's immigration policies have put up a roadblock to Girls Who Invest's international growth, Hingorani says. Girls Who Invest accepted fewer international students in 2017 than last year because several women struggled to obtain work visas. She says the policies hurt the talent pool because talented women aren’t getting interviews due to the fact they don’t have visas.

Tyson Foods is recalling about 30,000 of its dino-shaped chicken nuggets after some consumers reported finding small metal pieces in those nuggets.

Google on Monday will try to protect a lucrative piece of its internet empire at the same time it’s still entangled in the biggest U.S. antitrust trial in a quarter century.

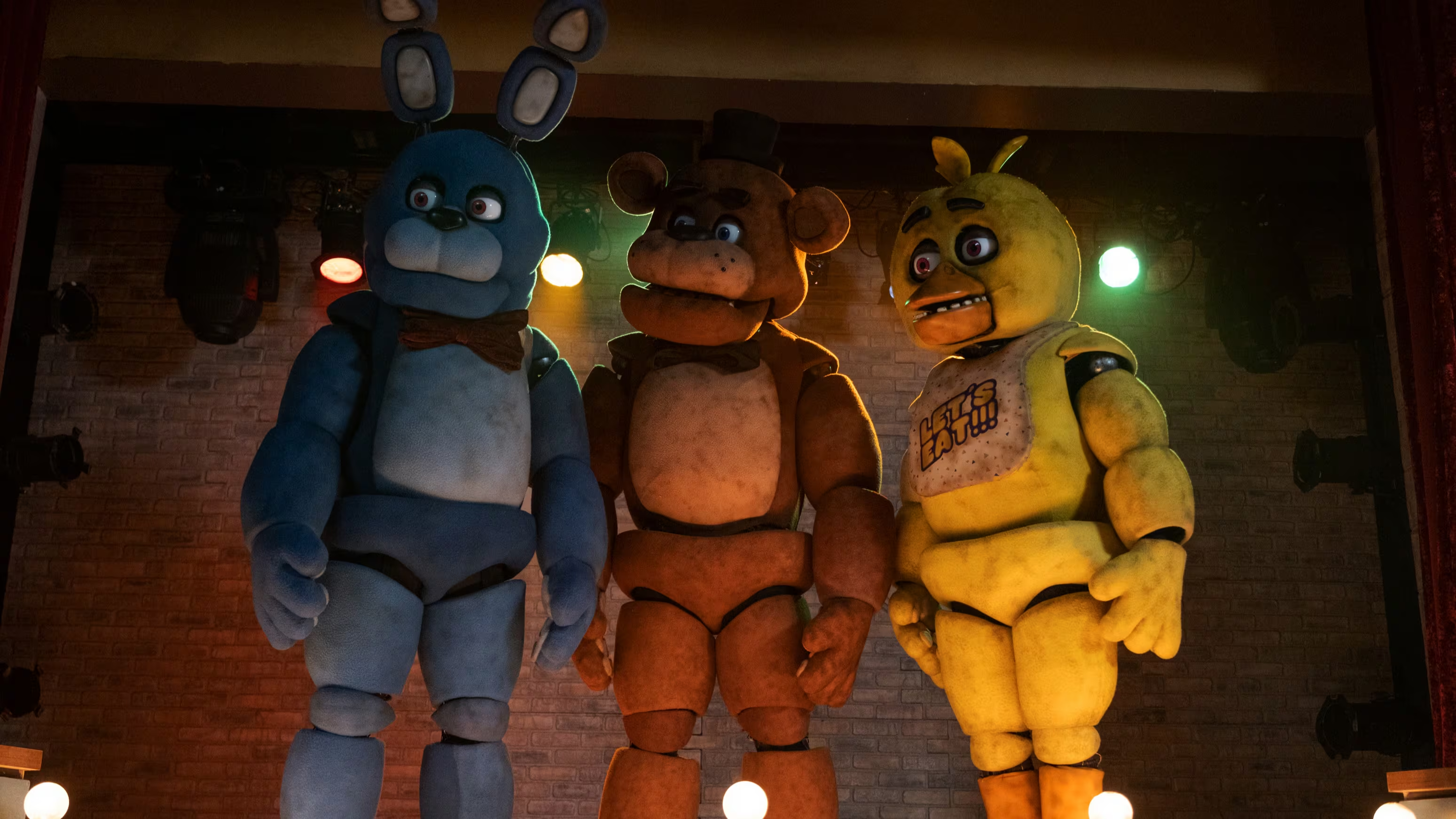

Before the SAG-AFTRA strike, this was the weekend “Dune: Part Two” was supposed to open. When Warner Bros. and Legendary pushed that opening back to March 2024 and no other blockbuster stepped in to take its spot.

A growing number of Californians are planting agave to be harvested forz use in spirits. The trend is fueled by the need to find hardy crops that don’t need much water and a booming appetite for premium alcoholic beverages.

Big Business This Week is a guided tour through the biggest market stories of the week, from winning stocks to brutal dips to the facts and forecasts generating buzz on Wall Street. This week we highlight Paramount, Maersk, Starbucks, Uber, Lyft and Beyond Meat.

With Donald Trump due on the witness stand next week, testimony from his adult sons in his civil business fraud trial wrapped up Friday with Eric Trump saying he relied completely on accountants and lawyers to assure the accuracy of financial documents key to the case.

DraftKings reported better-than-expected revenue in the third quarter.

Wallet Hub released a list of the 10 states with the highest median monthly student loan payments.

Oil and gas giant BP will purchase electric vehicle chargers from Tesla for $100 million.

Reports say olive oil prices have jumped 75% since January of 2021.