Gary Vaynerchuk, the outspoken CEO of creative agency VaynerMedia, checked in with Cheddar before the weekend to share his views on the biggest stories this week.

On creating jobs in the digital economy post-COVID:

"We've seen this before. When there's huge technology advancements, things evolve," he said.

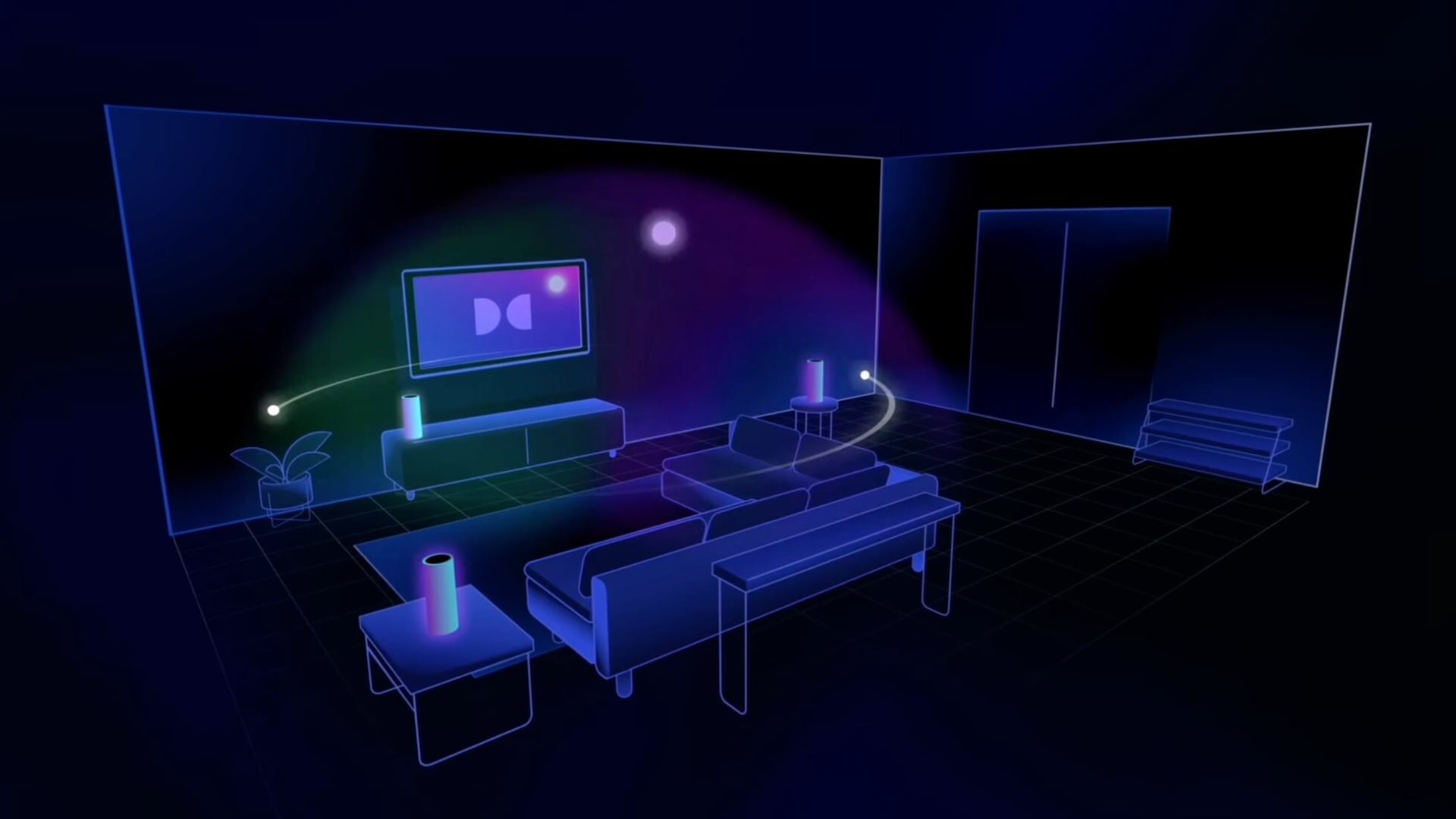

Rather than focusing on the jobs being lost to technological changes, Vaynerchuk emphasized the "millions" of jobs being created around capturing and producing online content. He pointed to the emergence of “non-fungible tokens” or NFTs, which are digital certificates on the Ethereum blockchain that authenticate ownership of a digital asset and can be bought and sold.

Digital economy evangelists such as Vaynerchuk see NFTs as crucial to monetizing the web.

"It feels like a sea change: the blockchain, the ledgerization [or] digitalization of all goods, the way music is distributed, books, the way art and collectibles are sold, the way season tickets can be sold."

The goal, Vaynerchuk explained, is for the NFT market to set prices for the online economy.

On the possibility of new regulations for bitcoin and other cryptocurrencies:

"Regulation is the elephant in the room," he said.

On the one hand, he said bitcoin has gotten "over the hump" of gaining legitimacy with the general public, but that it now presents a challenge to sovereign nations on what steps they will take to regulate the cryptocurrency, and how those actions could impact its long-term success.

"I think it's going to be extremely interesting over the next half-a-decade to a decade to see what happens, and how much momentum will that currency, that community have versus what happens if it gets overregulated," he said.

On the upcoming direct listing of Coinbase, a digital currency exchange:

"You don't see companies doing this level of revenue profitably before an IPO, with a trend that is so macro that they're dominating in," said Vaynerchuk, who disclosed that he invested in the company back in 2014. "So, I'm just very curious what the market is going to do with it, but they have a lot of good math on their side."