By Martin Crutsinger

The Federal Reserve announced a significant change Thursday in how it manages interest rates by saying it plans to keep rates near zero even after inflation has exceeded the Fed’s 2% target level.

The change signifies that the Fed is prepared to tolerate a higher level of inflation than it generally has in the past. And it means that borrowing rates for households and businesses — for everything from auto loans and home mortgages to corporate expansion — will likely remain ultra-low for years to come.

The new goal says that “following periods when inflation has been running persistently below 2%, appropriate monetary policy will likely aim to achieve inflation moderately above 2% for some time.”

The new Fed policy sought to underscore its belief that a low jobless rate was good for the economy by saying it would seek to assess the “shortfalls” in employment from the maximum level.

In a speech detailing the changes, Chairman Jerome Powell made clear that the policy change reflects the reality that high inflation — once the biggest threat to the economy — no longer appears to pose a serious danger, even when unemployment is low and the economy is growing strongly. Rather, Powell said, the economy has evolved in a way that allows the Fed to keep rates much lower than it otherwise would without igniting price pressures.

“The economy is always evolving,” Powell said. “Our revised statement reflects our appreciation for the benefits of a strong labor market, particularly for many in low- and moderate-income communities and that a robust job market can be sustained without causing an unwelcome increase in inflation."

In his speech, Powell said that the Fed's decision to allow unemployment to fall to a 50-year low before the pandemic had played an important role in lifting the fortunes of low-income workers.

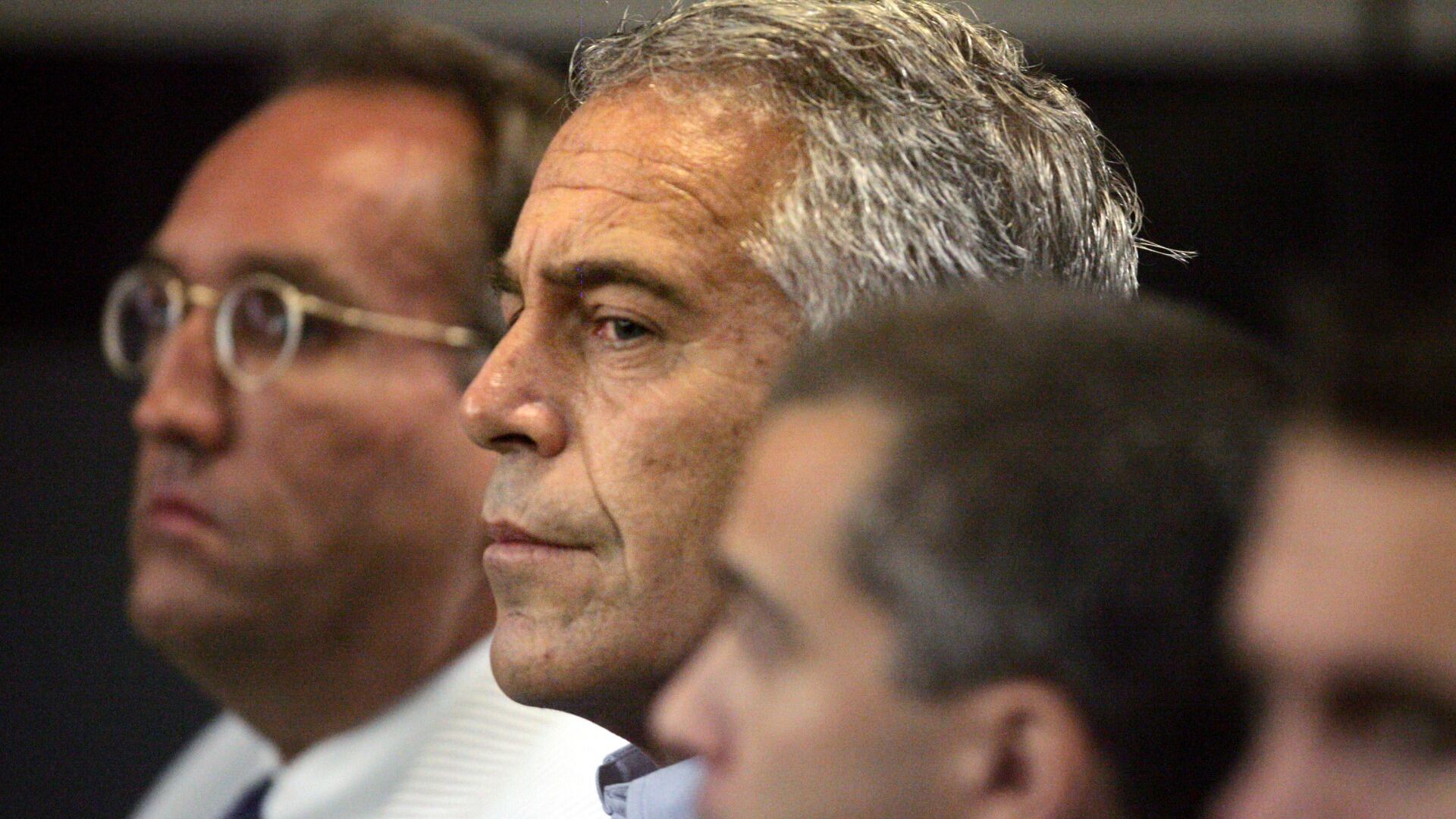

The bank said it regrets its involvement with Epstein over the years that he was a JPMorgan client. The settlement must still be approved by the judge in the case.

Stocks are ticking higher on Wall Street early Monday ahead of a big week for central banks and interest rates around the world.

Billionaire investor turned philanthropist George Soros is ceding control of his $25 billion empire to a younger son, Alexander Soros, according to an exclusive interview with The Wall Street Journal published online Sunday.

UBS said Monday that it has completed its takeover of embattled rival Credit Suisse, nearly three months after the Swiss government hastily arranged a rescue deal to combine the country's two largest banks in a bid to safeguard Switzerland’s reputation as a global financial center and choke off market turmoil.

Gene sequencing test maker Illumina Inc. said Sunday that its board has accepted the resignation of its CEO and director, Francis deSouza, effective immediately.

“Any consumer can tell you that online airline bookings are confusing enough," said William McGee, an aviation expert at the American Economic Liberties Project. "The last thing we need is to roll back an existing protection that provides effective transparency.”

Cheddar News checks in to see what to look out for Next Week on the Street as former president Donald Trump makes an appearance in federal court after being indicted. Investors will also keep an eye on the Federal Reserve meeting to see what comes out of that while earnings continue to pour in.

Google will launch its long-delayed News Showcase product this summer.

Walmart is expanding its HIV treatments, planning to add over 80 specialty facilities across nearly a dozen states by the end of the year.

The Internal Revenue Service said there are about $1.5 billion in unclaimed tax refunds dating back to 2019.