By Josh Boak

The Treasury Department said Monday that 39 million families are set to receive monthly child payments beginning on July 15.

The payments are part of President Joe Biden's $1.9 trillion coronavirus relief package, which expanded the child tax credit for one year and made it possible to pre-pay the benefits on a monthly basis. Nearly 88% of children are set to receive the benefits without their parents needing to take any additional action.

“This tax cut sends a clear and powerful message to American workers, working families with children: Help is here,” Biden said in remarks at the White House.

Qualified families will receive a payment of up to $300 per month for each child under 6 and up to $250 per month for children between the ages of 6 and 17. The child tax credit was previously capped at $2,000 and only paid out to families with income tax obligations after they filed with the IRS.

But for this year, couples earning $150,000 or less can receive the full payments on the 15th of each month, in most cases by direct deposit. The benefits total $3,600 annually for children under 6 and $3,000 for those who are older. The IRS will determine eligibility based on the 2019 and 2020 tax years, but people will also be able to update their status through an online portal. The administration is also setting up another online portal for non-filers who might be eligible for the child tax credit.

The president has proposed an extension of the increased child tax credit through 2025 as part of his $1.8 trillion families plan. Outside analysts estimate that the payments could essentially halve child poverty. The expanded credits could cost roughly $100 billion a year.

Updated on May 17, 2021, at 2:06 p.m. ET with the latest details.

A three-judge panel of the 9th U.S. Circuit Court of Appeals has thrown out California’s ban on high-capacity ammunition magazines.

Lee County, deep in the Appalachian Mountains, is one of many rural school districts around the country where the decision over whether to bring students back into classrooms is particularly fraught.

President Trump and economic adviser Larry Kudlow have been touting a capital gains tax cut as part of a Phase 4 stimulus package, but experts contend any gains from such a cut would be minimal and largely concentrated among the most wealthy citizens.

Facebook has launched the 'Voting Information Center' as a hub to provide users with accurate information regarding everything voting related. Emily Dalton, director of social impact product at Facebook, talks the company's new initiative and goals of the program.

Dodger Stadium will serve as a vote center for the presidential election in November, making the Dodgers the first Major League Baseball team to make their venue available for voting.

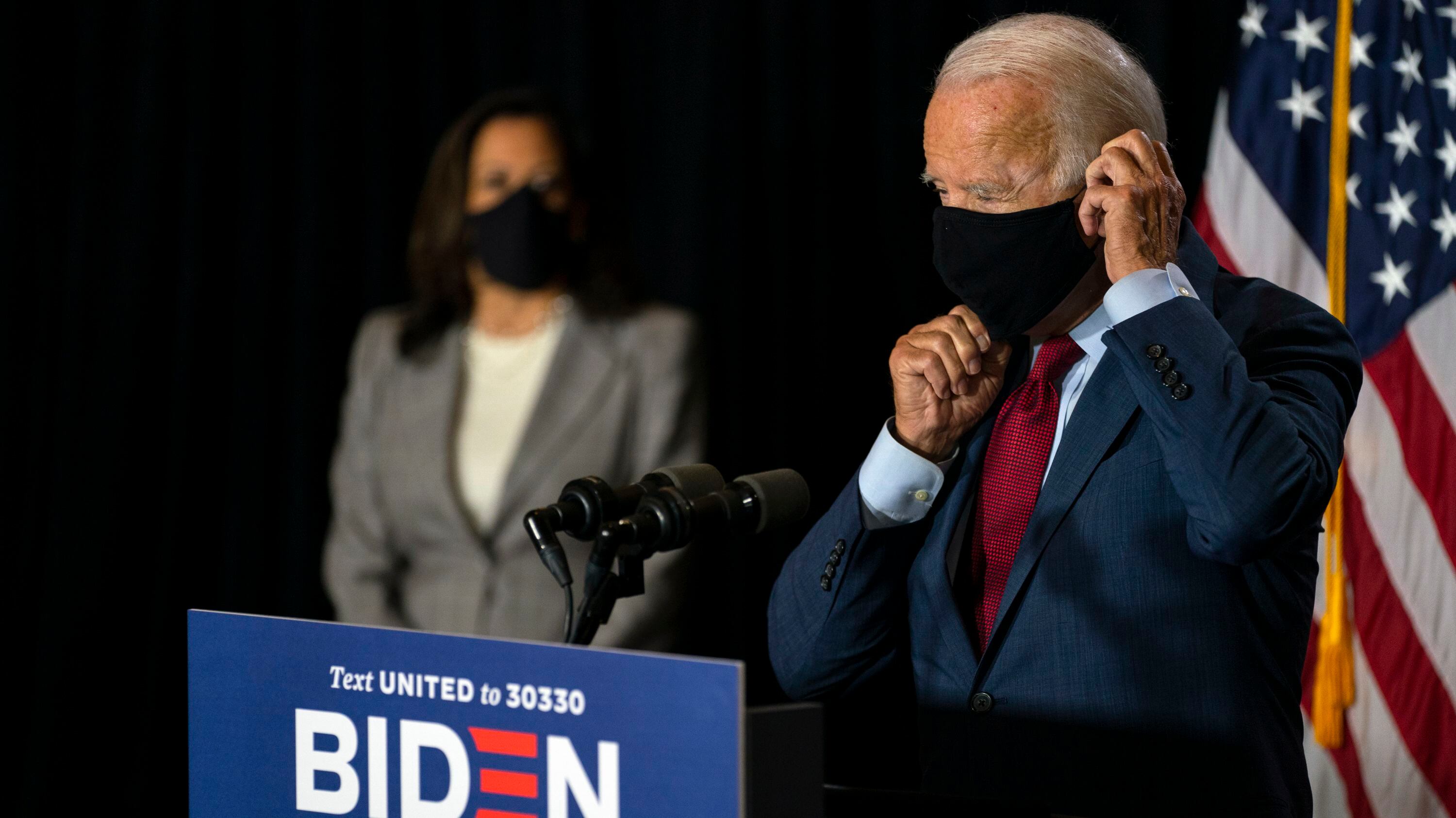

Joe Biden is calling for a nationwide mask mandate, citing health experts’ predictions that it could save 40,000 lives over the next three months.

Today, President Trump admitted to undermining the USPS in attempt to stall the mail-in voting process. California representative, Ami Bera, talks the November election and the stalled stimulus deal.

Cheddar's J.D. Durkin goes into why he believes leaving former candidate and businessman Andrew Yang isn't a good look for the DNC.

Young people across the world are uniting, calling on policymakers to adress the climate crisis. 15-year-old Alexandria Villasenor, founder of Earth Uprising, talks launching the movement and an upcoming partnership with GAP Kids on a virtual rally, encouraging the youth to make their voices heard about issues they want fixed.

Israel and the United Arab Emirates say they are establishing full diplomatic relations in a U.S.-brokered deal that required Israel to halt its contentious plan to annex occupied West Bank land sought by the Palestinians.