By Dee-Ann Durbin

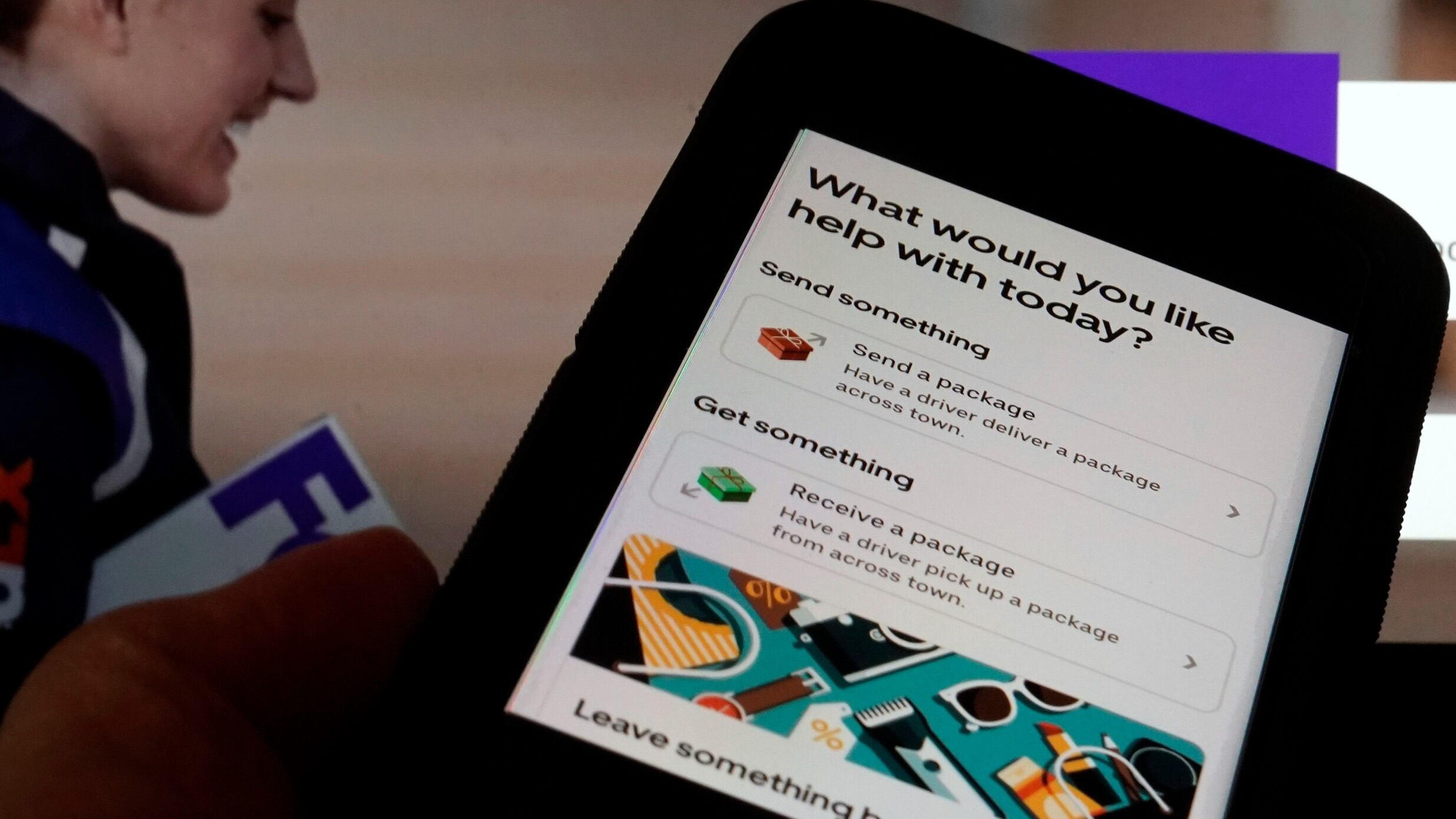

Uber is adding a new task to its list of services: mailing consumers' return packages.

The ride-hailing and delivery company said Wednesday that its drivers will collect up to five prepaid and sealed packages and drop them off at a local post office or at UPS or FedEx stores. Uber will charge a flat fee of $5 for the service or $3 for its Uber One members.

The San Francisco-based company said the service will be available in nearly 5,000 U.S. cities to start.

Uber said customers will be able to choose package drop off locations within its app. Only locations open for at least the next hour will be listed. Drivers will provide visual confirmation once a package has been dropped off.

While the service is expected to be used primarily to return packages, Uber drivers will also mail new packages that are sealed and have prepaid labels.

The new service gives Uber a vast opportunity.

Package returns have become a big business as consumers do more of their shopping online. According to the National Retail Federation, a trade group, 16.5% of online shopping sales were returned in 2022, or $212 billion worth of merchandise.

FedEx and UPS deliver 31 million parcels each day, while the U.S. Postal Service delivers 25 million, said Satish Jindel, a shipping and logistics consultant and president of ShipMatrix.

Much of that volume involves delivery to businesses that do not return packages often, Jindel said, and he believes many people will continue to return packages themselves, rather than pay Uber to do it.

“Consumers do not like to pay to return things,” he said.

Jindel estimates the target market for Uber's return package service is around 574,000 parcels each business. That would rise about 25% in January because of holiday returns, he said.

Still, Jindel has doubts about the service and whether it can be profitable for Uber, since it could cost drivers more than $5 in time and gas to drop off packages. He also said retailers are trying to cut back on the volume of returns by making it harder and more expensive to return items, so that could limit demand for Uber.