Though people are willing to spend more to stream movies and shows they want, new research says they're taking a closer look at how many subscriptions they sign up for, and are paying more attention to which services are worth it.

Consulting and research firm Magid found people are willing to spend about $42 a month on streaming services, an increase from $36 last year. But they only want four subscriptions on average, down from six in 2018.

"Consumers are saying: make it easier for me, give me fewer and fewer choices," Magid director of digital research and strategy Andrew Hare told Cheddar. "It's not going to be an issue where consumers want a ton of these."

Netflix has long been the leader in the streaming subscription space. With Apple TV+ now in the market and Disney+ launching on Tuesday, more media companies are trying their hand at forgoing cable and satellite to own their own digital services.

However, consumers are growing wary with the number of choices out there. Magid found 33 percent of survey takers found it was too hard to manage their subscriptions, with 47 percent interested in aggregating all services into one interface. More than half said they were interested in advertising-supported streaming services.

"We're basically getting to a point now where if you're going to try and enter the space a few years from now, good luck," Hare said. "Basically the money is going to be gone in a lot of ways in terms of share."

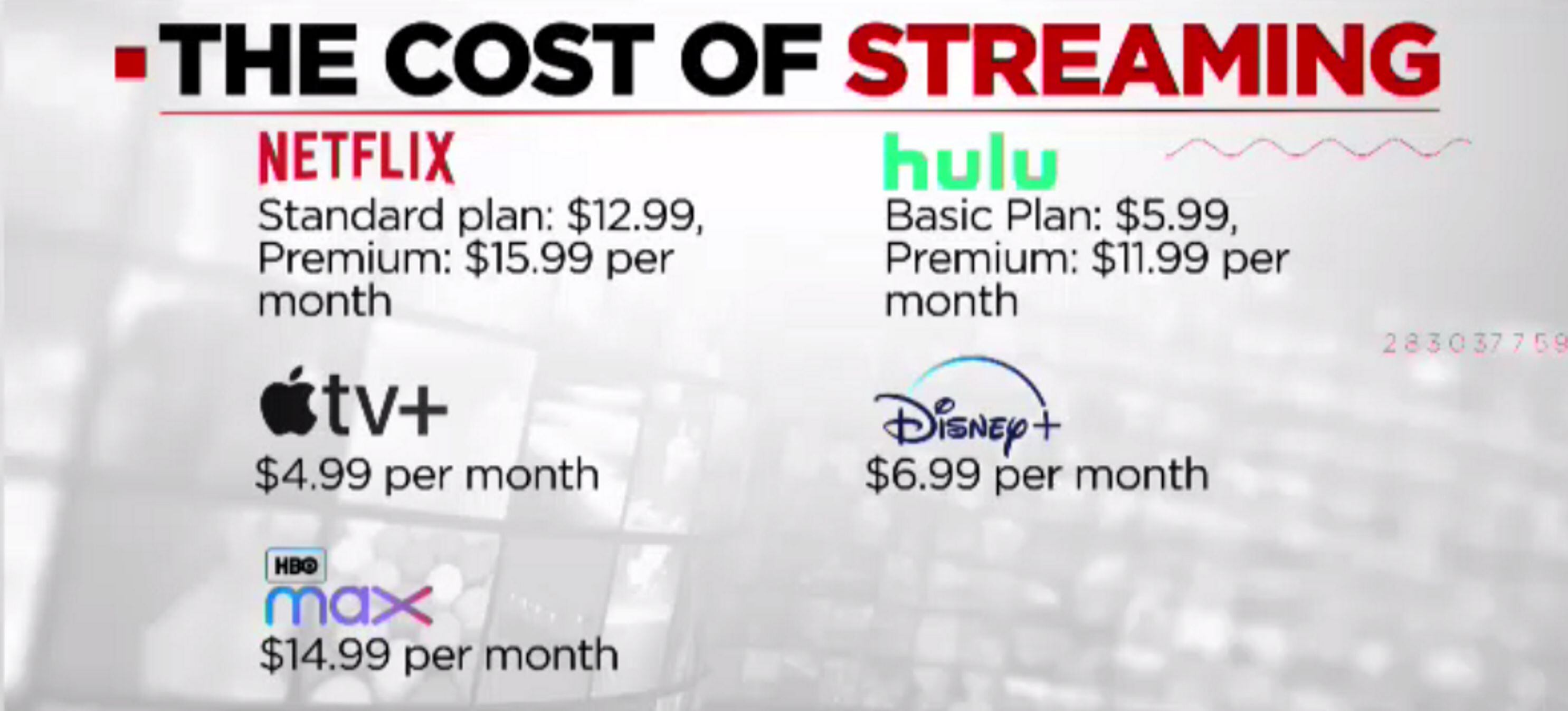

With Netflix's low cost of about $12 a month on average, services are finding themselves having to come in at an even lower price point to be appealing to viewers. Disney+ will cost about $7 a month, which should help it gain subscribers in these early years. Disney can also bundle the services with sister companies Hulu and ESPN+ to create better deals.

The company will have to take a loss for a bit to maintain this offer: Despite having thousands of hours of content from its shows and movies, the service won't be profitable until 2024.

HBO Max will be $15, which is the exact price as the current HBO service. Parent company WarnerMedia will give the upgraded offering to digital HBO subscribers for the same monthly fee and is working with cable companies and other providers to see if it can give a similar deal to people who subscribe through those channels.

"What Netflix has really done if you look at the ecosystem over the last five years, is they priced it so competitively with the value for consumers that it was like you can't come in ahead of them," Hare said. "I think that's why you're also seeing companies saying we can't price this at $17, $18, $19, because what's the relative value to Netflix."