*By Mike Teich*

President Trump pulled the United States out of the Iran nuclear deal Tuesday, abandoning the Obama administration's signature foreign policy accomplishment almost three years after it was agreed.

The oil market had already accounted for the likelihood Trump would abandon the deal, but volatility in oil prices could be affected by the tone of the president's statement, and the degree of the sanctions he imposes, said Patrick DeHaan, the head of petroleum analysis at GasBuddy.

"The more fiery the response from President Trump, the more oil prices could eventually rally," said DeHaan in an interview Tuesday with Cheddar.

A spike in oil prices might cause discretionary spending to drop, he said, adding that every penny the average price of oil rises, it takes $4 million a day away from the economy. While the initial increase in prices may make summer road trips a little more expensive for travelers, DeHaan doesn't anticipate a major impact on consumer spending until we hit a a more "psychological barrier" of $3 a gallon.

For the full interview, [click here](https://cheddar.com/videos/how-trumps-decision-to-withdraw-from-iran-nuclear-deal-affects-your-wallet).

New York City is using ranked choice voting in its Democratic mayoral primary election. Here's how it works.

Former congressman Billy Long of Missouri has been confirmed to lead the Internal Revenue Service, an agency he once sought to abolish.

Top Democratic strategist David Plouffe is joining Coinbase as an adviser as the cryptocurrency exchange broadens its political reach.

The director of national intelligence says artificial intelligence is speeding up the work of America's spy services.

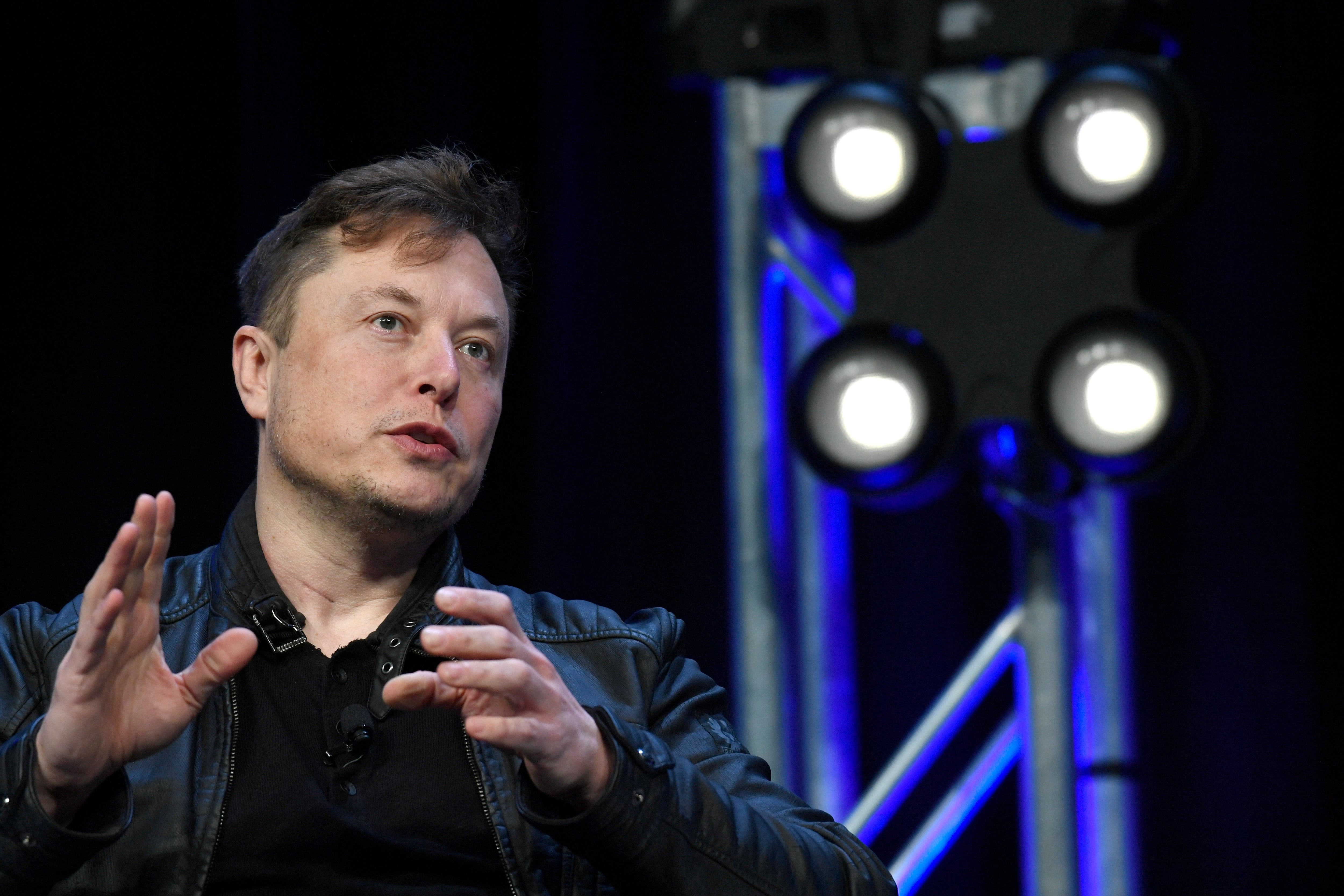

Elon Musk is dialing back his threat to decommission a capsule used to take astronauts and supplies to the International Space Station for NASA. T

President Donald Trump is threatening to cut Elon Musk’s government contracts as their fractured alliance rapidly escalated into a public feud.

President Donald Trump wants his “big, beautiful” bill of tax breaks and spending cuts on his desk to be singed into law by Independence Day. And he’s pushing the slow-rolling Senate to make it happen sooner rather than later. Trump met with Senate Majority Leader John Thune at the White House early this week and has been dialing senators for one-on-one chats, using both the carrot and stick to encourage them to act. But it’s still a long road ahead for the bill. Senators want to make changes to protect Medicaid and to make sure some tax breaks become permanent. Elon Musk called the whole bill a "disgusting abomination.”

China has blasted the U.S. for issuing AI chip export control guidelines, stopping the sale of chip design software to China, and planning to revoke Chinese student visas.

Would U.S. companies go back to Russia if there’s a peace deal over Ukraine?

The explosive growth of the data centers is eliciting some pushback.