*By Mike Teich*

President Trump pulled the United States out of the Iran nuclear deal Tuesday, abandoning the Obama administration's signature foreign policy accomplishment almost three years after it was agreed.

The oil market had already accounted for the likelihood Trump would abandon the deal, but volatility in oil prices could be affected by the tone of the president's statement, and the degree of the sanctions he imposes, said Patrick DeHaan, the head of petroleum analysis at GasBuddy.

"The more fiery the response from President Trump, the more oil prices could eventually rally," said DeHaan in an interview Tuesday with Cheddar.

A spike in oil prices might cause discretionary spending to drop, he said, adding that every penny the average price of oil rises, it takes $4 million a day away from the economy. While the initial increase in prices may make summer road trips a little more expensive for travelers, DeHaan doesn't anticipate a major impact on consumer spending until we hit a a more "psychological barrier" of $3 a gallon.

For the full interview, [click here](https://cheddar.com/videos/how-trumps-decision-to-withdraw-from-iran-nuclear-deal-affects-your-wallet).

Indiana's initial estimate for Medicaid expenses is nearly $1 billion short of its now-predicted need, state lawmakers learned in a report that ignited concern over the state's budget and access to the low-income healthcare program.

The IRS said Tuesday it is going to waive penalty fees for people who failed to pay back taxes that total less than $100,000 per year for tax years 2020 and 2021.

Senate leaders announced Tuesday that there will not be a vote this year on a border security package that included funding for Ukraine and Israel.

Criticism is continuing to mount on former President Donald Trump for his comments over the weekend saying immigrants are "poisoning the blood" of the country.

A former Proud Boys organizer was sentenced to 40 months in prison yesterday for his involvement in the January 6, 2021 attack on the U.S. Capitol.

Israel reportedly delivered an offer with possible terms for a second week-long ceasefire.

A divided Colorado Supreme Court is removing former President Donald Trump from the state’s primary ballot, saying in a historic ruling that he is ineligible to be president after his role in the Jan. 6, 2021, attack on the U.S. Capitol.

The death of a 5-year-old migrant boy and reported illnesses in other children living at a warehouse retrofitted as a shelter has raised fresh concerns about the living conditions and medical care provided for asylum-seekers arriving in Chicago.

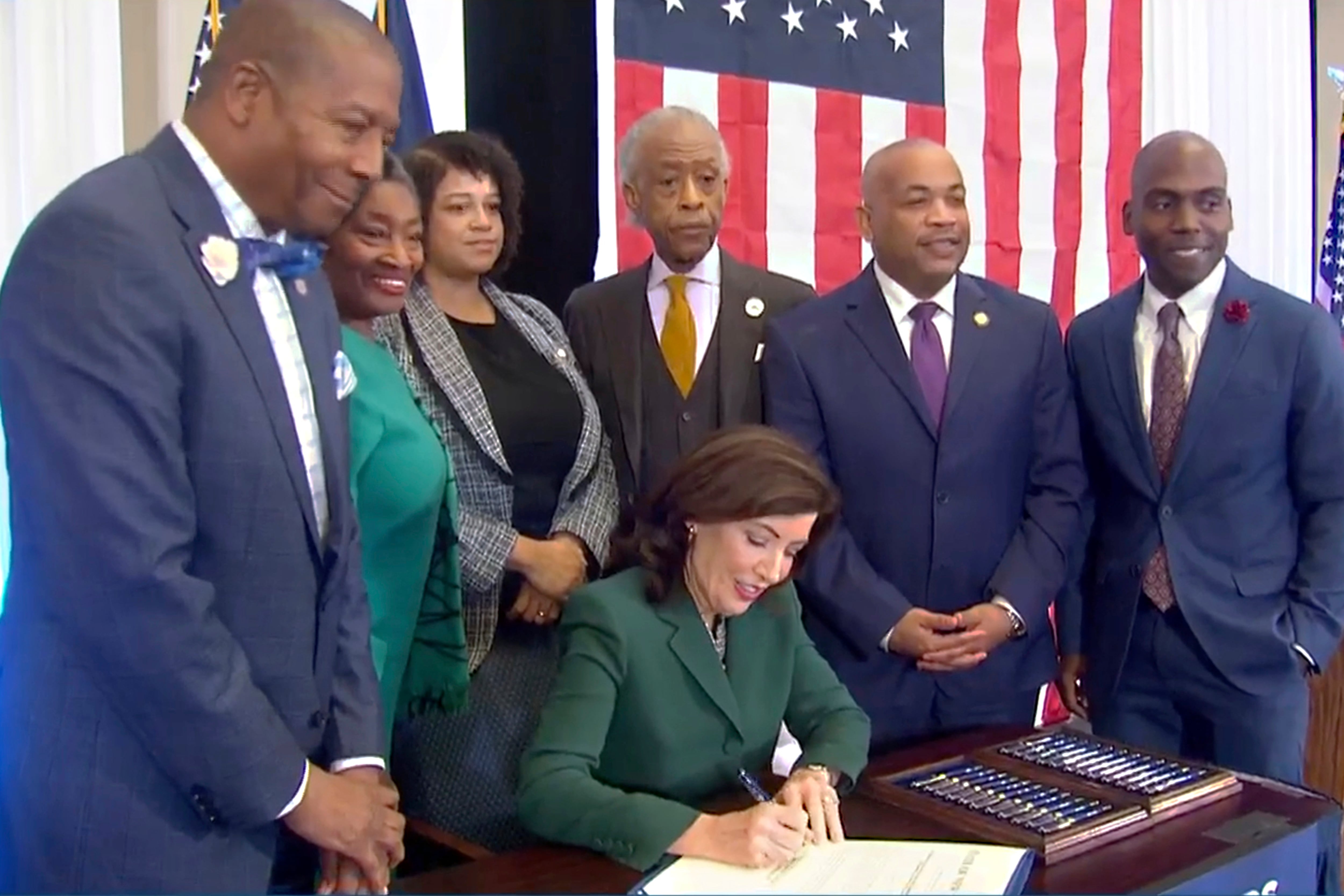

New York State will create a commission tasked with considering reparations to address the persistent, harmful effects of slavery in the state under a bill signed into law by Gov. Kathy Hochul on Tuesday.

The White House is lending its support to an auto industry effort to standardize Tesla’s electric vehicle charging plugs for all EVs in the United States.