When you buy your future home and take out a mortgage, you will likely be locked into a specific interest rate. However, you can refinance your mortgage to change how much you pay, and for how long.

The main advantage of refinancing is reducing your interest rate. If you have a variable loan rate, refinancing is a great way to get into a fixed rate mortgage.

People also refinance their mortgages to shorten the length of the mortgage term. The market average is a 30-year mortgage. When you refinance you can shorten your term to a 15- or even 10-year term.

Stocks jumped after the opening bell on Thursday a day after Wall Street suffered its worst loss since October.

Dunkin said it's removing coconut milk from the menu.

Power Brands is recalling two of its air fryer models following reports of burns.

With only a few days until Christmas, people are still scrambling to buy gifts for friends and family. Claudia Lombana, consumer and shopping expert, joined Cheddar News to provide tips on how to budget for those gifts.

With the New Year around the corner, it's time to start thinking about resolutions. Many folks begin to think about saving money or cutting down on bills. Caleb Silver, editor-in-chief of Investopedia, joined Cheddar News to provide some tips on tracking debt and staying organized.

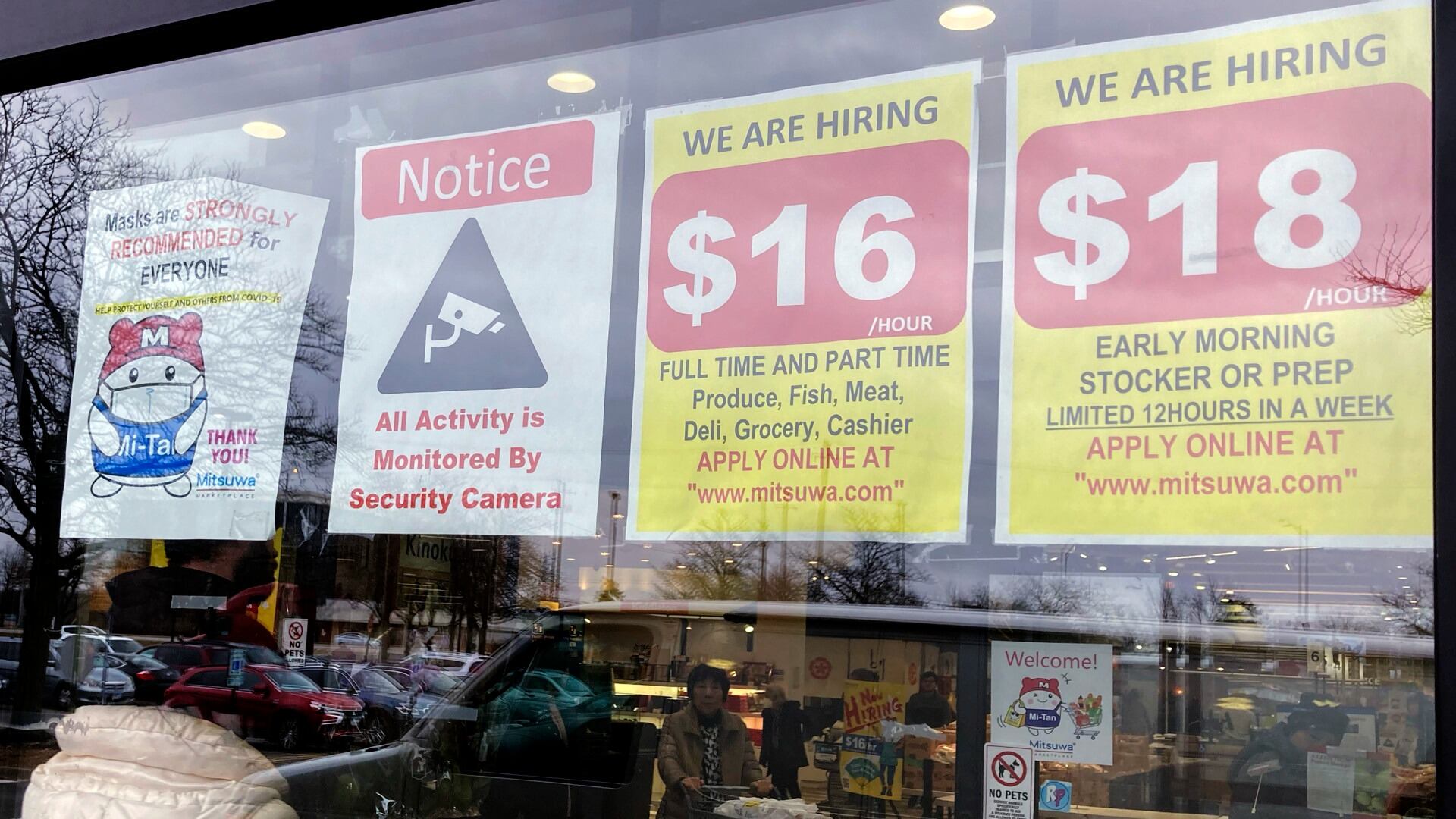

Half of U.S. states are raising their minimum wage next year.

Sony's PlayStation 5 console has now passed 50 million units sold.

FedEx decreased its full-year revenue forecast after reporting lower-than-expected quarterly profits in its latest results.

Cora is among dozens of young kids across the U.S. poisoned by lead linked to tainted pouches of the cinnamon-and-fruit puree

The IRS said Tuesday it is going to waive penalty fees for people who failed to pay back taxes that total less than $100,000 per year for tax years 2020 and 2021.