By Matt Ott

The number of Americans filing for jobless aid fell last week as the labor market remains resilient in the face of the Federal Reserve's interest rate increases meant to cool the economy.

Applications for unemployment benefits in the U.S. for the week ending Feb. 18 fell by 3,000 last week to 192,000, from 195,000 the previous week, the Labor Department said Thursday. It’s the sixth straight week claims were under 200,000.

The four-week moving average of claims, which evens out some of the weekly volatility, inched up by 1,500 to 191,250. It's the fifth straight week that figure has been below 200,000.

Applications for unemployment benefits are considered a proxy for the number layoffs in the U.S.

Earlier this month, the Fed raised its main lending rate by 25 basis points, its eighth rate hike in less than a year. The central bank’s benchmark rate is now in a range of 4.5% to 4.75%, its highest level in 15 years. Chair Jerome Powell appeared to suggest that he foresees two additional quarter-point rate hikes.

So far, the Fed’s hawkish interest rate policy has tempered inflation, but has had less impact on a robust U.S. job market.

Two weeks ago, the government reported that employers added a better-than-expected 517,000 jobs in January and that the unemployment rate dipped to 3.4%, the lowest level since 1969. Analysts were expecting job gains of around 185,000.

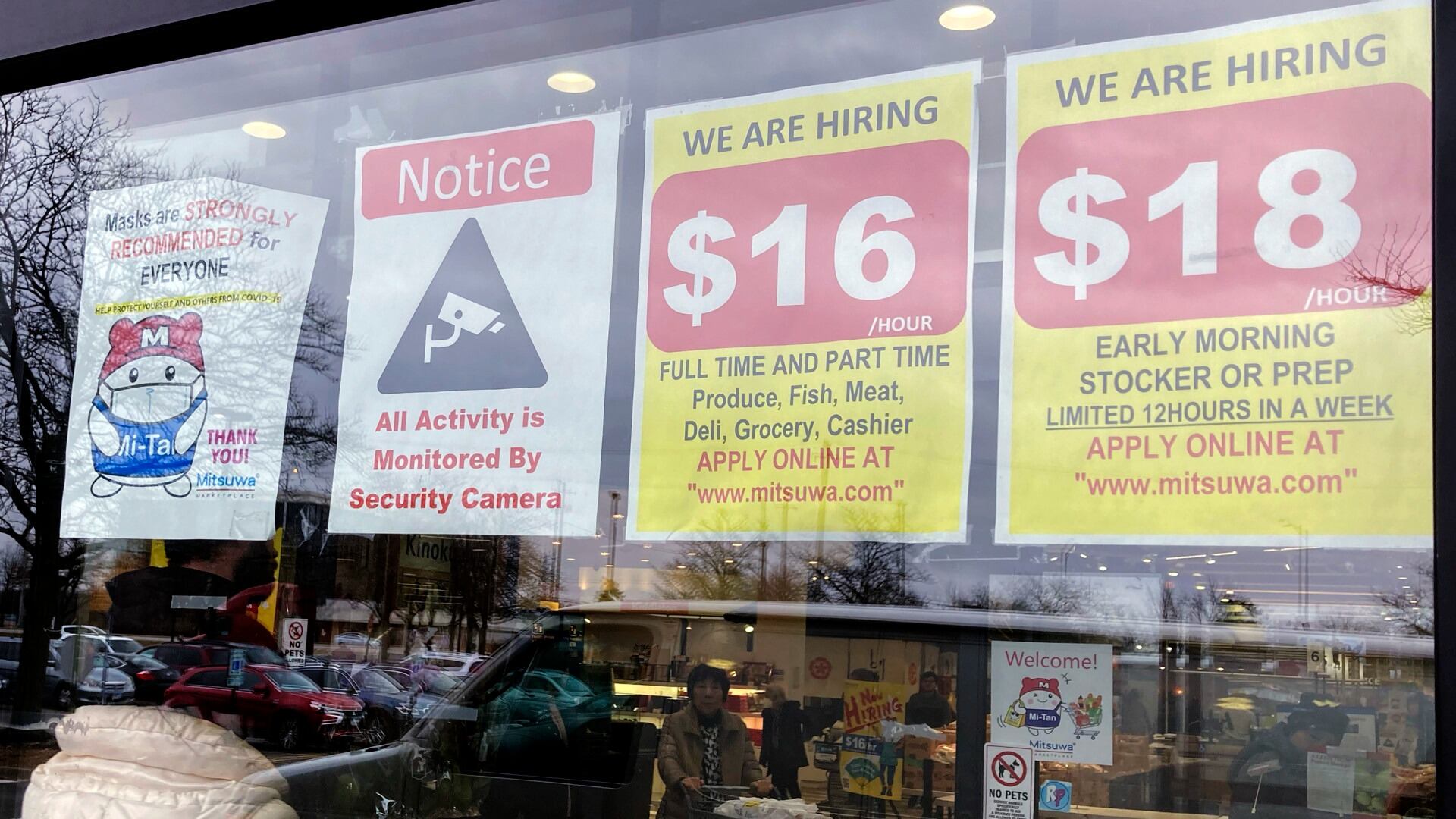

Job openings rose to 11 million in December, up from 10.44 million in November and the highest since July. For 18 straight months, employers have posted at least 10 million openings — a level never reached before 2021 in Labor Department data going back to 2000. In December, there were about two vacancies for every unemployed American.

Though the U.S. labor market remains strong, layoffs have been mounting in the technology sector, where many companies overhired after a pandemic boom. IBM, Microsoft, Amazon, Salesforce, Facebook parent Meta, Twitter and DoorDash have all announced layoffs in recent months.

The real estate sector has suffered the most from the Fed’s interest rate hikes, largely due to higher mortgage rates — currently above 6% — that have slowed home sales for 12 straight months. That’s almost in lockstep with the Fed’s rate hikes that began last March.

About 1.65 million people were receiving jobless aid the week that ended Feb. 11, a decrease of 37,000 from the week before.