The U.S. is seeing the biggest spike in demand for cold, hard cash since the Y2K “bug” panic of 1999, as customers of U.S. banks and credit unions have made big withdrawals to brace themselves for coronavirus fallout.

According to data by the Federal Reserve, the number of banknotes in circulation rose by $35 billion, from $1.808 trillion on March 11 to $1.843 trillion on March 18.

Last week the Federal Deposit Insurance Corporation, the agency that insures bank deposits and protects customers from any losses, urged people to keep their cash in the bank. FDIC Chairman Jelena McWilliams told Cheddar Wednesday that money in insured institutions will be safe, "even if we need to go above and beyond the bank assets to pay out depositors and then replenish the funds.”

The FDIC historically has insured customer deposits up to $250,000 per depositor at FDIC-insured institutions.

McWilliams said the agency doesn’t currently anticipate any bank failures directly resulting from the coronavirus pandemic and that despite the spike in cash withdrawals the FDIC isn’t worried about the system or financial stability of the U.S. The big banks themselves have also insisted they won’t need bailouts.

Nevertheless, the $2 trillion coronavirus stimulus bill, signed into law on Friday, includes a provision allowing the FDIC to insure deposits that total more than $250,000.

Updated March 31 to clarify that the FDIC does not anticipate any bank failures directly resulting from the coronavirus pandemic.

Consider this your sign to pack your bags. Airbnb says Colorado Springs will be a top travel destination in 2024.

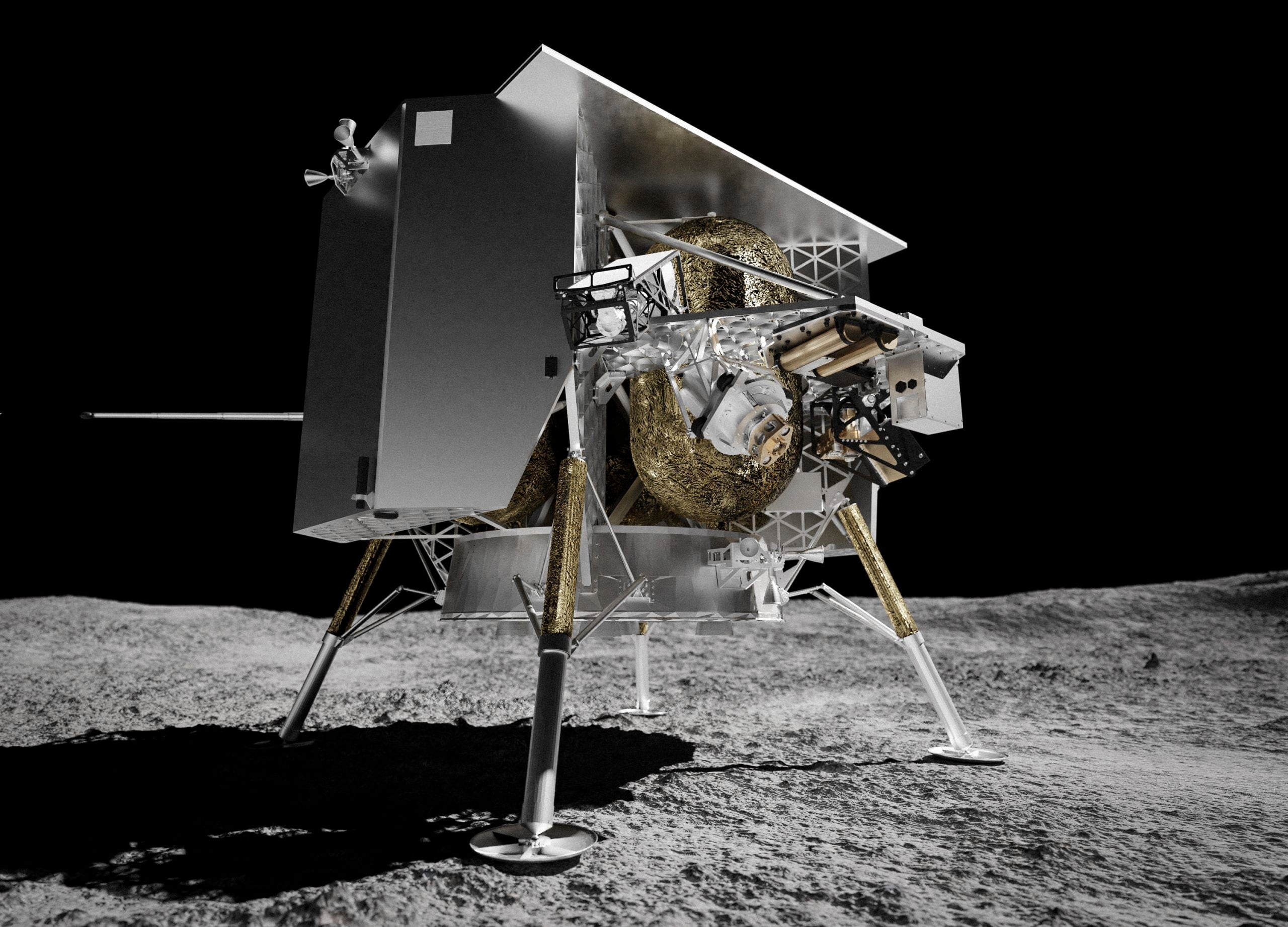

A moon landing attempt by a private US company appears doomed because of a fuel leak on the newly launched spacecraft. Astrobotic Technology managed to orient the lander toward the sun Monday so its solar panel could capture sunlight and charge its onboard battery.

Treasury Secretary Janet Yellen has announced that 100,000 businesses have signed up for a new database that collects ownership information intended to help unmask shell company owners. Yellen says the database will send the message that “the United States is not a haven for dirty money.”

A new version of the federal student aid application known as the FAFSA is available for the 2024-2025 school year, but only on a limited basis as the U.S. Department of Education works on a redesign meant to make it easier to apply.

A steep budget deficit caused by plummeting tax revenues and escalating school voucher costs will be in focus Monday as Democratic Gov. Katie Hobbs and the Republican-controlled Arizona Legislature return for a new session at the state Capitol.

The first U.S. lunar lander in more than 50 years is on its way to the moon. The private lander from Astrobotic Technology blasted off Monday from Cape Canaveral, Florida, catching a ride on United Launch Alliance's brand new rocket Vulcan.

Global prices for food commodities like grain and vegetable oil fell last year from record highs in 2022, when Russia’s war in Ukraine, drought and other factors helped worsen hunger worldwide, the U.N. Food and Agriculture Organization said Friday.

Wall Street is drifting higher after reports showed the job market remains solid, but key parts of the economy still don’t look like they’re overheating.

The Biden administration is docking more than $2 million in payments to student loan servicers that failed to send billing statements on time after the end of a pandemic payment freeze.

The nation’s employers added a robust 216,000 jobs last month, the latest sign that the American job market remains resilient even in the face of sharply higher interest rates.