Cheddar hosts Kristen Scholer and Tim Stenovec break down the top headlines this Tuesday morning. From Bitcoin to Disney, Cheddar has you covered.

Fans of bitcoin, rejoice. The crypto-currency will soon have futures trading. The Chicago Board Options Exchange announcing on Monday that its planned bitcoin futures product will start trading on December 10th.

Plus, the live sports streaming wars are heating up once again. Facebook will reportedly spend "a few billion dollars" to acquire sports streaming rights.

And it seems like Disney is the frontrunner to buy 21st Century Fox's assets. According to Bloomberg, 21st Century Fox views Disney as a better fit, with fewer regulatory hurdles in the way of a deal. Disney, Comcast, Sony, and Verizon had all expressed interest to buy certain Fox properties.

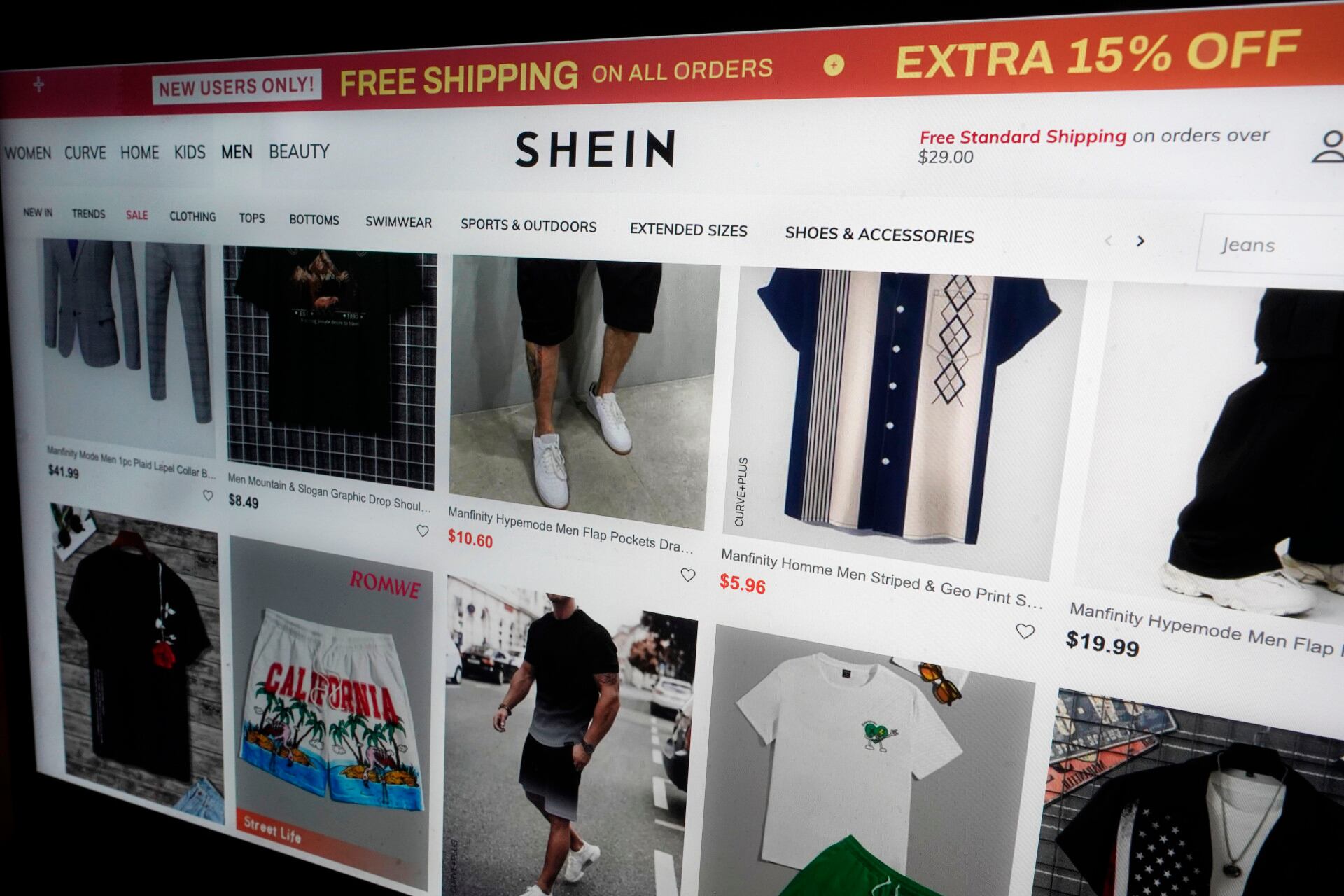

Two of the top low-cost online retailers are going head to head in a new legal battle. Cheddar News' Michelle Castillo breaks the lawsuit down.

The number of Americans filing for jobless benefits fell last week as the labor market continues to thrive despite high interest rates and elevated costs.

The earliest version of Disney's Mickey Mouse will become public domain on Jan. 1, 2024.

The toy magic oven called the Cookeez Makery is one of the hottest toys for kids this holiday season.

In the UK, IKEA is looking to give away some meatballs, and not just regular-size meatballs.

Dwayne 'The Rock' Johnson is set to star in a movie playing MMA and UFC legend, Mark Care, while Kevin Hart will headline a boxing project over on Peacock.

Coca-Cola is recalling drinks sold in three southern states due to possible "foreign materials" inside cans.

Stocks jumped after the Dow Jones closed at a record high while fresh retail sales data showed positive consumer spending ahead of the holidays.

The Food and Drug Administration is asking Congress for new powers, including the ability to mandate drug recalls and require eyedrop makers to undergo inspections before shipping products to the U.S.

The Federal Reserve kept its key interest rate unchanged Wednesday for a third straight time, and its officials signaled that they expect to make three quarter-point cuts to their benchmark rate next year.