Southwest Airlines Co. on Tuesday outlined a plan to strengthen its operational resilience after a winter storm late last year led to widespread cancellations and delays.

"We understand the root causes that led to the holiday disruption, and we're validating our internal review with the third-party assessment. Now, we expect to mitigate the risk of an event of this magnitude ever happening again," said CEO Bob Jordan. "Work is well underway implementing action items to prepare for next winter—with some items already completed."

The three-part plan comes after an internal review conducted with aviation consultancy Oliver Wyman. The effort will supplement an existing five-year modernization plan that began in 2022 and has already put aside $1.3 billion for new software and information technology.

In addition, the airline will purchase more winter equipment and vehicles, such as de-icing trucks for runways and engine covers and heaters for cold weather operations. It also plans to increase staffing around the winter season and increase cross-team collaboration.

"I'm confident in our path forward and truly believe our best days are ahead," said Andrew Watterson, chief operating officer for Southwest Airlines.

The airline said it will share more details from its internal review in the coming weeks.

Google on Monday will try to protect a lucrative piece of its internet empire at the same time it’s still entangled in the biggest U.S. antitrust trial in a quarter century.

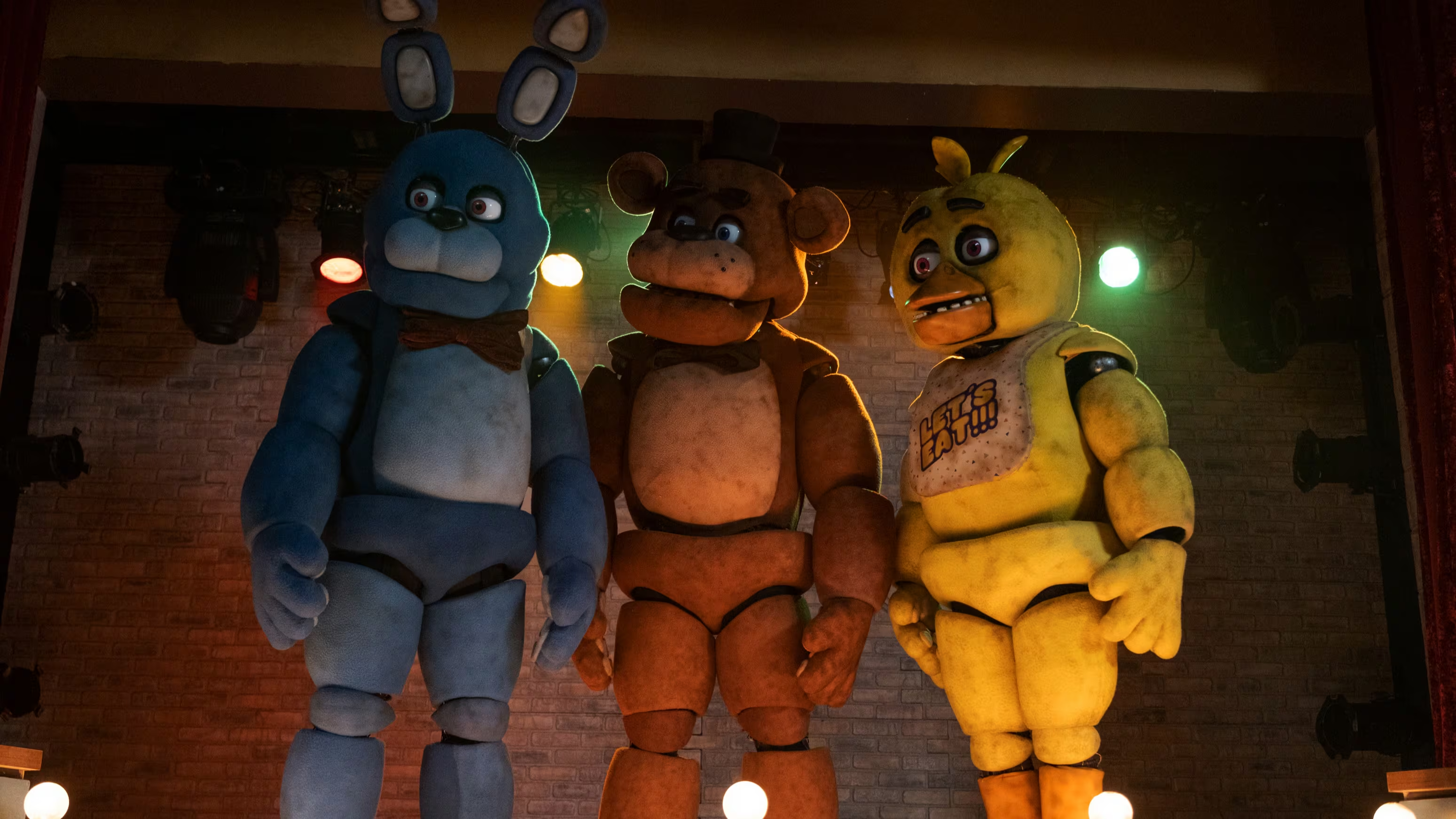

Before the SAG-AFTRA strike, this was the weekend “Dune: Part Two” was supposed to open. When Warner Bros. and Legendary pushed that opening back to March 2024 and no other blockbuster stepped in to take its spot.

A growing number of Californians are planting agave to be harvested forz use in spirits. The trend is fueled by the need to find hardy crops that don’t need much water and a booming appetite for premium alcoholic beverages.

Big Business This Week is a guided tour through the biggest market stories of the week, from winning stocks to brutal dips to the facts and forecasts generating buzz on Wall Street. This week we highlight Paramount, Maersk, Starbucks, Uber, Lyft and Beyond Meat.

With Donald Trump due on the witness stand next week, testimony from his adult sons in his civil business fraud trial wrapped up Friday with Eric Trump saying he relied completely on accountants and lawyers to assure the accuracy of financial documents key to the case.

DraftKings reported better-than-expected revenue in the third quarter.

Wallet Hub released a list of the 10 states with the highest median monthly student loan payments.

Oil and gas giant BP will purchase electric vehicle chargers from Tesla for $100 million.

Reports say olive oil prices have jumped 75% since January of 2021.

The big three car companies for GM and Stellantis have agreed to pay striking workers as they spend time on the picket line, according to The Wall Street Journal.