Peloton priced shares at $29 after the bell Wednesday, valuing the company at $8.06 billion as it prepares to make its public debut Thursday. That's at the high end of the original $26 to $29 price range Peloton was targeting. The company raised $1.16 billion in the offering.

Peloton is pitching itself to investors as more than just an at-home fitness company. With live and on-demand classes led by popular instructors, plus branded gear and clothing that members can flaunt in public, Peloton is hoping its cult-like following translates to a successful IPO.

Peloton boasts a loyal subscriber-base with over 1.4 million members that logged 55 million total workouts in fiscal 2019. In its S-1 filing, Peloton also said it had a 95 percent member retention rate which helped the company rake in $915 million in revenue. Most of that money came from sales of Peloton's high-margin and high-cost Connected Fitness Products.

The Peloton bike costs about $2,000 and its treadmill more than $4,000. The Connected Fitness Subscription, which allows members to stream classes for $39 a month, accounted for nearly 20 percent of Peloton's revenue for fiscal 2019.

Those classes are only getting more popular. Peloton says the average number of monthly workouts per connected subscriber has about doubled since the first quarter of 2017 to more than 12 workouts a month.

Still, losses for the company are widening. Peloton's annual net loss more than quintupled from $47.9 million in fiscal 2018 to $245.7 million in 2019. The company doesn't expect to achieve profitability in the near future.

Another reason that may give investors pause, Peloton is currently facing a $300 million lawsuit over the use of music streamed in its classes. The National Music Publisher's Association claims tracks from big-time artists like Taylor Swift, Adele, and the Beatles, have been used unlawfully. Peloton has spent $50.6 million on music licensing over the last three years.

Peloton will start trading Thursday on the Nasdaq Exchange under the ticker symbol PTON.

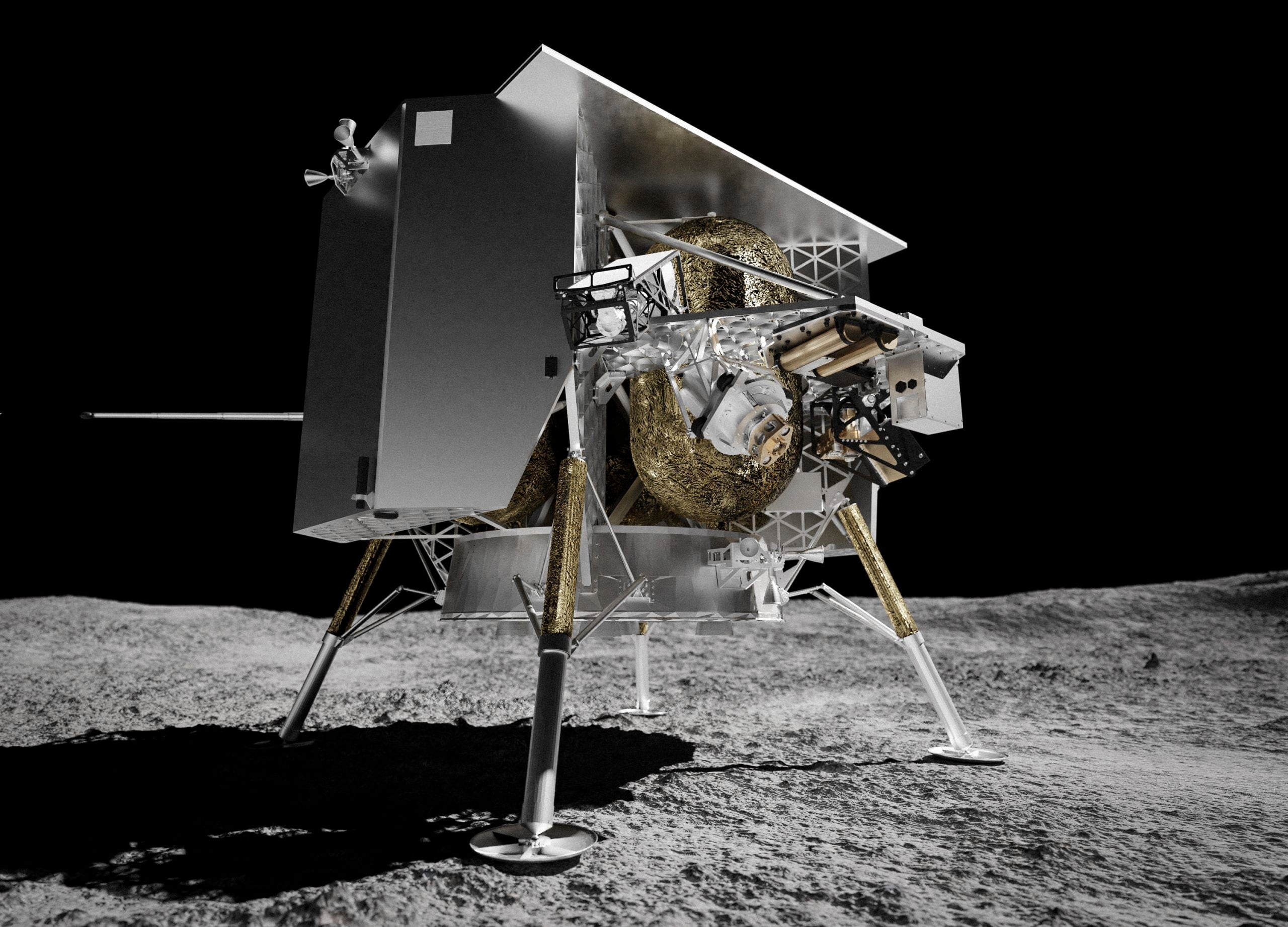

A moon landing attempt by a private US company appears doomed because of a fuel leak on the newly launched spacecraft. Astrobotic Technology managed to orient the lander toward the sun Monday so its solar panel could capture sunlight and charge its onboard battery.

Treasury Secretary Janet Yellen has announced that 100,000 businesses have signed up for a new database that collects ownership information intended to help unmask shell company owners. Yellen says the database will send the message that “the United States is not a haven for dirty money.”

A new version of the federal student aid application known as the FAFSA is available for the 2024-2025 school year, but only on a limited basis as the U.S. Department of Education works on a redesign meant to make it easier to apply.

A steep budget deficit caused by plummeting tax revenues and escalating school voucher costs will be in focus Monday as Democratic Gov. Katie Hobbs and the Republican-controlled Arizona Legislature return for a new session at the state Capitol.

The first U.S. lunar lander in more than 50 years is on its way to the moon. The private lander from Astrobotic Technology blasted off Monday from Cape Canaveral, Florida, catching a ride on United Launch Alliance's brand new rocket Vulcan.

Global prices for food commodities like grain and vegetable oil fell last year from record highs in 2022, when Russia’s war in Ukraine, drought and other factors helped worsen hunger worldwide, the U.N. Food and Agriculture Organization said Friday.

Wall Street is drifting higher after reports showed the job market remains solid, but key parts of the economy still don’t look like they’re overheating.

The Biden administration is docking more than $2 million in payments to student loan servicers that failed to send billing statements on time after the end of a pandemic payment freeze.

The nation’s employers added a robust 216,000 jobs last month, the latest sign that the American job market remains resilient even in the face of sharply higher interest rates.

A U.S. labor agency has accused SpaceX of unlawfully firing employees who penned an open letter critical of CEO Elon Musk and creating an impression that worker activities were under surveillance by the rocket ship company.