By Ken Sweet

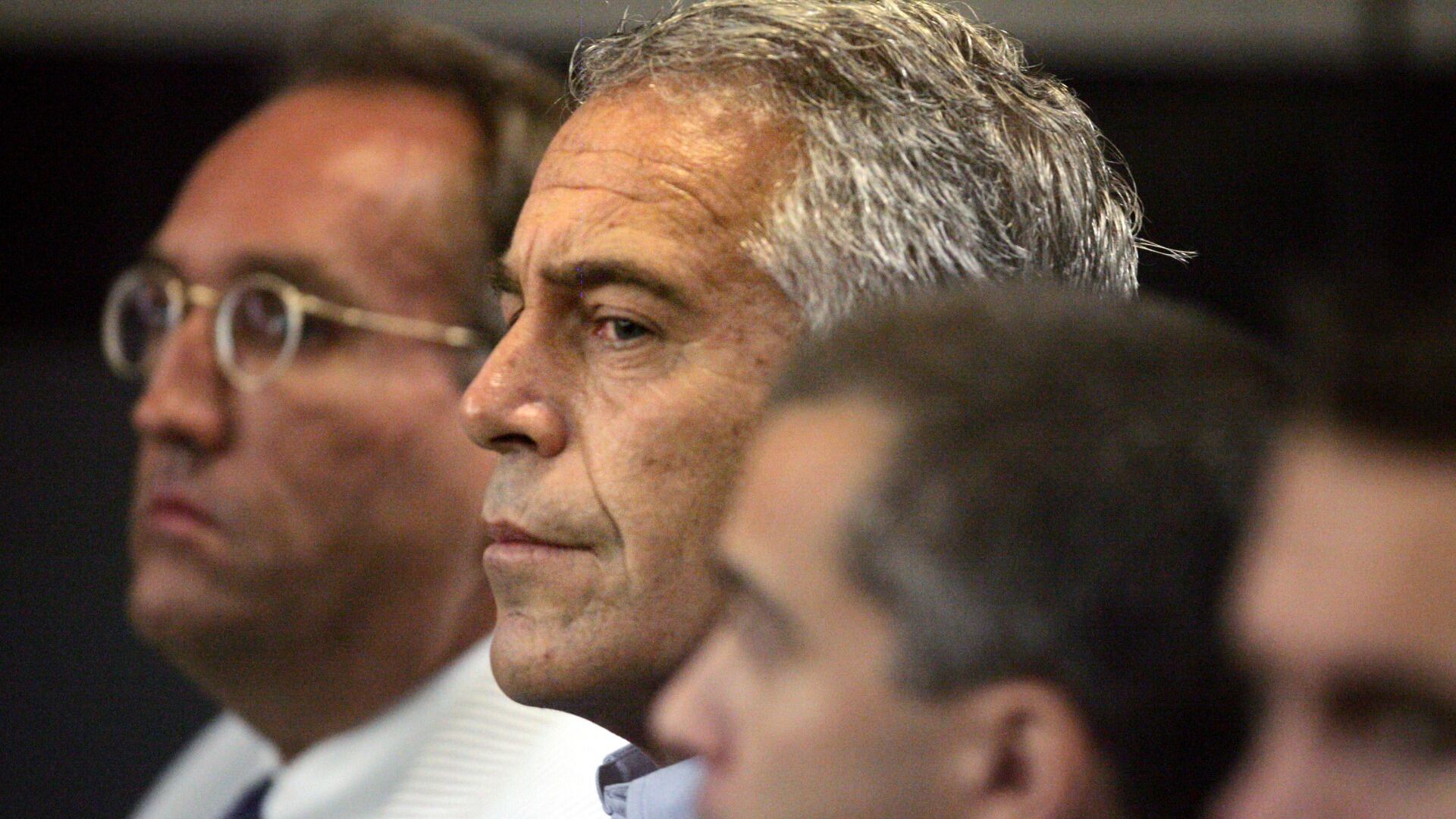

JPMorgan Chase agreed Tuesday to pay $75 million to the U.S. Virgin Islands to settle claims that the bank enabled the sex trafficking acts committed by financier Jeffrey Epstein.

JPMorgan said that $55 million of the settlement will go toward local charities and assistance for victims. Another $20 million will go toward legal fees.

The Virgin Islands, where Epstein had an estate, sued JPMorgan last year, saying its investigation has revealed that the financial services giant enabled Epstein’s recruiters to pay victims and was “indispensable to the operation and concealment of the Epstein trafficking enterprise."

In effect, the Virgin Islands had argued that JPMorgan had been complicit in Epstein's behavior and did not raise any red flags to law enforcement or bank regulators about Epstein being a “high risk” customer and making repeated large cash withdrawals.

The settlement averts a trial that had been set to start next month.

The bank also said it reached an confidential legal settlement with James “Jes” Staley, the former top JPMorgan executive who managed the Epstein account before leaving the the bank. JPMorgan sued Staley earlier this year, alleging that he covered up or minimized Epstein's wrongdoing in order to maintain the lucrative account.

JPMorgan had already agreed to pay $290 million in June in a class-action lawsuit that involved victims of Epstein's trafficking crimes.

Epstein died by suicide in a federal jail in 2019.

If you have a flexible spending account, here's some short information for you so you don't leave money on the table.

With high healthcare costs, bills can quickly add up. In some cases, it is possible to negotiate your medical bills. Barak Richman, law professor at George Washington University, joined Cheddar News to discuss the easiest way to talk to medical debt companies about what's owed.

Millions of people have selected insurance plans for 2024 but sometimes navigating them can be tricky time consuming and expensive. Paula Pant, host of 'Afford Anything' podcast, joined Cheddar News to break down what's needed to know about their insurance plans.

The European Union is investigating Elon Musk's X over alleged illicit content and disinformation on its platform. Cheddar News breaks it all down and discusses what it could mean for users.

Adobe and Figma called off their $20 million merger, Southwest Airlines gets fined, Nippon Steel is buying U.S. Steel and oil and gas prices surge after a pause in shipments.

With more employees being called back to the office, many workers are suddenly protesting by being in the office for as little time as possible. As the term suggests, coffee-badging means coming in for just enough time to have a cup of coffee, show your face, and swipe your badge.

Japan's Nippon steel is buying U.S. Steel for $14.9 billion.

Southwest Airlines will pay a $35 million fine as part of a settlement over a 2022 holiday season disaster that saw the airline cancel thousands of flights and leave millions of people stranded.

Cheddar News' Need2Know is brought to you by Securitize, which helps unlock broader access to alternative investments in private businesses, funds, and other alternative assets. The private credit boom is here and the Hamilton Lane Senior Credit Opportunities Fund has tripled in assets under management in just six months from November 2022 through April this year. Visit Securitize.io to learn more.

Stocks opened slightly higher after Monday's opening bell after several weeks of gains as the year closes out.