By Ken Sweet

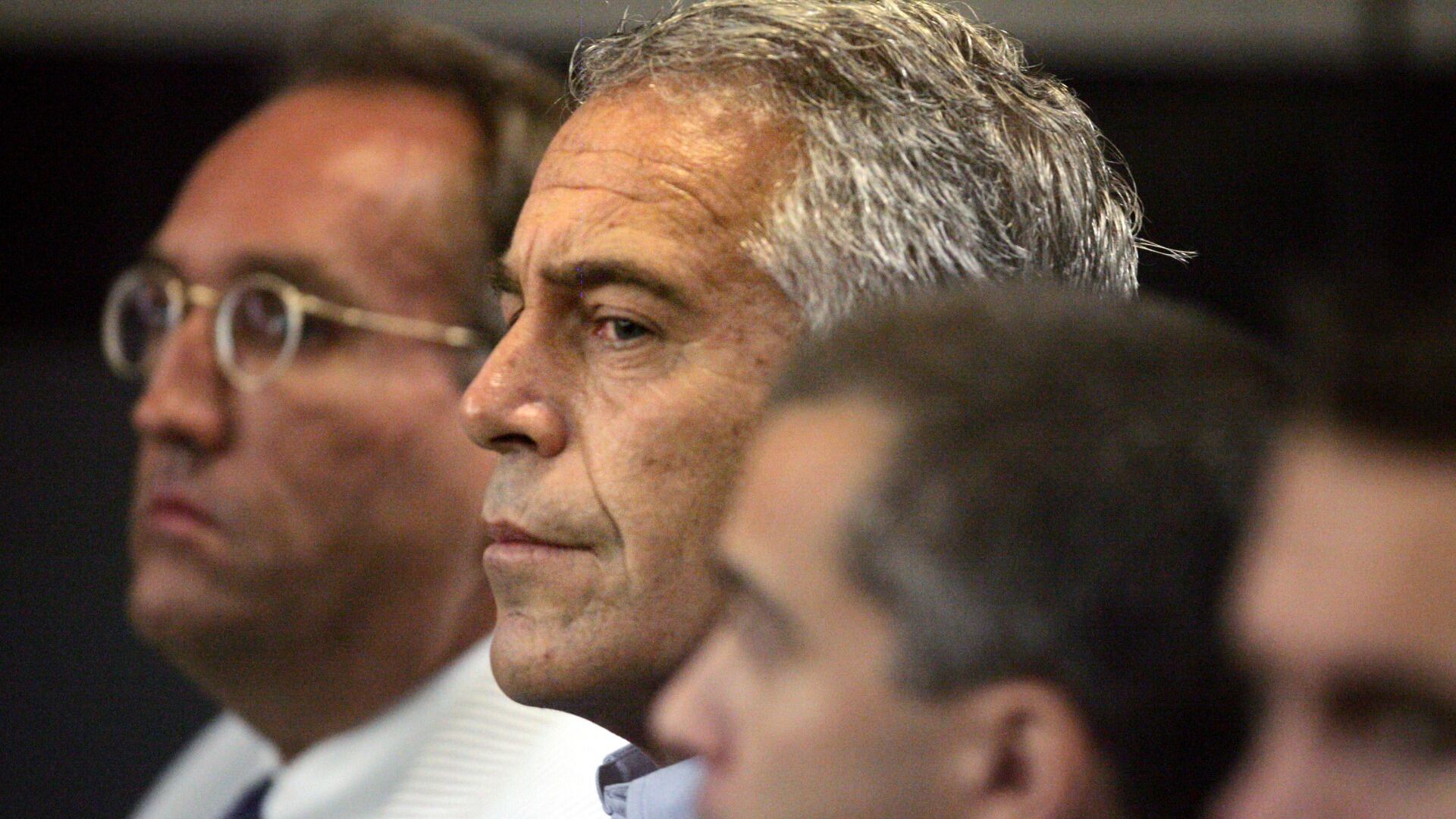

JPMorgan Chase agreed Tuesday to pay $75 million to the U.S. Virgin Islands to settle claims that the bank enabled the sex trafficking acts committed by financier Jeffrey Epstein.

JPMorgan said that $55 million of the settlement will go toward local charities and assistance for victims. Another $20 million will go toward legal fees.

The Virgin Islands, where Epstein had an estate, sued JPMorgan last year, saying its investigation has revealed that the financial services giant enabled Epstein’s recruiters to pay victims and was “indispensable to the operation and concealment of the Epstein trafficking enterprise."

In effect, the Virgin Islands had argued that JPMorgan had been complicit in Epstein's behavior and did not raise any red flags to law enforcement or bank regulators about Epstein being a “high risk” customer and making repeated large cash withdrawals.

The settlement averts a trial that had been set to start next month.

The bank also said it reached an confidential legal settlement with James “Jes” Staley, the former top JPMorgan executive who managed the Epstein account before leaving the the bank. JPMorgan sued Staley earlier this year, alleging that he covered up or minimized Epstein's wrongdoing in order to maintain the lucrative account.

JPMorgan had already agreed to pay $290 million in June in a class-action lawsuit that involved victims of Epstein's trafficking crimes.

Epstein died by suicide in a federal jail in 2019.

Some of America’s biggest retailers are working to increase their shipping speeds to please shoppers expecting faster and faster deliveries.

A group representing several big tech companies is suing Utah over state laws about children's social media use.

Google has agreed to pay $700 million to settle an anti-trust settlement.

Stocks were up after the closing bell as Wall Street continued to pin their hopes on rate cuts after last week's comments from the Fed.

Cheddar News' Need2Know is brought to you by Securitize, which helps unlock broader access to alternative investments in private businesses, funds, and other alternative assets. The private credit boom is here and the Hamilton Lane Senior Credit Opportunities Fund has tripled in assets under management in just six months from November 2022 through April this year. Visit Securitize.io to learn more.

Google has agreed to pay $700 million and make several other concessions to settle allegations that it had been stifling competition against its Android app store — the same issue that went to trial in another case that could result in even bigger changes.

Nicki Minaj just reached a milestone that no other woman in rap has reached.

Apple announced that starting this week, it will stop selling some versions of the Apple watch in the U.S.

Southwest Airlines will pay a $35 million fine as part of a $140 million settlement to resolve a federal investigation into a debacle in December 2022 when the airline canceled thousands of flights and stranded more than 2 million travelers over the holidays.

The House of Representatives recently passed a bill aimed at increasing transparency in healthcare.