By Ken Sweet

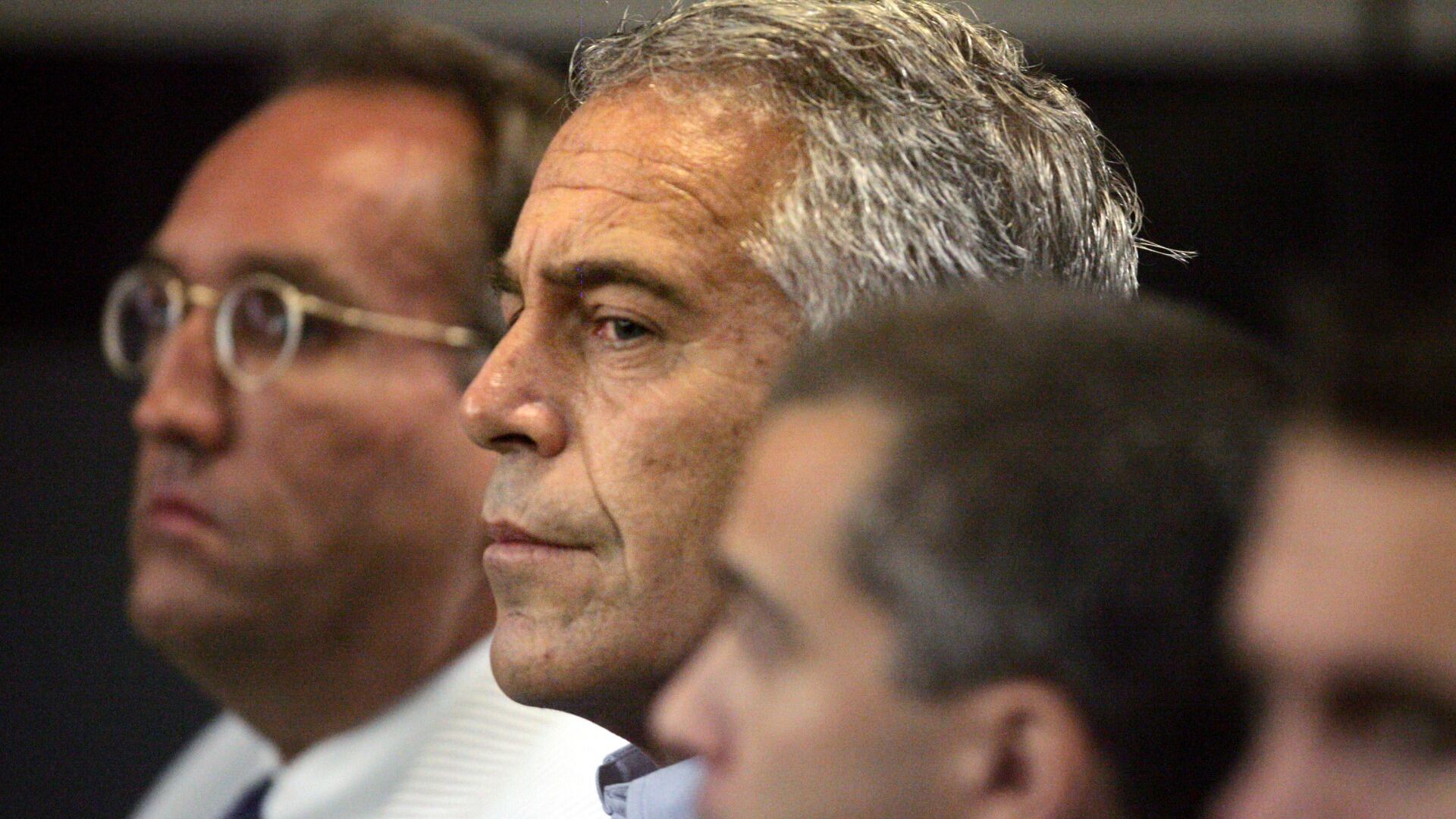

JPMorgan Chase agreed Tuesday to pay $75 million to the U.S. Virgin Islands to settle claims that the bank enabled the sex trafficking acts committed by financier Jeffrey Epstein.

JPMorgan said that $55 million of the settlement will go toward local charities and assistance for victims. Another $20 million will go toward legal fees.

The Virgin Islands, where Epstein had an estate, sued JPMorgan last year, saying its investigation has revealed that the financial services giant enabled Epstein’s recruiters to pay victims and was “indispensable to the operation and concealment of the Epstein trafficking enterprise."

In effect, the Virgin Islands had argued that JPMorgan had been complicit in Epstein's behavior and did not raise any red flags to law enforcement or bank regulators about Epstein being a “high risk” customer and making repeated large cash withdrawals.

The settlement averts a trial that had been set to start next month.

The bank also said it reached an confidential legal settlement with James “Jes” Staley, the former top JPMorgan executive who managed the Epstein account before leaving the the bank. JPMorgan sued Staley earlier this year, alleging that he covered up or minimized Epstein's wrongdoing in order to maintain the lucrative account.

JPMorgan had already agreed to pay $290 million in June in a class-action lawsuit that involved victims of Epstein's trafficking crimes.

Epstein died by suicide in a federal jail in 2019.

The union representing Southwest Airlines pilots says it reached a new contract agreement in principle with the airline following three years of negotiations.

U.S. Bank has been hit with a $36 million fine for freezing debit cards that distributed unemployment benefits during the pandemic.

Construction of new homes rose by double digits in November, according to data from the Commerce Department.

Cheddar News' Need2Know is brought to you by Securitize, which helps unlock broader access to alternative investments in private businesses, funds, and other alternative assets. The private credit boom is here and the Hamilton Lane Senior Credit Opportunities Fund has tripled in assets under management in just six months from November 2022 through April this year. Visit Securitize.io to learn more.

Stocks opened lower after the opening bell and on track for its first decline in 10 days after a recent winning streak.

Tesla drivers in the U.S. were in more accidents than drivers of any other car brand this year, according to a study.

The promise of self-checkout was alluring: Customers could avoid long lines by scanning and bagging their own items, workers could be freed of doing those monotonous tasks themselves and retailers could save on labor costs.

Monsanto was ordered to pay $857 million to students and parent volunteers at a Washington school.

A federal judge has struck down hundreds of lawsuits filed against the makers of Tylenol and generic acetaminophen.

California regulators are preparing to vote on new rules for turning recycled wastewater into drinking water.