What would you do if you bought a slice of pizza, but the vendor took a bite out of it first?

That’s the image Goldman Sachs wants you to conjure up when you think of a fee-based loan. The investment bank is using humor like that to advertise its latest division, Marcus by Goldman, a personal loan platform with no fees.

Dustin Cohn, head of marketing for the unit, says Marcus by Goldman aims to take the stigma out of loan conversations and marry the security of a traditional bank experience with the modernization of fintech firms.

“We are trying to help people better manage their debt,” he said. “The product is differentiated.”

While millennials may want to solve their financial issues and build their bank accounts digitally, they don’t always like having those discussions. According to the American Bankers Association, 71 percent of the demo would rather go to the dentist than chat with a financial advisor. And nearly a quarter of the group says that not having a mobile app makes it less likely they’ll engage with banks.

Cohn says, however, that Goldman’s platform aims to make interactions more natural.

“We built this with the consumer; the experience, the site experience, we co-created with our consumers,” he said. “It’s intuitive, it’s seamless.”

For full interview [click here] (https://cheddar.com/videos/goldman-sachs-gets-personal).

Hackers accessed Xfinity customers’ personal information by exploiting a vulnerability in software used by the company, the Comcast-owned telecommunications business announced this week.

Some folks want to leave the cold for a quick getaway. Bobby Laurie, travel expert, joined Cheddar News to provide tips on how and when to look for a winter escape.

Julia Pollak, chief economist with ZipRecruiter, joined Cheddar News to provide tips on navigating a job loss and explain the benefits of working with a recruiter to find new employment.

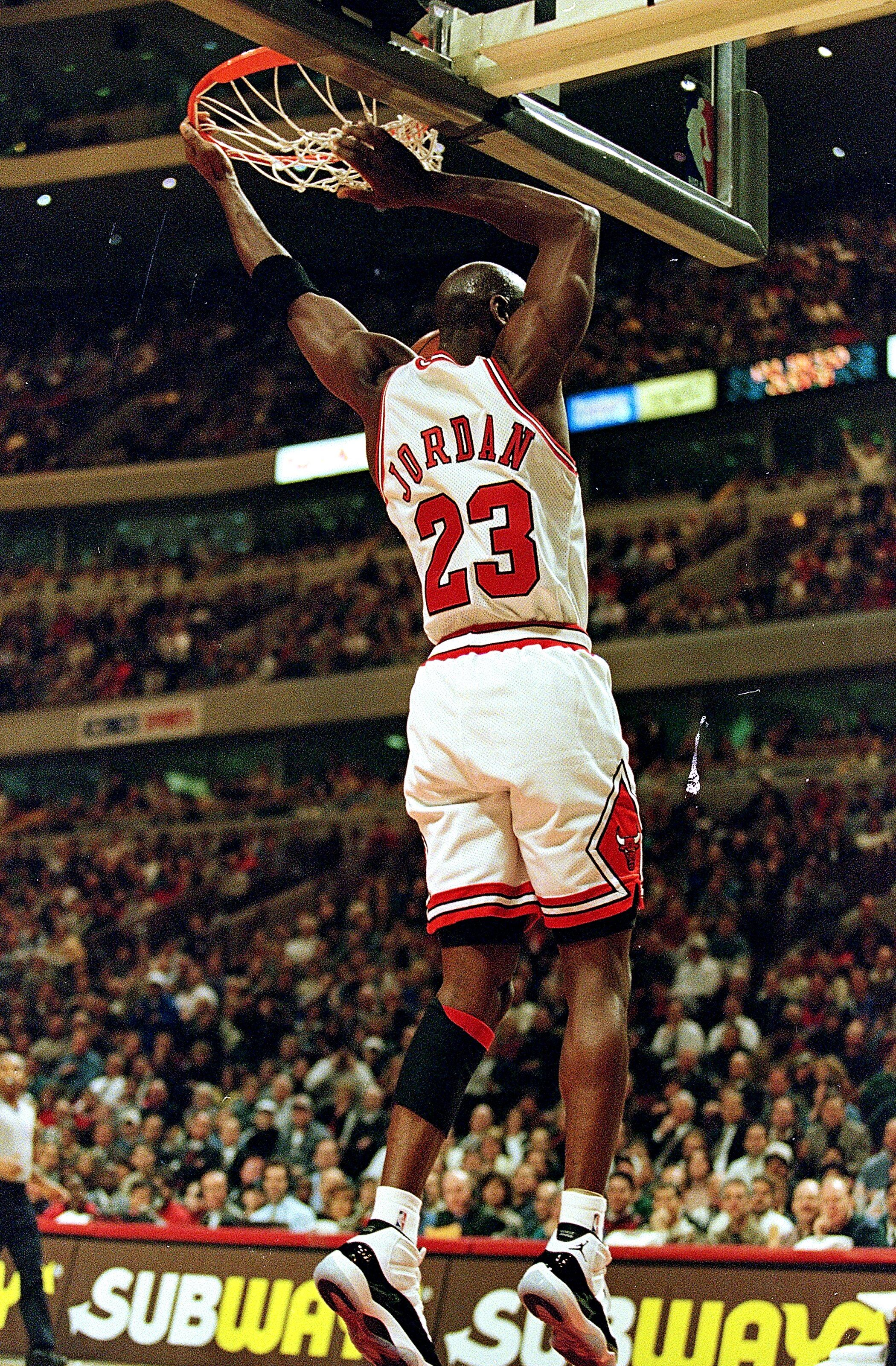

A pair of sneakers that were made for director Spike Lee sold for more than $50,000 at auction.

Union members for Anheuser-Busch are looking for a better deal and they are willing to go on strike.

New data from the National Association of Home Builders shows that falling mortgage rates have improved homebuilder confidence and increased demand to buy homes.

About nine million people with student loans missed their first payment after the recent pandemic pause, according to data.

Spending this holiday season is set to significantly rise, according to an economic survey from CNBC.

Google settled an antitrust lawsuit, Tesla is reportedly raising pay, a group is suing Utah over its social media policies for kids and the founder of Nikola was sentenced to prison.

The White House is lending its support to an auto industry effort to standardize Tesla’s electric vehicle charging plugs for all EVs in the United States.