Hippo is a new start-up that is trying to revolutionize the way consumers purchase home insurance. The company utilizes big data to streamline the process and take it from agencies and agents to online.

Assaf Wand is the CEO of Hippo. He joins Cheddar to explain how Hippo is disrupting the insurance space. Hippo boasts a 90-second process and savings of up to 25%. Wand explains this is due to their use of big data. Hippo tries to foresee any issues in your home and through big data are able to give you an estimate in those 90 seconds rather than the 4 days it normally takes.

Wand explains that Hippo's customer acquisition strategy has been furthered through networking. Their key to success has been getting their product and info in front of new homebuyers so they are exposed to the brand as they are closing on a new deal.

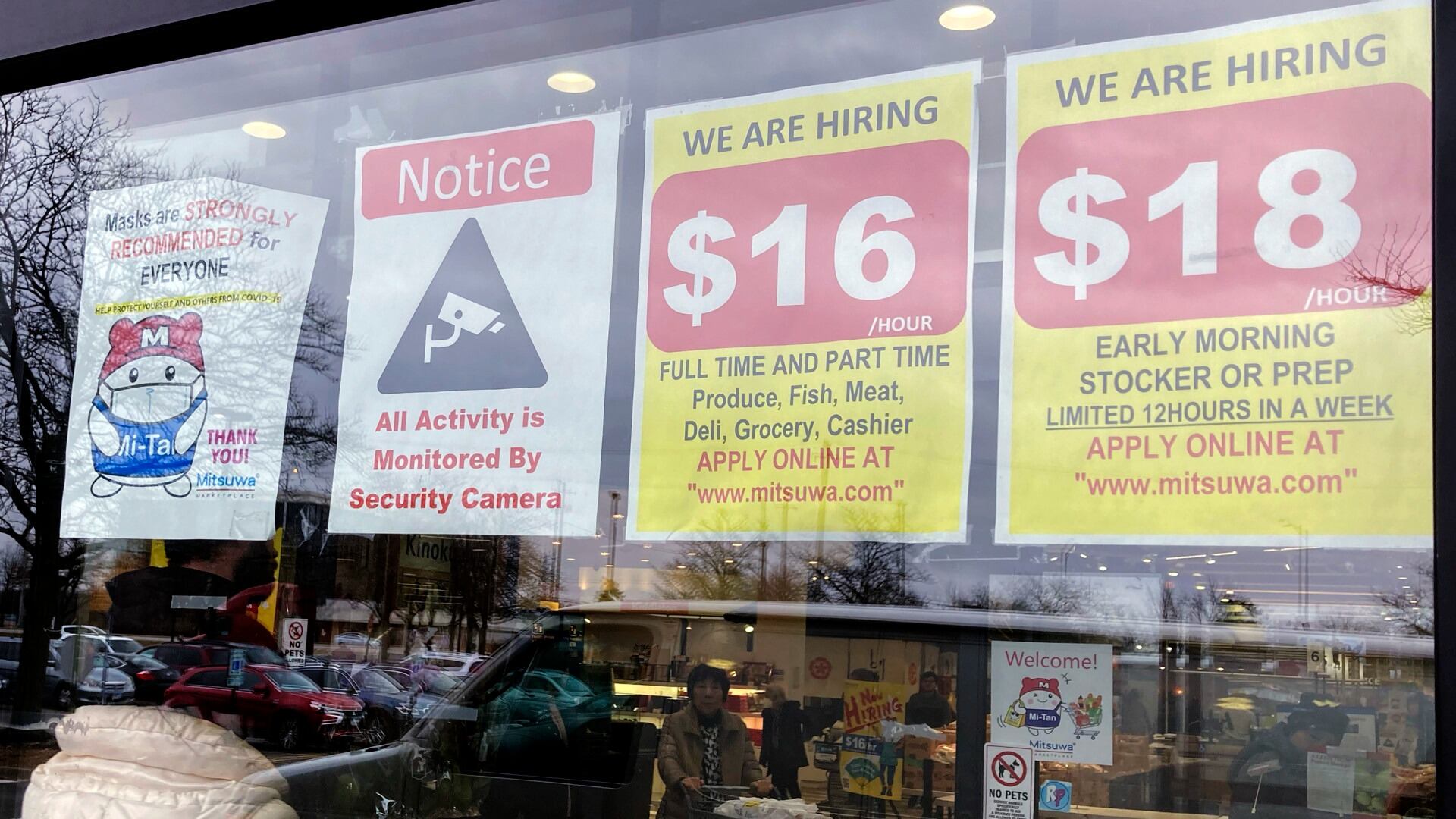

Half of U.S. states are raising their minimum wage next year.

Sony's PlayStation 5 console has now passed 50 million units sold.

FedEx decreased its full-year revenue forecast after reporting lower-than-expected quarterly profits in its latest results.

Cora is among dozens of young kids across the U.S. poisoned by lead linked to tainted pouches of the cinnamon-and-fruit puree

The IRS said Tuesday it is going to waive penalty fees for people who failed to pay back taxes that total less than $100,000 per year for tax years 2020 and 2021.

Rite Aid has been banned from using facial recognition technology for five years over allegations that a surveillance system it used incorrectly identified potential shoplifters, especially Black, Latino, Asian or female shoppers.

The union representing Southwest Airlines pilots says it reached a new contract agreement in principle with the airline following three years of negotiations.

U.S. Bank has been hit with a $36 million fine for freezing debit cards that distributed unemployment benefits during the pandemic.

Construction of new homes rose by double digits in November, according to data from the Commerce Department.

Cheddar News' Need2Know is brought to you by Securitize, which helps unlock broader access to alternative investments in private businesses, funds, and other alternative assets. The private credit boom is here and the Hamilton Lane Senior Credit Opportunities Fund has tripled in assets under management in just six months from November 2022 through April this year. Visit Securitize.io to learn more.