Your Cheddar hosts Kristen Scholer and Tim Stenovec bring you today's top financial news headlines. From a market sell-off to consumer spending, we have you covered!

Global stocks mostly steadied on Wednesday in pre-market trading, keeping major equity benchmarks on pace for monthly gains. Futures point to a higher open for the Dow after rising bond yields and pressure on the healthcare sector sent it to its biggest daily drop since May on Tuesday.

Plus, strong job prospects and a general upswing in the market in recent months have triggered a decrease in saving for many Americans. According to the Commerce Department, an increase in consumer spending in December led to a 12 year low in the U.S. household saving rate. This was the lowest saving rate since the height of the housing boom in the early 2000s.

The House of Representatives recently passed a bill aimed at increasing transparency in healthcare.

If you have a flexible spending account, here's some short information for you so you don't leave money on the table.

With high healthcare costs, bills can quickly add up. In some cases, it is possible to negotiate your medical bills. Barak Richman, law professor at George Washington University, joined Cheddar News to discuss the easiest way to talk to medical debt companies about what's owed.

Millions of people have selected insurance plans for 2024 but sometimes navigating them can be tricky time consuming and expensive. Paula Pant, host of 'Afford Anything' podcast, joined Cheddar News to break down what's needed to know about their insurance plans.

The European Union is investigating Elon Musk's X over alleged illicit content and disinformation on its platform. Cheddar News breaks it all down and discusses what it could mean for users.

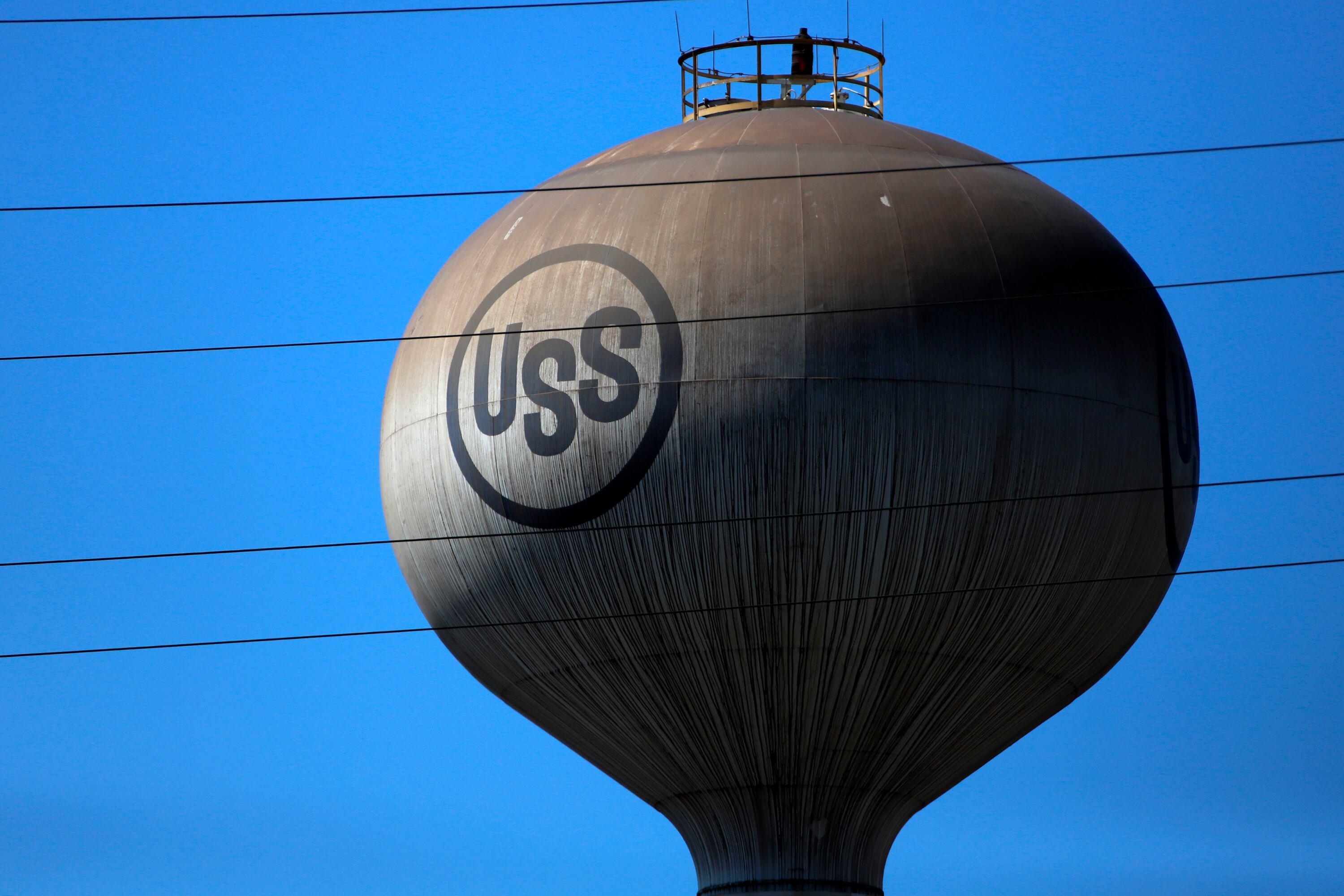

Adobe and Figma called off their $20 million merger, Southwest Airlines gets fined, Nippon Steel is buying U.S. Steel and oil and gas prices surge after a pause in shipments.

With more employees being called back to the office, many workers are suddenly protesting by being in the office for as little time as possible. As the term suggests, coffee-badging means coming in for just enough time to have a cup of coffee, show your face, and swipe your badge.

Japan's Nippon steel is buying U.S. Steel for $14.9 billion.

Southwest Airlines will pay a $35 million fine as part of a settlement over a 2022 holiday season disaster that saw the airline cancel thousands of flights and leave millions of people stranded.

Cheddar News' Need2Know is brought to you by Securitize, which helps unlock broader access to alternative investments in private businesses, funds, and other alternative assets. The private credit boom is here and the Hamilton Lane Senior Credit Opportunities Fund has tripled in assets under management in just six months from November 2022 through April this year. Visit Securitize.io to learn more.