Crypto bank Silvergate Capital has announced that it is winding down its operations and liquidating its assets.

"In light of recent industry and regulatory developments, Silvergate believes that an orderly wind down of Bank operations and a voluntary liquidation of the Bank is the best path forward," the company said in a news release. "The Bank’s wind down and liquidation plan includes full repayment of all deposits. The Company is also considering how best to resolve claims and preserve the residual value of its assets, including its proprietary technology and tax assets."

The company's primary role was in helping large investors navigate the crypto space, moving their money in and out of crypto exchanges. It also operated its own exchange, called the Silvergate Exchange Network, which shut down last week.

The bank struggled with liquidity issues as the broader crypto space declined over the past year. These market headwinds combined with regulatory pressure to eventually make the bank's situation untenable.

It is one of the few non-crypto firms to collapse since the market took a turn last year.

A federal judge has struck down hundreds of lawsuits filed against the makers of Tylenol and generic acetaminophen.

California regulators are preparing to vote on new rules for turning recycled wastewater into drinking water.

Hackers accessed Xfinity customers’ personal information by exploiting a vulnerability in software used by the company, the Comcast-owned telecommunications business announced this week.

Some folks want to leave the cold for a quick getaway. Bobby Laurie, travel expert, joined Cheddar News to provide tips on how and when to look for a winter escape.

Julia Pollak, chief economist with ZipRecruiter, joined Cheddar News to provide tips on navigating a job loss and explain the benefits of working with a recruiter to find new employment.

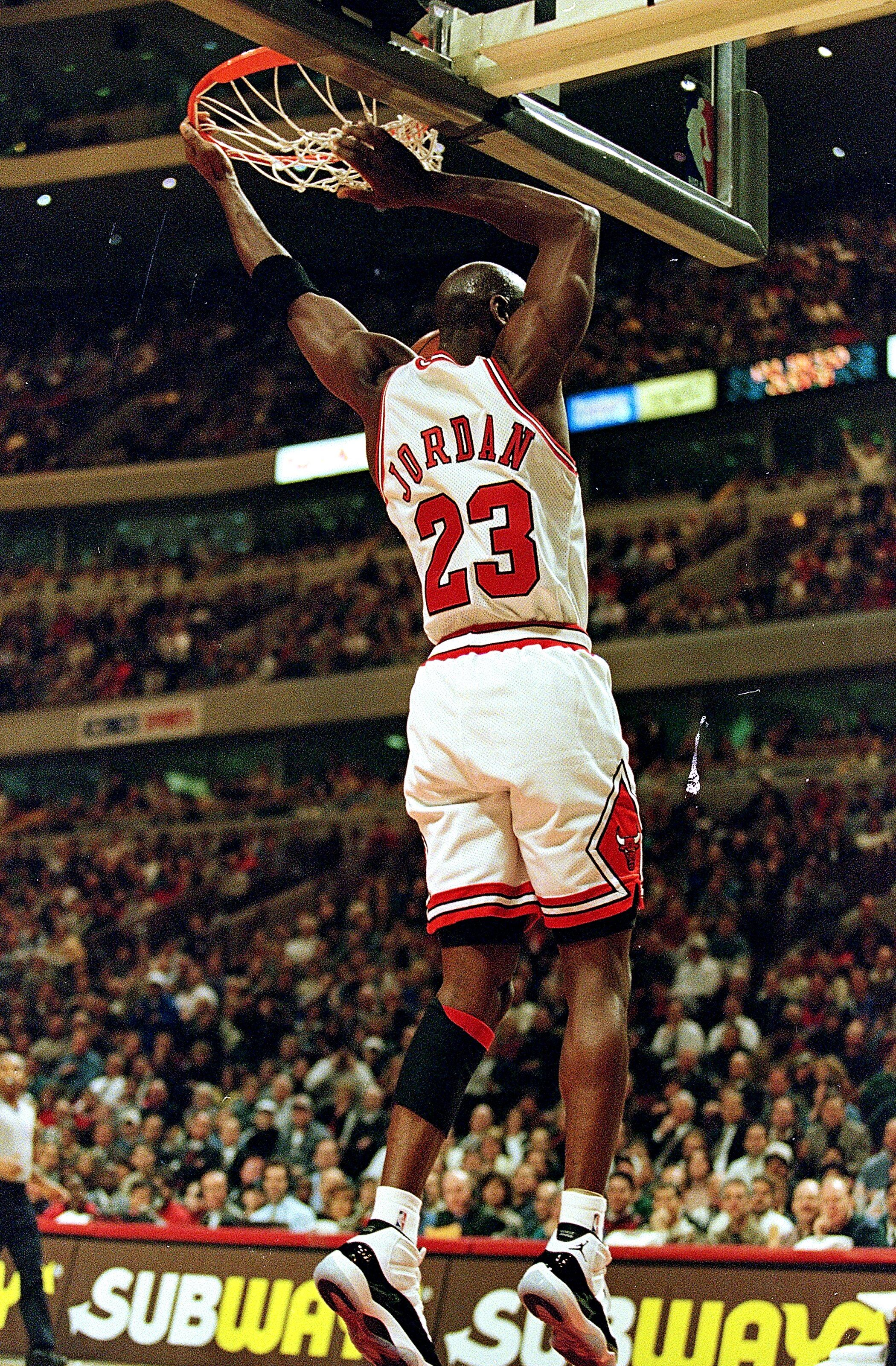

A pair of sneakers that were made for director Spike Lee sold for more than $50,000 at auction.

Union members for Anheuser-Busch are looking for a better deal and they are willing to go on strike.

New data from the National Association of Home Builders shows that falling mortgage rates have improved homebuilder confidence and increased demand to buy homes.

About nine million people with student loans missed their first payment after the recent pandemic pause, according to data.

Spending this holiday season is set to significantly rise, according to an economic survey from CNBC.